It can be last but not least in this article: the prolonged-predicted buyer pullback.

Starbucks announced a surprise fall in similar-shop income in its most up-to-date quarter, sending its shares down 17% on Wednesday. Pizza Hut and KFC also described shrinking exact same-shop product sales. And even stalwart McDonald’s said has adopted a “street-preventing mentality” to compete for benefit-minded diners.

For months, economists have been predicting that customers would slash again on their paying in response to greater rates and curiosity fees. But it is really taken a although for fast-foods chains to see their product sales really shrink, regardless of several quarters of warnings to buyers that reduced-revenue customers have been weakening and other diners were investing down from pricier options.

Lots of restaurant businesses also provided other reasons for their weak benefits this quarter. Starbucks explained negative weather conditions dragged its very same-keep product sales lessen. Yum Brands, the mother or father organization of Pizza Hut, KFC and Taco Bell, blamed January’s snow storms and difficult comparisons to a solid very first quarter previous calendar year for its brands’ very poor functionality.

But individuals excuses do not entirely make clear the weak quarterly outcomes. Alternatively, it appears to be like like the competition for a lesser pool of customers has developed fiercer as the diners still hunting to invest in a burger or chilly brew come to be pickier with their funds.

The expense of feeding on out at quick-company dining establishments has climbed more quickly than that of consuming at home. Selling prices for constrained-assistance restaurants rose 5% in March when compared with the calendar year-in the past interval, when costs for groceries have been rising more gradually, according to the Bureau of Labor Figures.

“Clearly everybody’s fighting for fewer consumers or consumers that are certainly visiting less frequently, and we’ve bought to make certain we’ve acquired that road-fighting mentality to get, irregardless of the context close to us,” McDonald’s CFO Ian Borden mentioned on the company’s conference connect with on Tuesday.

Outliers show that buyers will continue to order their favorite foods, even if they’re far more pricey than they had been a yr ago. Wingstop, Wall Street’s favored cafe chain, described its U.S. exact same-shop income soared 21.6% in the very first quarter. Chipotle Mexican Grill noticed site visitors increase 5.4% in its initial quarter. And Cafe Makes International’s Popeyes noted exact same-store income expansion of 5.7%.

Even so, quite a few providers in the cafe sector and over and above it have warned client pressures could persist. McDonald’s CEO Chris Kempczinski explained to analysts the shelling out caution extends worldwide.

“It is really well worth noting that in [the first quarter], industry site visitors was flat-to-declining in the U.S., Australia, Canada, Germany, Japan and the U.K.,” he said.

