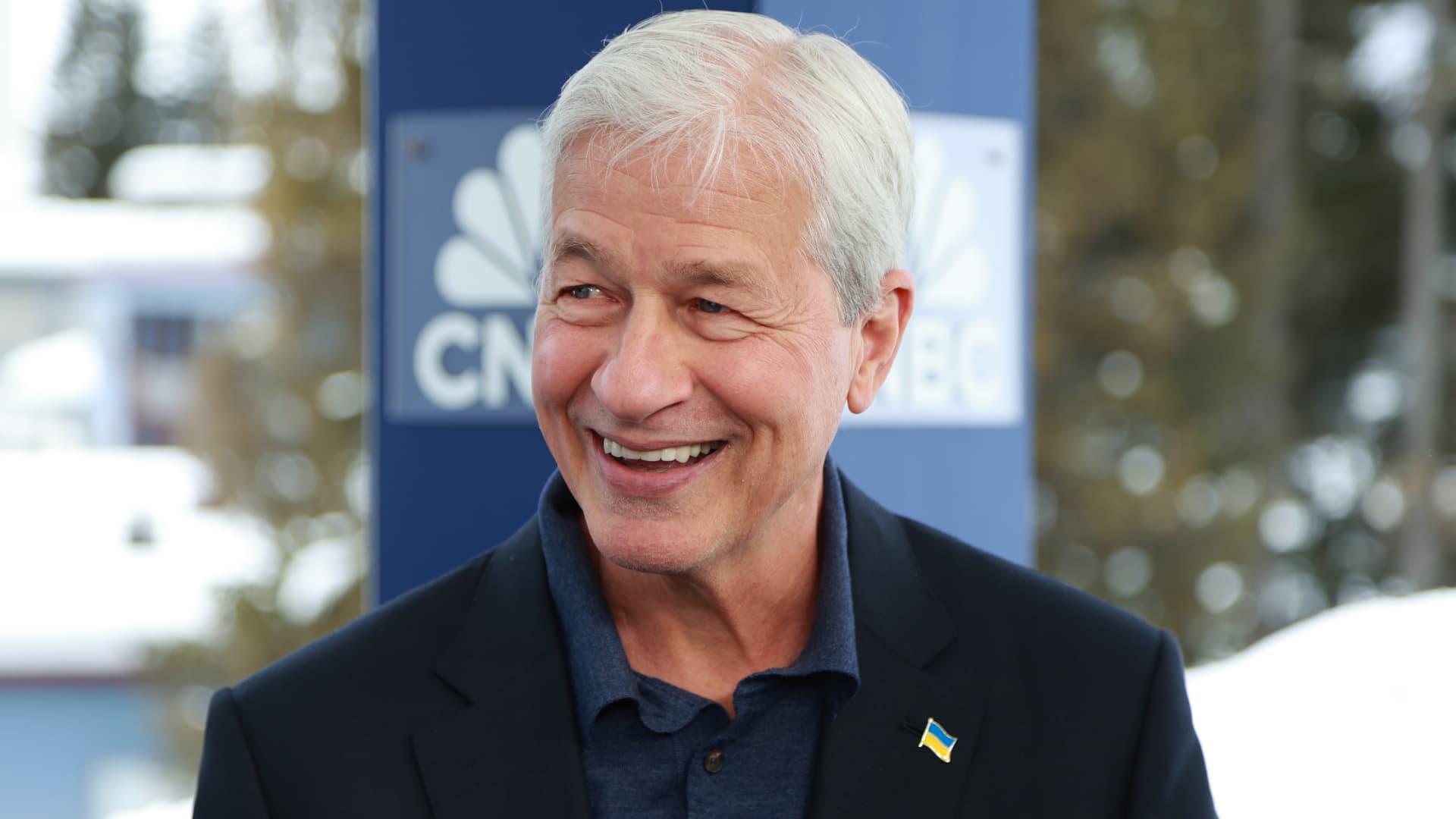

Jamie Dimon, President and CEO of JPMorgan Chase, speaking on CNBC’s “Squawk Box” at the World Economic Forum Yearly Conference in Davos, Switzerland, on Jan. 17, 2024.

Adam Galici | CNBC

JPMorgan Chase is scheduled to report initial-quarter earnings ahead of the opening bell Friday.

This is what Wall Street expects:

- Earnings: $4.11 a share, in accordance to LSEG

- Income: $41.85 billion, in accordance to LSEG

- Internet interest cash flow: $23.18 billion, in accordance to StreetAccount

- Trading Revenue: Fixed revenue of $5.19 billion and equities of $2.57 billion, according to StreetAccount

JPMorgan will be watched closely for clues on how banking institutions fared at the start off of the calendar year.

Though the largest U.S. bank by belongings has navigated the amount ecosystem well considering the fact that the Federal Reserve began boosting rates two many years in the past, scaled-down peers have witnessed their profits squeezed.

The industry has been pressured to spend up for deposits as shoppers change hard cash into greater-yielding instruments, squeezing margins. Problem is also mounting over soaring losses from commercial financial loans, in particular on office structures and multifamily dwellings, and greater defaults on credit playing cards.

Nevertheless, significant banks are envisioned to outperform more compact kinds this quarter, and expectations for JPMorgan are significant. Analysts think the financial institution can enhance steerage for 2024 net fascination profits as the Federal Reserve is compelled to keep desire fee ranges amid stubborn inflation details.

Analysts will also want to hear what CEO Jamie Dimon has to say about the financial state and the industry’s initiatives to force again from initiatives to cap credit card and overdraft charges.

Wall Street may provide some assistance this quarter, with expenditure banking costs for the business up 11% from a 12 months previously, in accordance to Dealogic.

Shares of JPMorgan have jumped 15% this 12 months, outperforming the 3.9% gain of the KBW Financial institution Index.

Wells Fargo and Citigroup are scheduled to launch outcomes later on Friday, when Goldman Sachs, Bank of The united states and Morgan Stanley report up coming 7 days.

This tale is establishing. Remember to verify again for updates.