The latest increase of the common very long-expression U.S. mortgage loan charge, which poses a new obstacle to aspiring property owners hoping to buy a home in the course of this homebuying year, could have extraordinary repercussions on the country’s housing marketplace.

The national weekly regular for 30-year mortgages, the most common in the nation, was 6.88 percent as of April 11, according to information from the Federal Property Loan Property finance loan Corp., far better identified as Freddie Mac. That was .06 of a share issue higher than a week before and up .61 compared to a year before. The countrywide typical for 15-calendar year home loans was 6.16 %, up .1 of a percentage issue when compared to the prior 7 days and .62 in comparison to a yr in advance of.

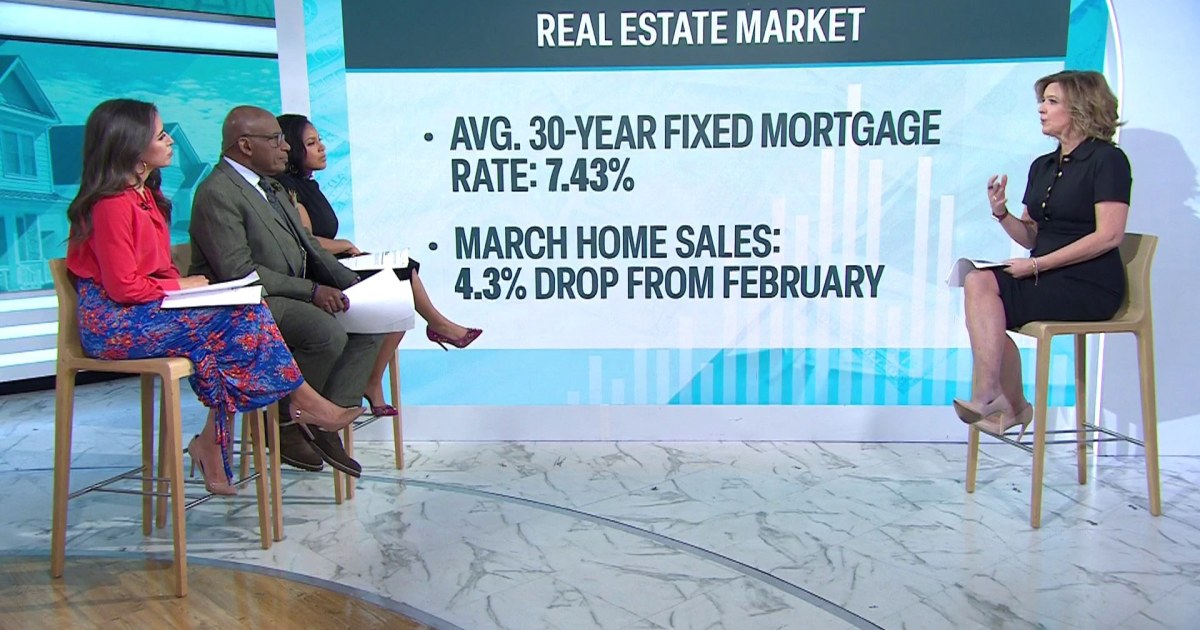

On Monday, gurus checking house loan costs on a each day foundation mentioned that the nationwide common for 30-year preset home loans attained 7.44 percent—the highest they’ve been so much this 12 months and shut to the 23-12 months weekly document of 7.79 p.c arrived at on Oct 25, 2023. On Monday, the 15-calendar year property finance loan charge was 6.85 p.c. At its peak on October 25, 2023, it experienced reached 7.03 per cent.

“Major a person-day jump,” commented journalist Lance Lambert on X, formerly regarded as Twitter. “The ordinary 30-calendar year set mortgage rate ticks up to 7.44 p.c. New superior for 2024.”

Visions of The usa/Joe Sohm/Common Photos Group via Getty Pictures

The increase in property finance loan charges will come as homebuying period, a time when the amount of households listed for sale will increase, is heating up. This climb in inventory starts off in spring and typically peaks in summertime right before declining as the weather gets colder, marking a person of the busiest periods of the yr for residence revenue. But higher home loan premiums could have an early chilling impact on the industry.

The median every month U.S. housing payment strike an all-time higher of $2,747 for the duration of the four months ending April 7, up 11 p.c from a year previously, according to a report from serious estate brokerage Redfin last 7 days. It pointed out that the common 30-calendar year fixed house loan amount, then at 6.82 per cent, was more than double pandemic-period lows.

