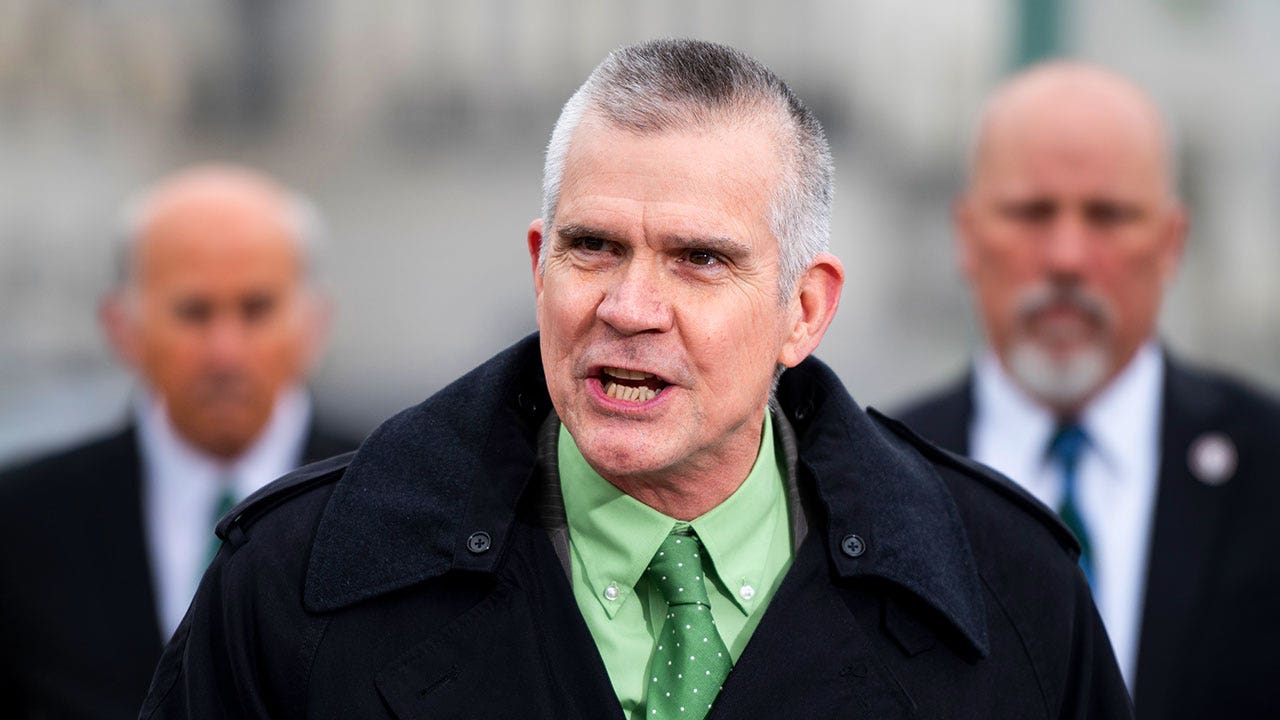

Initially ON FOX: Rep. Matt Rosendale, R-Mont., launched a bill Friday to prohibit the Inner Income Services (IRS) from working with taxpayer pounds to acquire firearms for its brokers, pursuing the unanticipated raid of a community Montana gun store.

The congressman launched the “Why Does the IRS Need Guns Act” Friday, immediately after 20 armed IRS and Bureau of Liquor, Tobacco, Firearms and Explosives (ATF) brokers entered Highwood Creek Outfitters in Wonderful Falls, Montana, earlier in June and reportedly confiscated the own info of customers who obtained a gun from the keep.

“Biden’s alphabet companies have no organization intimidating hardworking Montanans,” Rosendale explained to Fox Information Digital in an exceptional statement. “The weaponization of our federal government should conclude, which is why I am happy to introduce this legislation to prohibit taxpayer cash from remaining leveraged from the American individuals.”

After the armed brokers closed the gun retail store unannounced in June, Rosendale frequented the website and found that 4,473 varieties that contains gun acquire documents have been acquired by the federal agencies.

MONTANA CONGRESSMAN Calls FOR More TRANSPARENCY About BALLOON FLIGHTS

Rep. Matt Rosendale, left, at Highwood Creek Outfitters in Wonderful Falls, Montana. (Rosendale Twitter)

The Montana congressman introduced the laws to press back again versus the new incident and prohibit the IRS from obtaining, getting or storing guns and ammo.

The new Republican-introduced invoice would also “transfer the IRS’ arsenal to the GSA in 120 days where it would be offered at auction to accredited sellers and the general general public” and “transfer the Prison Investigations Division to the Division of Justice.”

