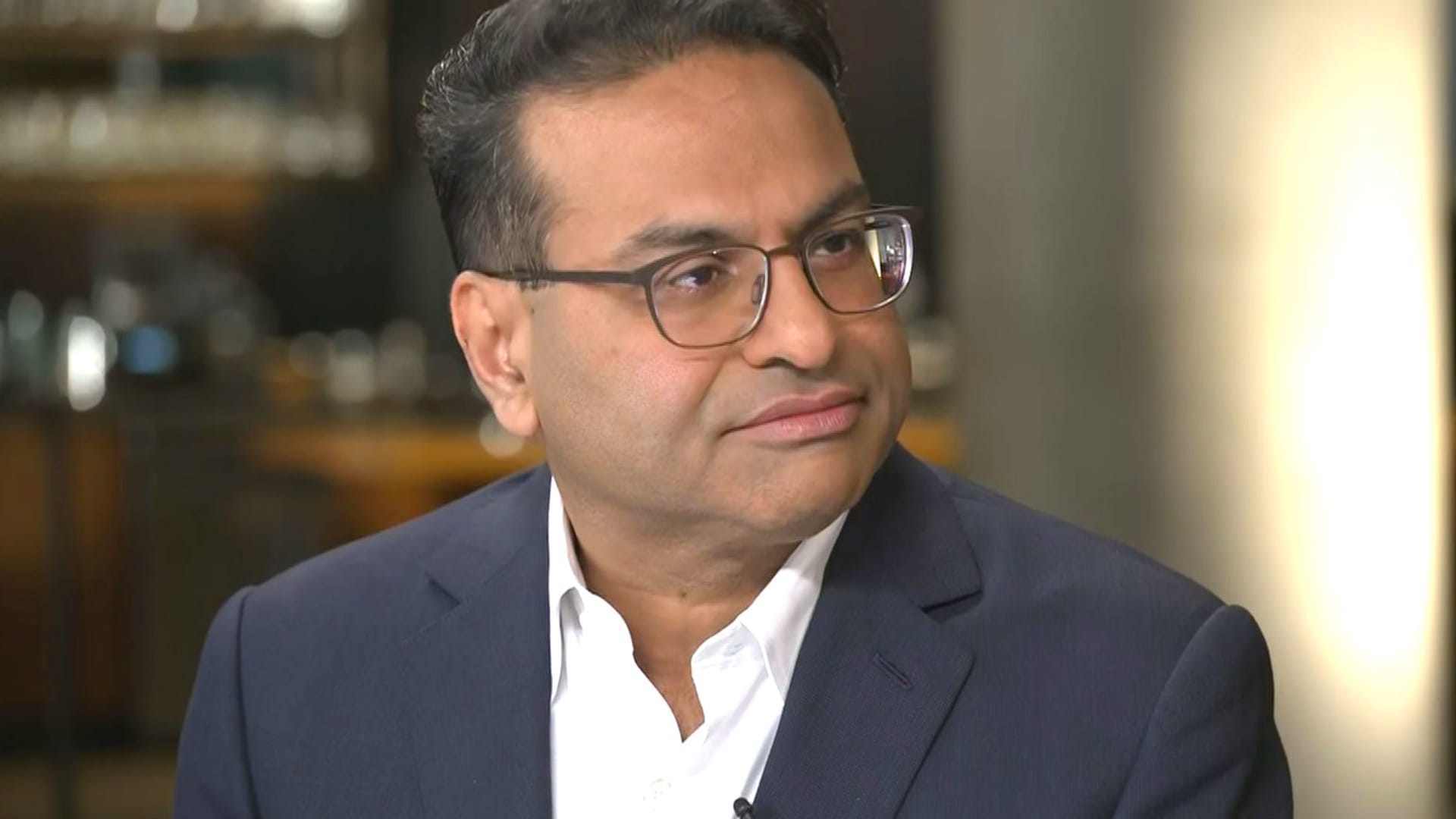

Starbucks shares plummeted Tuesday evening by around 11.5% following the espresso large shipped a a great deal weaker-than-envisioned quarter. The company also cut its outlook for fiscal 2024, leaving minimal place for optimism of a brief rebound in site visitors at its outlets. Revenue fell 2% calendar year around 12 months to $8.56 billion in the fiscal 2024 second quarter, beneath the $9.13 billion expected by analysts, according to LSEG. Adjusted earnings for every share of 68 cents fell 14% calendar year above 12 months, lacking the 80-cent estimate. Starbucks Why we have it : Starbucks has just one of the most recognizable makes of any cafe. But more than the previous couple of years, operations have been challenged by store inefficiencies and a slow restoration in China. Underneath CEO Laxman Narasimhan, we assume there is a strategy in position to unlock advancement and boost margins about time. Competition : Dutch Bros , McDonalds and Dunkin’ Donuts Most modern invest in : Feb. 14, 2024 Initiated : August 2022 Bottom line We have been expressing for weeks to be ready for a skip when it came time for Starbucks to report. We considered the setup was comparable to its earnings report a quarter earlier when the overall marketplace understood a pass up was coming. When administration skipped very last quarter by 3 cents for every share but said it had numerous paths to reaching its earnings growth outlook concerning 15% to 20%, the inventory did not go down on the news. This quarter was a great deal various. The transitory challenges the business identified as out past time persisted this quarter. The combination of these ongoing difficulties with what administration reported was serious weather conditions and a difficult client backdrop led to a steep decrease in shop traffic that made it much too tricky to drive margin improvement and a pass up that was far better than expected. Some of the shortfall was owing to unmet need, which administration is attacking with a program to unlock capability and boost the client experience. But the continued sluggish effects here have us thinking if Starbucks alienated much too a great deal of its buyer foundation by boosting price ranges also substantial. It can be difficult not to be involved when you see a thirty day period-over-month drop in the quantity of 90-working day energetic associates in the United States utilizing the Starbucks Reward loyalty method, which fell from 34.3 million a quarter in the past to 32.8 million, although the consequence was even now up 6% 12 months above 12 months. Our knowledge is that this is meant to be the company’s most faithful foundation. Starbucks is dealing with as well several headwinds correct now and thanks to the unsure timing of when it will get past them, the sharp stock decrease is just one we do not have programs of immediately obtaining. As a result, we are downgrading our ranking to a 2 and slicing our selling price concentrate on to $90, which is about a 25x various on the reduced stop of management’s new EPS outlook. SBUX YTD mountain Starbucks YTD Quarterly commentary Equivalent keep product sales in North America — a important restaurant sector metric — fell 3%, well beneath estimates of the .5% advancement forecasted by Wall Road analysts, in accordance to FactSet. What was most concerning in this article was that transactions had been down 7%, representing a large fall in men and women coming to the outlets. Ticket was up 4%, offsetting some of the transaction weakness, but price tag hikes can only get you so considerably. Issues linked to a extra cautious customer plagued the quarter, but management explained serious climate was a key factor way too, impacting each U.S. and whole corporation comps by 3 percentage points. Yet another headwind was from much less visits from Starbucks’ so-named “more occasional customers” which are a frequency phase below its most loyal clients. On the convention get in touch with, CEO Laxman Narasimhan highlighted three execution prospects to get the US organization again on observe. The initial is to meet up with the desire it has throughout dayparts to generate long run advancement by investing in new instruments and utilizing new processes. 