There’s not considerably hope that home finance loan rates will come down before long, as the U.S. Labor Section said past 7 days that inflation has risen more rapidly than expected previous thirty day period, at 3.5 per cent more than the 12 months to March. That was up from 3.2 percent in February.

“For homebuyers, the latest CPI [consumer price index] report means property finance loan costs will keep bigger for longer since it makes the Fed not likely to lower fascination charges in the upcoming handful of months,” reported Redfin Financial Research Direct Chen Zhao. “Housing expenses are probable to proceed going up for the in the vicinity of long term, but persistently higher home finance loan costs and soaring offer could neat house-price progress by the conclude of the year, getting some strain off fees.”

Jamie Dimon, CEO of JPMorgan Chase, voiced problem final 7 days around “persistent inflationary pressures” and stated the lender was well prepared for “a really broad vary of desire premiums, from 2 p.c to 8 per cent or even far more, with similarly extensive-ranging economic outcomes.”

While the bounce in home loan prices seems modest, it would make a enormous change for borrowers, who may well conclusion up paying hundreds of pounds a month far more on major of what is currently a single of the most considerable bills in their life.

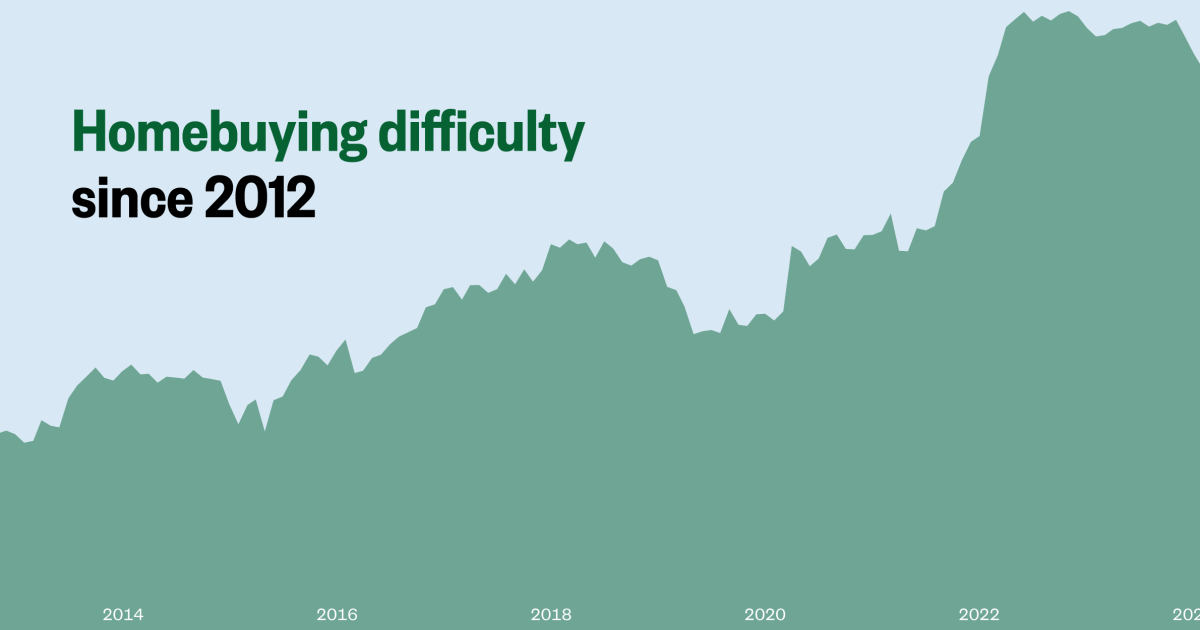

Lots of may make a decision that they won’t be able to pay for to invest in a home—which is what occurred when home loan prices abruptly skyrocketed between late 2022 and early 2023 as a consequence of the Federal Reserve’s aggressive desire charge-climbing campaign.

Between late summer season 2022 and spring 2023, a fall in demand brought about by the unaffordability of purchasing a residence led to a modest selling price correction of the housing sector. But charges have considering the fact that climbed back again owing to the mixture of pent-up need and historic small stock.

While the Federal Reserve won’t straight set home finance loan fees, these are hugely affected by the central bank’s conclusion to hike or reduce interest costs. The Fed left premiums unchanged in March and is regarded not likely to cut them this month taking into consideration the most recent facts on inflation.

Uncommon Understanding

Newsweek is committed to challenging common wisdom and getting connections in the lookup for typical floor.

Newsweek is fully commited to hard traditional wisdom and getting connections in the research for prevalent floor.