Cosponsors of the monthly bill consist of Reps. Clay Higgins, R-La., Randy Weber, R-Texas, Harriet Hageman, R-Wyo., Eli Crane, R-Ariz., Mary Miller, R-Sick., Bob Superior, R-Va., Brian Babin, R-Texas, Jeff Duncan, R-S.C., and Nancy Mace, R-S.C.

BIDEN IRS Needs TO BANKRUPT ME: GUN Store Owner TOM VAN HOOSE

Rosendale’s monthly bill mirrors laws a short while ago launched by Sen. Joni Ernst, R-Iowa., that seeks to “prohibit the Inside Profits Support from furnishing firearms and ammunition to its staff, and for other uses.”

Rep. Matt Rosendale with gun shop proprietor Tom Van Hoose, proper. (Rosendale Twitter)

Ernst highlighted that the IRS reportedly expended $35.2 million of taxpayer resources on “guns, ammunition, and armed service-design and style tools considering the fact that 2006,” together with $10 million on “weaponry and equipment” considering the fact that 2020, in accordance to a recent OpenTheBooks report.

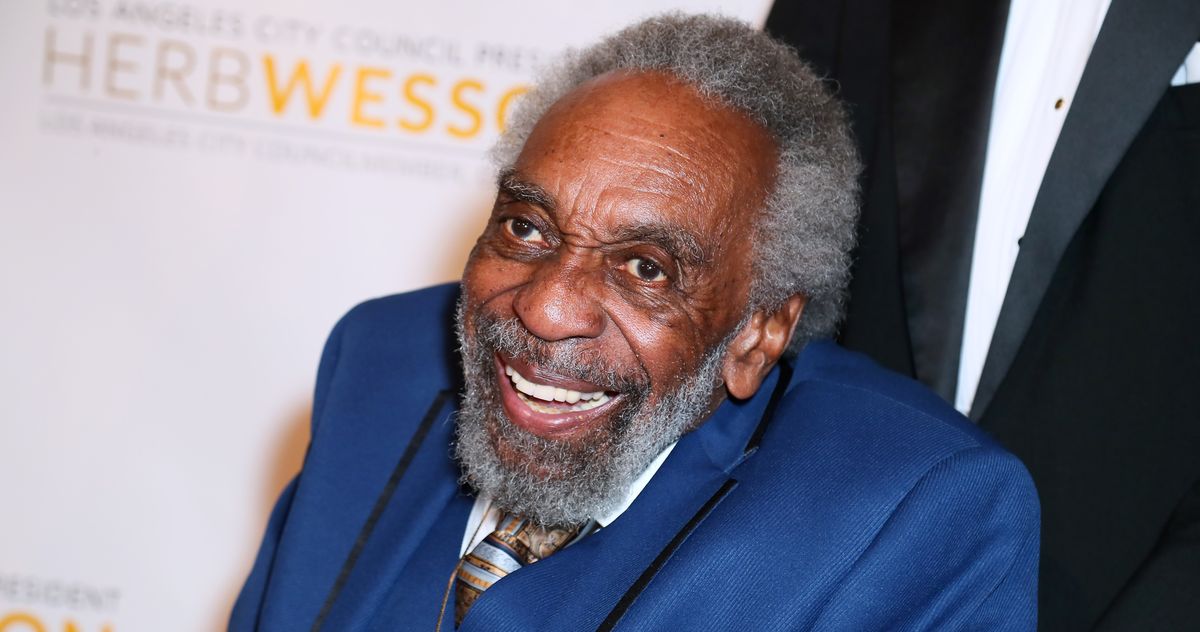

Tom Van Hoose, proprietor of Highwood Creek Outfitters, recalled feeling stunned when he located the group of IRS brokers getting into his retail store unannounced.

IRS paperwork. (Luke Sharrett)

“I was completely frightened for all the passersbyers,” the gun keep proprietor informed Fox News’ Jesse Watters. “What do you do when you received seriously 20 armed in total battle rattle with guns at the completely ready?”

Simply click In this article TO GET THE FOX Information Application

A comparable scenario unfolded in March, when about 16 ATF agents from across the state showed up to an Adventure Outdoors store in Georgia searching for an audit and hunting retailer records.

In a 2023 report, the IRS claimed its armed Legal Investigation Unit is the sixth-major federal legislation enforcement company, and the only one particular authorized to examine tax crimes.

The device “assures the American public that criminals are held accountable, citizens are paying out their honest share of taxes, and sources are focused to the most impactful legal investigations,” the IRS report stated.

Fox Business’ Greg Norman contributed to this report.