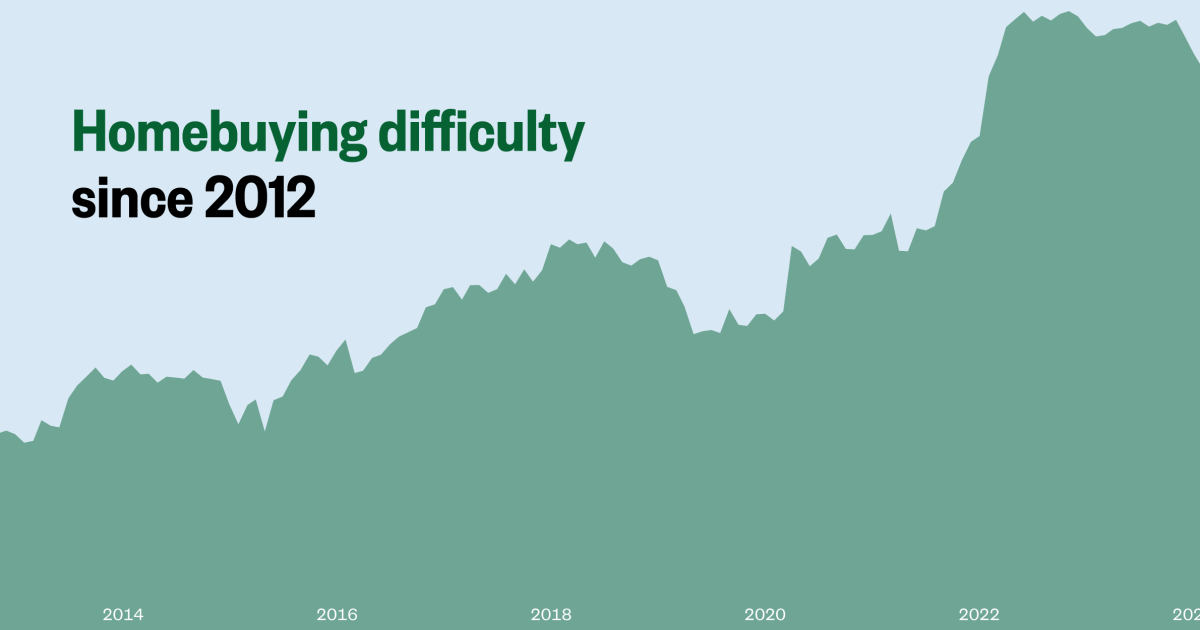

Experts warned that U.S. towns may well be failing in their method to dealing with “what is broadly regarded as a housing-affordability crisis” if latest housebuilding approaches do not modify.

Amid a historic housing offer lack, a new doing the job paper by Harvard University’s Joint Center for Housing Scientific tests posits that continuing to develop additional residences in the suburbs in the hope this will deliver down hosing charges in metropolitan areas might not be successful.

The study advised that the ongoing target on new suburban housing has experienced a negligible outcome on mounting housing fees for urban households.

The evaluation drew on knowledge from the Census Bureau, focusing on “residential vacancy chains,” which the report describes as: “the sequence of moves in between housing models initiated by new housing building.”

Justin Sullivan/Getty Photographs

According to the report’s conclusions, expanding suburban properties “has minor impact on city housing affordability or on the welfare of small-profits urban households.”

“Each individual new suburban dwelling qualified prospects to only .015 moves in small-revenue urban neighborhoods.”

In other words, the added benefits provided by new homebuilding outside of densely populated urban areas hardly ever arrive at individuals who live in these kinds of locations.

There are commonly two major educational facilities of assumed regarding how very best to alleviate housing charges that are ever more considered as unaffordable.

According to the report, some argue that setting up houses of any type, everywhere, is the uncomplicated answer.

The authors of this new paper as a substitute advocate for a a lot more specific method.

They reported that given that the effects of suburban housebuilding are very little felt by city dwellers, any household-building really should be targeted in the spots it is specifically required.

“New suburban housing supply has very little outcome on urban housing affordability or on the welfare of small-cash flow city homes,” they wrote.

They mentioned minimal and center-income city homes would gain most from “insurance policies that improve the source of housing that is fiscally and geographically available to these households.”

Newsweek has contacted the authors of the review for further remark.

A modern report from Bankrate, based mostly on assessment of Zillow and Redfin housing knowledge, observed that in all 50 of the U.S.’s most significant metros, it was now more affordable to lease than to buy.

House loan rates are probably to continue to be substantial as the Federal Reserve declared on Wednesday it will hold fascination costs at 5.5 p.c.

In April, Florida property rates continued to rise regardless of rising interest costs, a growth explained by professionals at Florida Atlantic University and Florida International University as a “worrying indicator” for the state’s housing marketplace.

Do you have a story we must be covering? Do you have any queries about the housing current market? Get hold of LiveNews@newsweek.com

Unusual Expertise

Newsweek is committed to hard conventional wisdom and getting connections in the research for typical ground.

Newsweek is fully commited to demanding conventional wisdom and obtaining connections in the search for frequent ground.