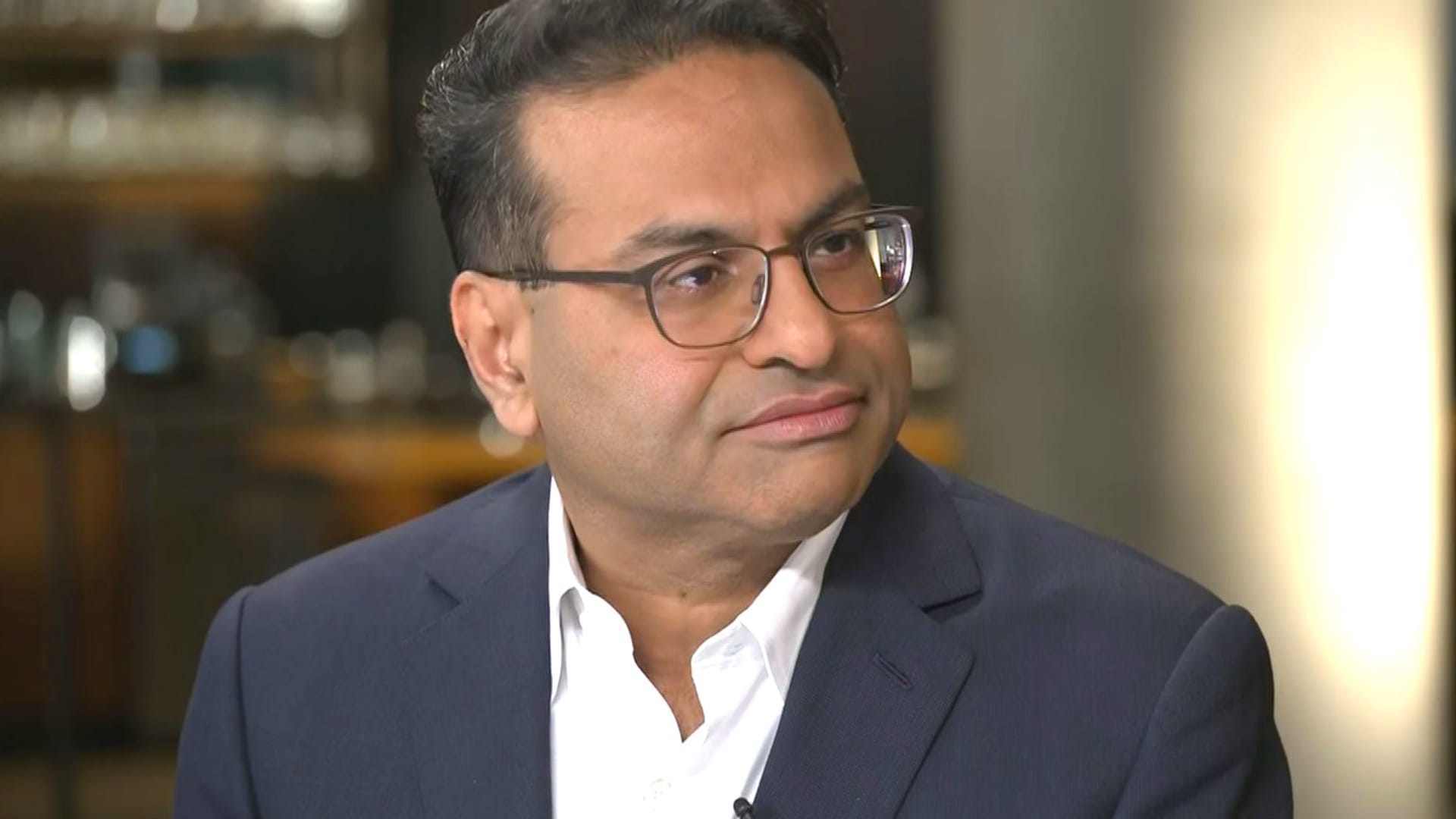

Two of the chains that struggled in the first quarter cited price as a element. Starbucks CEO Laxman Narasimhan explained occasional consumers weren’t obtaining the chain’s coffee for the reason that they wanted more assortment and benefit.

“In this natural environment, lots of clients have been more exacting about where by and how they pick to invest their income, particularly with stimulus cost savings typically spent,” Narasimhan mentioned on the company’s Tuesday phone.

Yum CEO David Gibbs pointed out that rivals’ benefit bargains for rooster menu things hurt KFC’s U.S. product sales. But he said the change to benefit need to advantage Taco Bell, which accounts for a few-quarters of Yum’s domestic running revenue.

“We know from the marketplace data that price is much more critical and that some others are having difficulties with worth, and Taco Bell is a price leader. You are observing some very low-money buyers drop off in the field. We are not looking at that at Taco Bell,” he claimed on Wednesday.

It really is unclear how prolonged it will consider speedy-food items chains’ gross sales to bounce back again, whilst executives supplied optimistic timelines and plans to get sales back again on track. For instance, Yum claimed its very first quarter will be the weakest of the year.

For its part, McDonald’s options to make a nationwide benefit menu that will charm to thrifty shoppers. But the burger big could experience pushback from its franchisees, who have turn into a lot more outspoken in latest many years. Although offers drive sales, they strain operators’ earnings, significantly in marketplaces exactly where it is now pricey to work.

Nonetheless, getting rid of ground to the competitiveness could motivate McDonald’s franchisees. This marks the next consecutive quarter that Burger King described much better U.S. similar-store revenue growth than McDonald’s. The Restaurant Models chain has been in turnaround method about the very last two years and investing heavily on promotion.

Starbucks is also betting on promotions. The coffee chain is gearing up to launch an up grade of its app that allows all customers — not just loyalty associates – to order, pay out and get reductions. Narasimhan also touted the success of its new lavender consume line that released in March, despite the fact that enterprise was continue to sluggish in April.