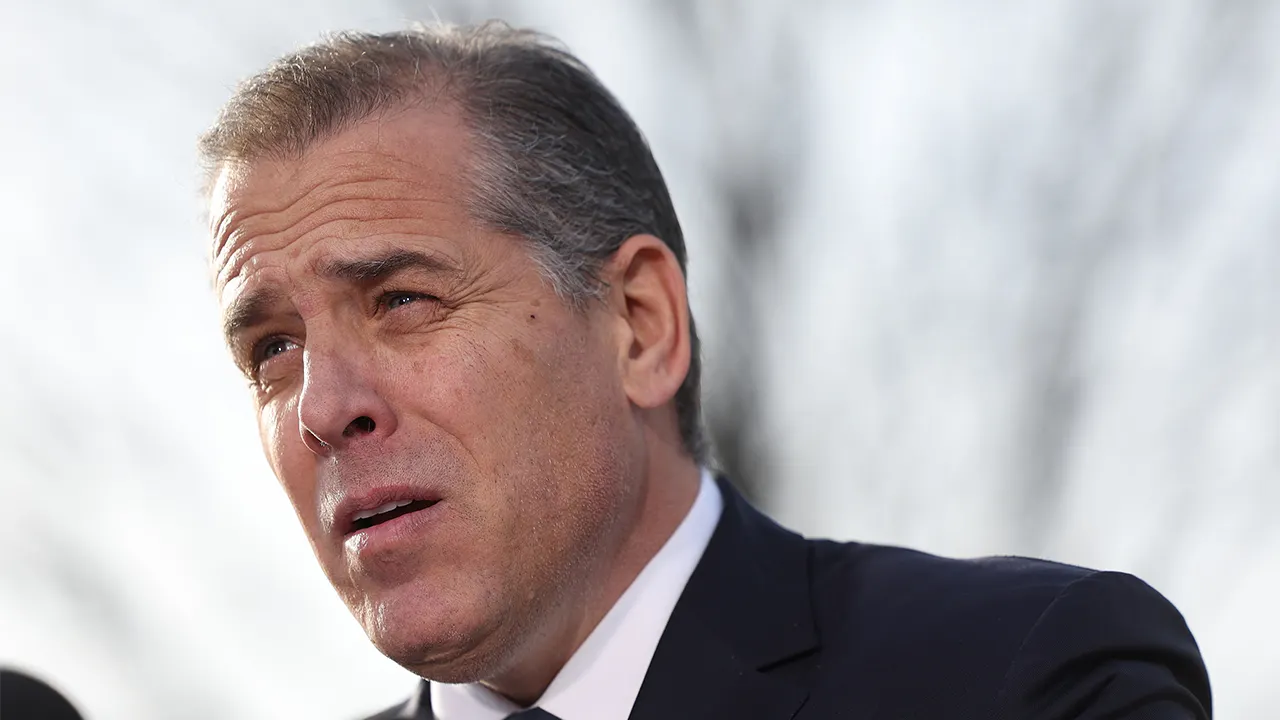

A former IRS worker informed the Property Ways and Suggests Committee that U.S. Legal professional David Weiss sought authority to charge Hunter Biden in two federal districts with prices broader than the tax-similar misdemeanors the president’s son agreed this 7 days to plead responsible to, in accordance to a 212-web page transcript of his interview.

The whistleblower, Gary Shapley, claims Legal professional Typical Merrick Garland was not telling Congress the fact when he asserted in before testimony that Weiss, who is primarily based in Delaware, experienced the authority to demand in other jurisdictions, which includes California and Washington, D.C. Shapley said bringing prices in these districts is not one thing the U.S. attorneys there, who were appointed by President Joe Biden, would do.

The Justice Section denied Shapley’s assertions.

“As equally the Legal professional General and U.S. Lawyer David Weiss have explained, U.S. Lawyer Weiss has whole authority in excess of this subject, such as obligation for determining in which, when, and whether to file fees as he deems acceptable. He requirements no even further acceptance to do so,” mentioned Wyn Hornbuckle, the deputy director of the Justice Office Business office of Community Affairs.

Shapley explained to the committee that as an investigator for the IRS, he attained messages Hunter Biden sent on the WhatsApp system, together with one that he go through demanding payment from a Chinese businessman named Henry Zhao. In the information, Biden appeared to counsel that he was sitting down with his father, then the former vice president, declaring, “I will make selected that between the guy sitting next to me and every particular person he appreciates and my means to forever maintain a grudge that you will regret not subsequent my way.”

Shapley, a supervisory exclusive agent with IRS criminal investigations who has worked for the company because July 2009, testified in May well, and the committee built the transcript out there Thursday.

The Justice Department has insisted that Weiss, who remained the U.S. lawyer in Delaware after having been appointed by President Donald Trump, was permitted to act with independence and that no strain was put on him to go effortless on Biden.

Weiss’s place of work declined to comment but pointed to his June 7 letter to the Dwelling Judiciary Committee in which he mentioned his decisions were built independently.

“Throughout my tenure as U.S. Attorney my conclusions have been made — and with respect to the subject will have to be manufactured — without the need of reference to political factors,” he wrote.

Even so, critics of the president have billed that he put his thumb on the scale in favor of his son and that Hunter Biden’s agreement to plead guilty to two misdemeanors and prevent jail time was a “sweetheart” deal.

In his opening assertion right before the Republican-managed Ways and Means Committee, Shapley claimed, “I am alleging, with evidence, that DOJ delivered preferential remedy, slow-walked the investigation, did nothing to steer clear of apparent conflicts of desire in this investigation.”

He added, “The investigation into Hunter Biden, code name Sportsman, was first opened in November 2018 as an offshoot of an investigation the IRS was conducting into a foreign-primarily based amateur on the net pornography system.”

Biden pleaded guilty in connection with his 2017 and 2018 tax filings. Shapley reported he saw evidence that Biden should also have been charged in relationship with his tax submitting for 2014 — a 12 months his father was vice president.

The Justice Office would have charged in “any other circumstance I ever worked with identical reality patterns, identical functions of evasion and very similar tax thanks and owing,” Shapley explained to the committee.

In his job interview with the committee, he was demonstrated an email — very first reported by NBC Information in December — from Biden’s enterprise associate stating that Biden wanted to re-point out his income on his tax returns in substantial component for the reason that of his Burisma payments.

Shapley mentioned that the email is essential to that circumstance but that it was not brought since the statute of limits was permitted to expire.

In addition, Shapley claims initiatives to lookup Biden-affiliated attributes and a community relations agency named Blue Star Procedures were being not permitted. The latter “was a important blow to the Foreign Brokers Registration Act piece of the investigation,” referring to the law that calls for people today performing in the U.S. on behalf of international governments to register.

Shapley said he participated in the investigation of the 2018 tax filing. Court filings in Delaware indicating that a plea agreement is forthcoming have been sparse on depth, but Shapley testified underneath oath that Biden was listing own costs as business enterprise fees.

“He was expensing particular expenditures, his enterprise charges,” Shapley stated. “So, I indicate, every thing, there was a payment that — there was a $25,000 to just one of his girlfriends, and it explained, ‘golf membership.’ And then we went out and adopted that income, it was for a sexual intercourse club membership in L.A.”

Shapley suggests vacation prices to stop by prostitutes were being also improperly booked as business enterprise bills.

He states he considered it was valuable for the FBI and the IRS to check with inquiries about the now infamous e-mail “10 for the huge person,” an clear reference to funds for Joe Biden out of one of Hunter Biden’s attempted corporations with a Chinese agency.