Top rated Republican legislators and the Democratic governor in Kansas have brokered a offer on reducing taxes immediately after GOP leaders gave up on shifting the condition to a single-amount personal profits tax that the governor strongly opposed.

The Kansas Dwelling and Senate were envisioned to vote on the compromise package Thursday or Friday, and Gov. Laura Kelly was expected to indication it if it reached her desk. The plan would preserve taxpayers about $1.4 billion above the upcoming 3 decades, but it is smaller than different programs approved previous month by every single chamber and lesser than a single handed by the Republican-managed Legislature in January that Kelly vetoed.

GOP leaders wished to shift Kansas to a single individual earnings tax amount from the 3 present-day prices and slash the top price from its present 5.7%, which Kelly reported would reward the “super rich.” The very same dispute thwarted key tax cuts in 2023, when a dozen other states slash income tax fees, according to the conservative Tax Basis.

The compromise approach preserves 3 private money tax fees but cuts the major charge to 5.5%. Republican leaders did not have the two-thirds majorities important to override a Kelly veto of a solitary-price system, many thanks to Republican defectors who, as condition Senate President Ty Masterson place it Wednesday, “chained on their own to the tree of progressive taxation.”

“So, you know what?” We’re just heading to slice the tree off on the best,” claimed Masterson, a Wichita-location Republican. “Every thing else is a get.”

The bill also would do away with condition earnings taxes on retirees’ Social Safety advantages, which kick in as soon as a man or woman receives $75,000 a 12 months. It would also improve the state’s typical own money tax deductions, enhance an revenue tax credit score for kid treatment costs, minimize property taxes the point out imposes to elevate dollars for community schools and stop the state’s presently expiring 2% sales tax on groceries six months early, on July 1.

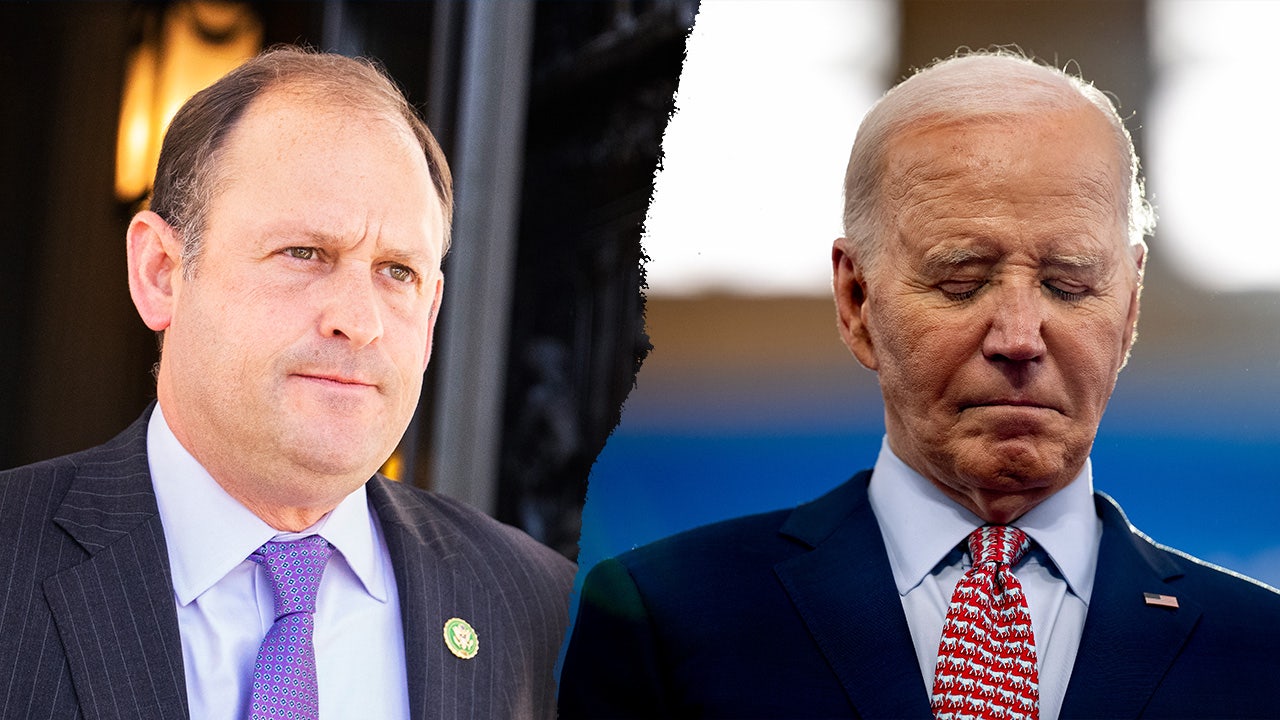

Kansas Residence Taxation Committee Chair Adam Smith watches as the Residence votes on April 3, 2024, at the Statehouse in Topeka, Kansas. Smith suggests he is not guaranteed no matter whether he will assistance a deal on chopping taxes brokered by Democratic Gov. Laura Kelly and Republican legislative leaders. (AP Image/John Hanna)

However, the last deal encouraged bipartisan grumbling. Kelly’s business office and GOP leaders worked it out privately instead of 3 House and 3 Senate negotiators drafting a approach, with some conversations in community.

Home Taxation Committee Chair Adam Smith reported ahead of both chamber voted that he failed to know no matter if he’d help the offer — even even though it was his work to describe it to colleagues and he’d generally endorse a program backed by GOP leaders.

“I’m listening to a ton of dissent,” reported Smith, a western Kansas Republican. “I have acquired to have the invoice, and it’s lousy when I don’t even know if I’m going to vote for it.”

Republicans had wanted to lower taxes by in between $500 million and $600 million on a yearly basis or involving $1.5 billion and $1.8 billion in excess of 3 decades. The new system, value about $430 million annually, is considerably less generous in expanding regular deductions than the Senate’s plan, which boosted the one particular for married partners to $22,000 to help reduced-revenue family members.

Some lawmakers also mentioned the new system won’t cut property taxes more than enough amid rising house values and area levies. For the proprietor of a dwelling at the Kansas median benefit of $210,000, the once-a-year cost savings would be about $140.

“This, to me, doesn’t slash it,” said northeastern Kansas Sen. Tom Holland, who represented Democratic senators in tax negotiations. “There are monster boosts just about every calendar year.”

The deal in Kansas came two months following Georgia’s Republican-controlled Legislature passed personalized and company income tax cuts that GOP Gov. Brian Kemp favored. Like Georgia, Kansas has a massive price range surplus — nevertheless projected at more than $4 billion for the finish of June 2025.

But tax debates in Kansas are fraught for the reason that of a nationally notorious experiment in cutting money taxes in 2012 and 2013 under GOP Gov. Sam Brownback. Substantial budget shortfalls followed and persisted until finally bipartisan legislative majorities reversed most of the cuts in 2017 around Brownback’s opposition.

Kelly won the 1st of her two terms in 2018 by functioning towards Brownback’s fiscal guidelines, and she even now cites them in criticizing Republican proposals. She referred to as the GOP program she vetoed in January fiscally reckless.

Click on Here TO GET THE FOX Information App

Republican leaders stated continuously that they weren’t repeating the issues of 2012 and 2013 and that, with its huge surplus, Kansas could sustain their proposed cuts.

But, unable to override a Kelly veto, they became fewer ready to opportunity having no cuts enacted this 12 months. All 40 condition Senate seats and 125 Home seats are up for election this calendar year.

“We’ve obtained to get some thing, and this is a compromise,” mentioned Residence Speaker Dan Hawkins, a Wichita Republican. “We need to get it finished and get out of right here.”