FIRST ON FOX: A new bill that would strip the tax-exempt status of nonprofits found to be materially supporting terrorists – which passed the House with broad bipartisan support – is facing lobbying efforts to sink it by groups like the American Civil Liberties Union (ACLU).

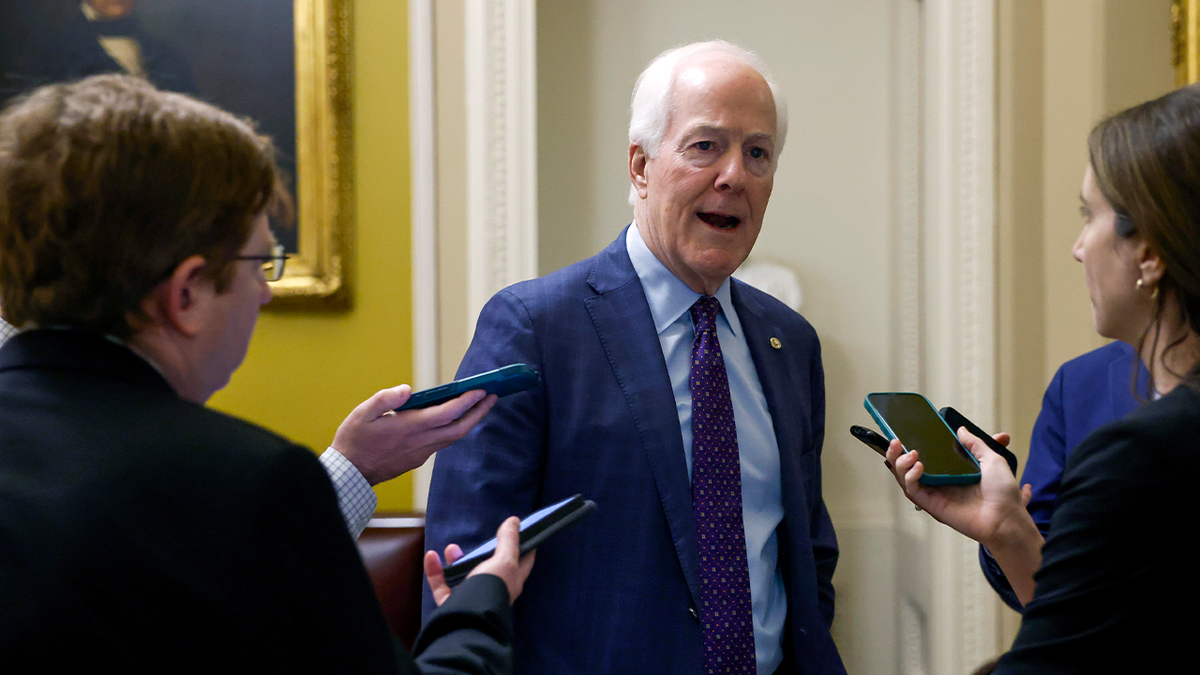

The bill, introduced by Reps. David Kustoff, R-Tenn., and Brad Schneider, D-Ill., passed the House of Representatives in April by a sweeping vote of 382-11. Sens. John Cornyn, R-Texas, and Angus King, I-Maine, have pushed a companion version of the bill. A spokesperson for Cornyn called the legislation a “commonsense” proposal to ban tax breaks for anyone who “bankrolls terrorists.”

The ACLU has joined calls for Congress to kill the bill from groups like Council on American-Islamic Relations and American Muslims for Palestine (AMP) – the center of a recent lawsuit alleging that it and National Students for Justice in Palestine are “collaborators and propagandists for Hamas.”

The ACLU argued in a letter obtained by Fox News Digital that the prohibitions instituted by the bill, which would amend the Internal Revenue Code of 1986, are already illegal under current law.

IRS URGED TO PROBE TAX-EXEMPT GROUPS SUPPORTING ANTI-ISRAEL PROTESTS

Anti-Israel protesters demonstrate along NYPD police lines outside of Columbia University’s campus in New York City on Thursday, April 18, 2024. (Peter Gerber for Fox News Digital)

The group also claimed “the legislation raises serious constitutional concerns,” and because it “vests vast discretion in the Secretary of the Treasury, it creates a high risk of politicized and discriminatory enforcement.”