1 solution Starbucks has appear up with is its siren craft technique, which is now expanding peak all over by nearly 1 comp level yearly in the stores that have it. The organization must do much better to increase functions all through and minimize wait around moments in stores to spur expansion, so we were pleased to hear that this was a target. The next is to launch even a lot more new products and solutions even though continuing to focus on its core coffee-ahead choices. The 3rd is to access and offer much more benefit for the occasional and non-Rewards buyers. Compared with last quarter where working margin growth assisted offset some of the equivalent shop development softness, profitability contracted 110 basis details from final year, principally owing to deleverage, incremental investments in retail outlet spouse wages and rewards, and increased promotional exercise. However, the corporation mentioned efficiencies generated through its reinvention system aided offset some of the deleveraging. In Starbucks’ worldwide segment, comparable retailer revenue fell 6% and missed estimates of .5% advancement. The decrease was balanced with a 3% drop in the two transactions and tickets. The success in China ended up worse, with equivalent income falling 11%, with transactions down 4% and tickets down 8%, a outcome of increased advertising activity as the business deals with growing competitiveness from nearby gamers. The avenue was hunting for flat equivalent product sales in China, according to FactSet. But the final results were being impacted by a lot more than just the promotional atmosphere. A decrease in the occasional consumer and transforming holiday styles also weighed on the results. Excluding China, the international phase grew profits and comps in Latin The usa, the Asia Pacific, and Japan. Steering Following the disappointing fiscal next final results, the organization created several downward revisions to its fiscal calendar year 2024 steerage. The improvements ended up: Total worldwide earnings advancement of minimal solitary digits from the prior array of 7% to 10%. Global and US comp development in the variety of a reduced solitary-digit decrease to flat from the previous variety of 4% to 6%. China similar product sales are expected to drop by a single-digit share compared to expectations of very low single-digit expansion in the next quarter as a result of the fourth quarter. Worldwide internet new store development was tweaked down from 6% to 7%. Which is due to slower China retail outlet openings, which was revised to 12% expansion from 13%. Operating margins are expected to be flat as opposed to previous expectations of progressive enlargement. Adjusted EPS progress is envisioned to be flat to lower one digits, down from its preceding vary of 15% to 20%. (Jim Cramer’s Charitable Have confidence in is long SBUX. See below for a total record of the stocks.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will get a trade warn prior to Jim helps make a trade. Jim waits 45 minutes immediately after sending a trade notify right before acquiring or advertising a stock in his charitable trust’s portfolio. If Jim has talked about a inventory on CNBC Tv set, he waits 72 several hours soon after issuing the trade notify right before executing the trade. THE Over INVESTING CLUB Information IS Topic TO OUR Terms AND Situations AND Privateness Coverage , Jointly WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR Obligation EXISTS, OR IS Developed, BY Advantage OF YOUR RECEIPT OF ANY Info Presented IN Link WITH THE INVESTING CLUB. NO Particular End result OR Gain IS Certain.

A Starbucks espresso cup sits on a table at a retail store in Manhattan, New York Metropolis, on Jan. 30, 2024.

Spencer Platt | Getty Visuals

Starbucks shares plummeted Tuesday evening by approximately 11.5% after the espresso giant delivered a considerably weaker-than-envisioned quarter. The business also cut its outlook for fiscal 2024, leaving tiny place for optimism of a swift rebound in traffic at its suppliers.