Two Republicans are demanding solutions from the Biden administration about how it strategies to tackle the resumption of university student mortgage payments that is expected to happen when the years-lengthy pause ends in October.

The pause on pupil loan fascination and repayments has been in put due to the fact the commence of the COVID-19 pandemic and was prolonged 9 times by both President Joe Biden and Donald Trump as element of an effort and hard work to offer economic aid to hundreds of thousands of federal borrowers. But in June Biden announced he would not be extending it all over again when the close of the pause was bundled in the invoice he signed to elevate the personal debt ceiling.

No matter of the Supreme Courtroom‘s forthcoming choice on Biden’s system for scholar debt forgiveness, fascination and payments will resume in the fall. The unparalleled return of payments has raised queries about no matter if debtors will be in a position to get well timed and exact info.

In a Tuesday letter to Instruction Secretary Miguel Cardona, Agent Virginia Foxx and Senator Bill Cassidy expressed issue that the Department of Instruction is “unwell-geared up” to restart scholar loan payments. The two GOP lawmakers criticized the department’s vagueness in its before reaction to an April letter despatched by Republicans, contacting its reply “devoid of evidence of any program of action.”

“The Section has still to provide any tangible evidence of any strategy for the return to reimbursement,” Foxx and Cassidy wrote in their joint letter.

Newsweek has reached out by e-mail to the Department of Education and learning for remark on the letter.

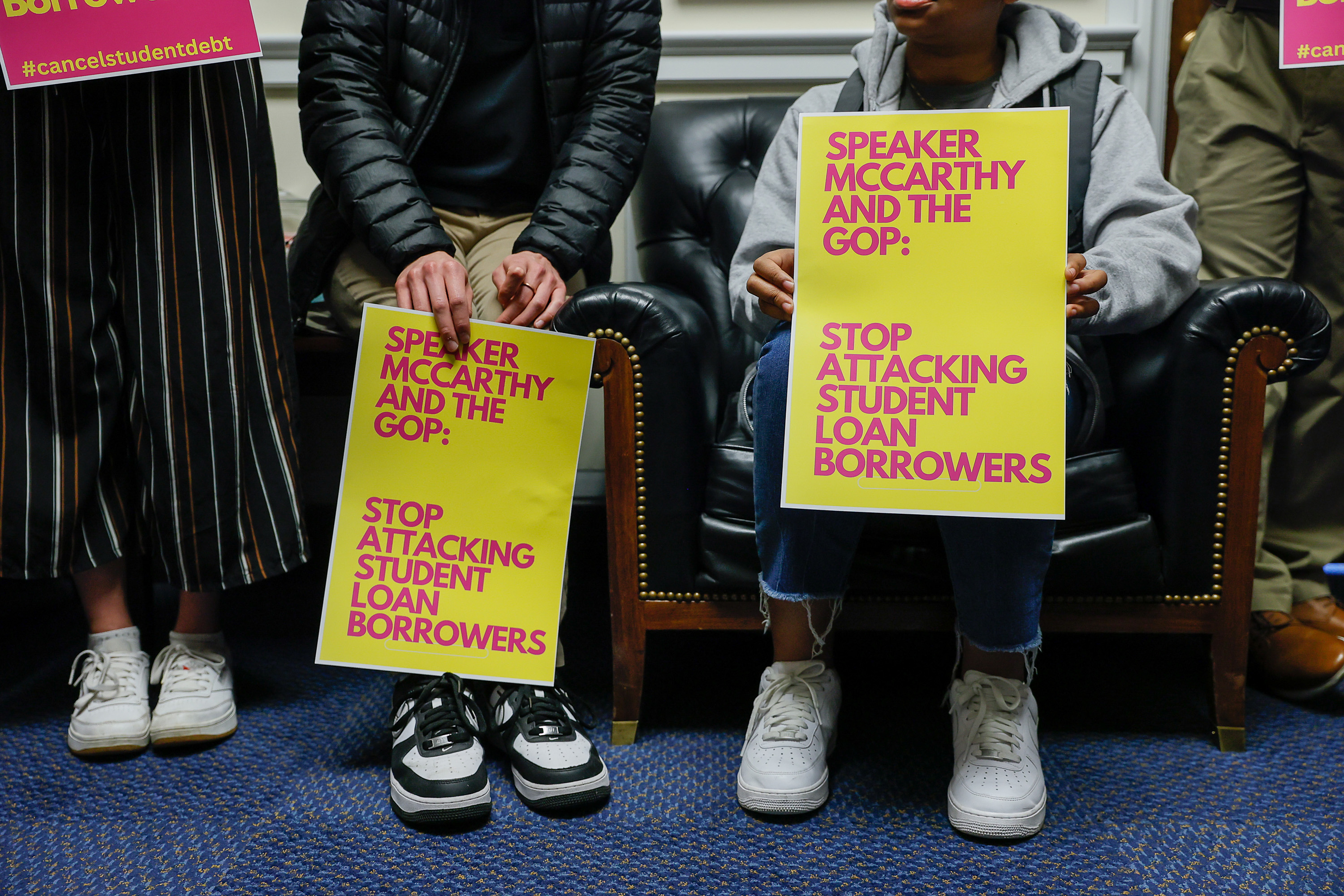

Jemal Countess/Getty

Ethan Harris, head of global economics exploration at Lender of The us Securities, wrote in a new note that the financial institution is anticipating delinquency amounts to return to exactly where they have been prior to the pandemic. Harris set the amount at $167 billion in “new critically delinquent balances,” calling it a “sizeable shock.”

Facts from the Shopper Economical Defense Bureau exhibits that far more than 1 in 13 college student financial loan borrowers are driving in their payment obligations and that 1 in 5 faces hazard components suggesting they will struggle once payments resume. The bureau also mentioned that numerous significant servicers have ended their contracts with the Division of Instruction in the previous three and a fifty percent several years. This means that 44 percent of debtors will be doing the job with a firm different from the a single they made use of prior to the pandemic.

“For some borrowers, this process may perhaps be easy with few alterations. But other debtors may possibly need to have to develop new logins with their new services, re-enroll in autopay, or update their payment information,” the bureau wrote in a June 7 website put up.

In their letter Foxx and Cassidy also expressed worry about debtors flouting specifications to pay back their loans following the pause finishes. They cited a Newsweek report about debtors refusing to pay again financial loans and criticized a professor who referred to as for persons to refuse “en masse” to pay back again loans.

“We expect you and senior officers of the Office to exercising management in countering these efforts where ever and any time they come about, specially given that nonpayment will lead to destructive money penalties for debtors and limitations to foreseeable future financial prospects,” the letter reported.

Throughout a Might congressional hearing, Cardona admitted that demanding resumed payments for 43 million people today is one thing which is unprecedented in U.S. background. Nevertheless, he mentioned the Office of Training is prepared to aid debtors through the system.

An advisory label on the department’s federal scholar help web site suggests that it designs to “notify debtors very well prior to payments restart” in Oct. Fascination will resume a month before, on September 1, in accordance to the page.