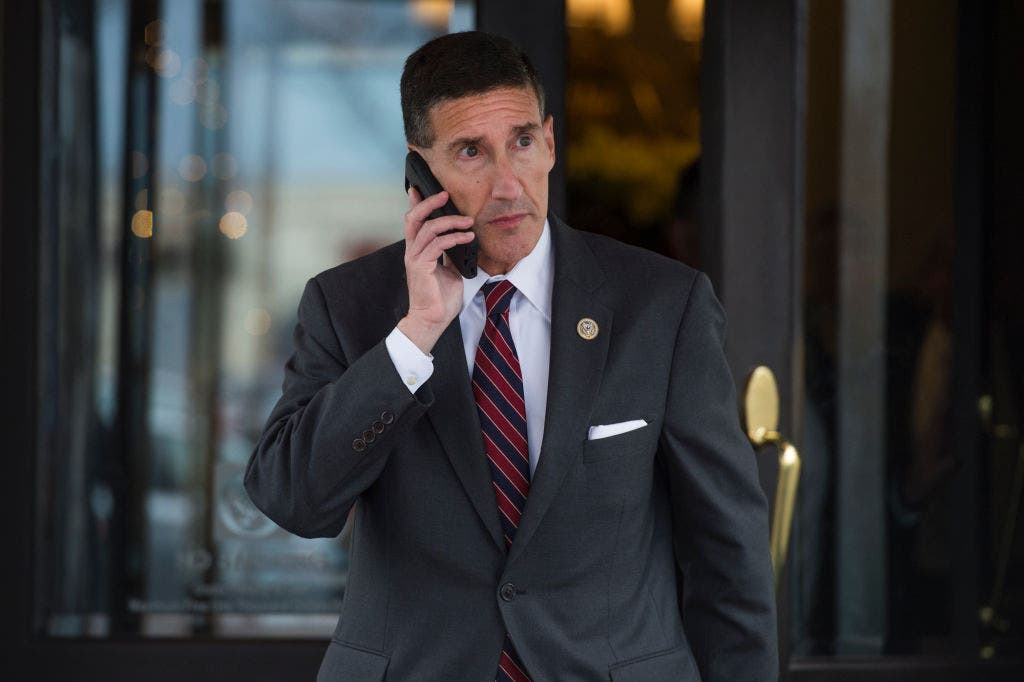

However, Kustoff, one of only two Jewish Republicans in Congress, is baffled by the opposition.

“Several weeks ago, the House of Representatives overwhelmingly voted to pass bipartisan legislation I introduced that does one simple thing: take away the tax-exempt status of nonprofits that give financial support to terrorist groups and organizations,” he told Fox News Digital.

“This bill and its purpose are clear and simple. The American taxpayer should not unknowingly be funding terrorists. It should be a no-brainer,” he said.

“Now, there are some left-wing radical groups, and at least one pro-Hamas group, trying to influence the United States Senate,” he said.

“Even in deeply divided Washington, 382 Members of Congress agree that any organization that funds terrorism should not receive tax-exempt status under the U.S. tax code,” he said.

Rep. David Kustoff, R-Tenn. (CQ-Roll Call/Getty Images)

The ACLU claimed in its letter that “there has been no evidence presented as to the necessity of this legislation, and the lack of guardrails creates the potential for a future administration to weaponize this legislation to further its own political motives to target U.S. nonprofits, exposing them to stigmatizing and financially devastating punishments.”

It also claimed the bill raises due process concerns, alleging it “switches the burden of proof about whether a nonprofit provides material support from the government to the nonprofit.”

However, Rabbi Yaakov Menken, managing director of the Coalition for Jewish Values disagrees. “A tax exemption from the federal government is not a right, it’s a privilege. The burden of proof is on the organization to demonstrate that it is not using its tax exemption to engage in activities forbidden by a tax-exempt organization.”

Under the current U.S. tax code, an entity’s tax-exempt status is suspended if it is designated by the U.S. Department of State as a terrorist organization, which includes groups like Hamas, Hezbollah and al Qaeda.

Cornyn says the legislation would extend the current prohibition to include organizations that provide material support or resources, such as finances, services or training, to a terrorist organization within the past three years.

Kia Hamadanchy, senior policy counsel at ACLU said in a statement, “While it is already illegal under current law to provide material support to foreign terrorist organizations, by vesting vast discretion in the Secretary of Treasury, this bill creates a high risk of politicized and discriminatory enforcement.”

“As drafted the lack of due process protections would hand current and future presidential administrations a tool perfectly designed to stifle free speech, target political opponents, and punish disfavored groups on both ends of the political spectrum,” Hamadanchy said.

Sen. John Cornyn, R-Texas. (Anna Moneymaker/Getty Images)

“If this legislation isn’t necessary, how is it that American Muslims for Palestine are still tax-exempt? Within 36 hours of the atrocities of October 7, AMP’s campus arm, Students for Justice in Palestine, had already emerged with a detailed ‘Day of Resistance’ toolkit for campus chapters to hold activities in support of Hamas,” said Menken.

“They declared that they not only support the messaging of Hamas, but they part of it,” Menken said, referring to the toolkit document released by the groups.

AMP, headquartered in Falls Church, Virginia, is currently under investigation by Virginia Attorney General Jason Miyares for allegedly soliciting contributions in the commonwealth without first having registered with the commissioner of the Virginia Department of Agriculture and Consumer Services.

Miyares also announced in November that he is investigating allegations the group may have used funds raised for illegal purposes under state law, including benefiting or providing support to terrorist organizations.

Earlier this month, a major U.S. and global law firm, Greenberg Traurig, filed a federal lawsuit representing nine survivors of the Oct. 7 terrorist attacks on southern Israel, arguing that NSJP and AMP are working in the United States “as collaborators and propagandists for Hamas.”

Through NSJP, AJP Educational Foundation Inc. – also known as AMP – allegedly “uses propaganda to intimidate, convince, and recruit uninformed, misguided, and impressionable college students to serve as foot soldiers for Hamas on campus and beyond,” according to the lawsuit filed in the U.S. District Court for the Eastern Division of Virginia, Alexandria Division.

The litigation alleges AMP “serves as Hamas’s propaganda division in the United States” and “was founded from the ashes of disbanded organizations created by senior Hamas officials after those organizations and related individuals were found criminally and civilly liable for providing material support to Hamas and other affiliated terrorist groups.”

CLICK HERE TO GET THE FOX NEWS APP

AMP’s co-founder and current chairman, Hatem Bazian, founded the first SJP chapter as a professor at the University of California at Berkeley, the lawsuit notes.

In an email to Fox News Digital, a representative for AMP said it does not support the bill “due to the inherent flaws in the proposed bill.”

The proposed legislation “grant[s] the Secretary of the Treasury broad discretionary powers to terminate the tax-exempt status of nonprofit organizations based solely on a subjective declaration that they are ‘terrorist supporting organizations,'” the representative said.

The representative also said AMP utilizes donations “completely within the United States to support its mission of educating American Muslims and the American public on the rich history and culture of Palestine.”