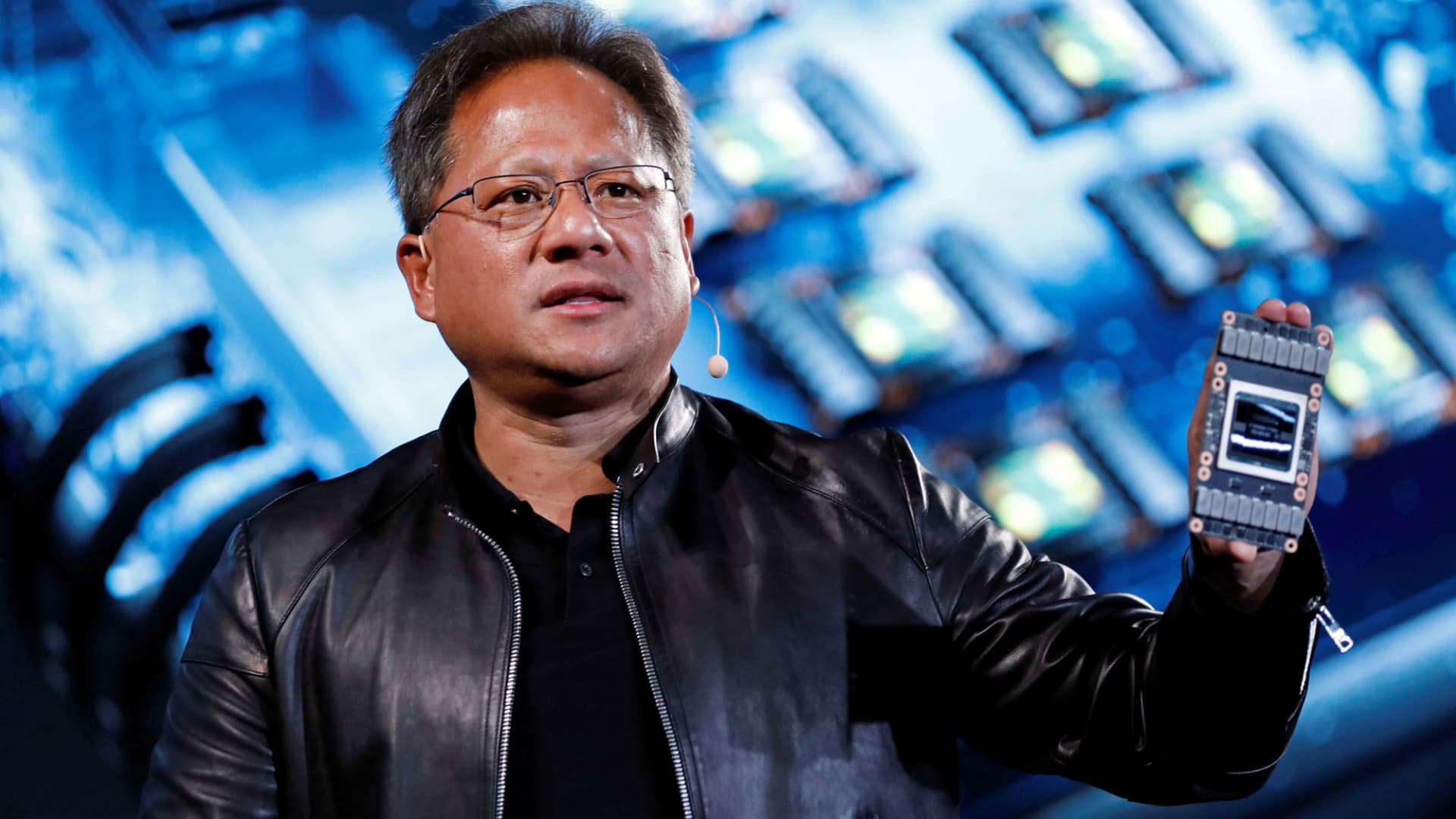

Nvidia co-founder and CEO Jensen Huang attends an occasion throughout the annual Computex computer system exhibition in Taipei.

Tyrone Siu | Reuters

Nvidia noted first-quarter earnings for its fiscal 2024 on Wednesday, with a more powerful-than-anticipated forecast that drove shares up 26% in prolonged trading.

Here is how the corporation did versus Refinitiv consensus estimates for the quarter ended in April:

- EPS: $1.09, altered, versus 92 cents expected

- Revenue: $7.19 billion, as opposed to $6.52 billion predicted

Nvidia stated it anticipated product sales of about $11 billion, as well as or minus 2%, in the latest quarter, extra than 50% better than Wall Road estimates of $7.15 billion.

Prior to the after-hours transfer, Nvidia stock was up 109% so significantly in 2023, primarily pushed by optimism stemming from the firm’s main posture in the marketplace for synthetic intelligence chips. Nvidia CEO Jensen Huang reported the business was looking at “surging desire” for its information center items.

Nvidia’s facts middle group described $4.28 billion in revenue, compared to anticipations of $3.9 billion, a 14% yearly boost. Nvidia claimed that effectiveness was driven by demand for its GPU chips from cloud vendors as perfectly as huge buyer internet companies, which use Nvidia chips to practice and deploy generative AI applications like OpenAI’s ChatGPT.

Nvidia’s robust effectiveness in information heart displays that AI chips are turning out to be increasingly important for cloud providers and other businesses that run massive numbers of servers.

Having said that, Nvidia’s gaming division, which features the company’s graphics cards for Computer revenue, claimed a 38% fall in income to $2.24 billion in income vs . anticipations of $1.98 billion. Nvidia blamed the drop on a slower macroeconomic environment as properly as the ramp up of the company’s most recent GPUs for gaming.

Nvidia’s automotive division, including chips and software program to build self-driving vehicles, grew 114% year in excess of year, but continues to be little at underneath $300 million in gross sales for the quarter.

Net income for the quarter was $2.04 billion, or 82 cents a share, when compared with $1.62 billion, or 64 cents, throughout the year-earlier time period. Nvidia’s all round product sales fell 13% from $8.29 billion a year back.