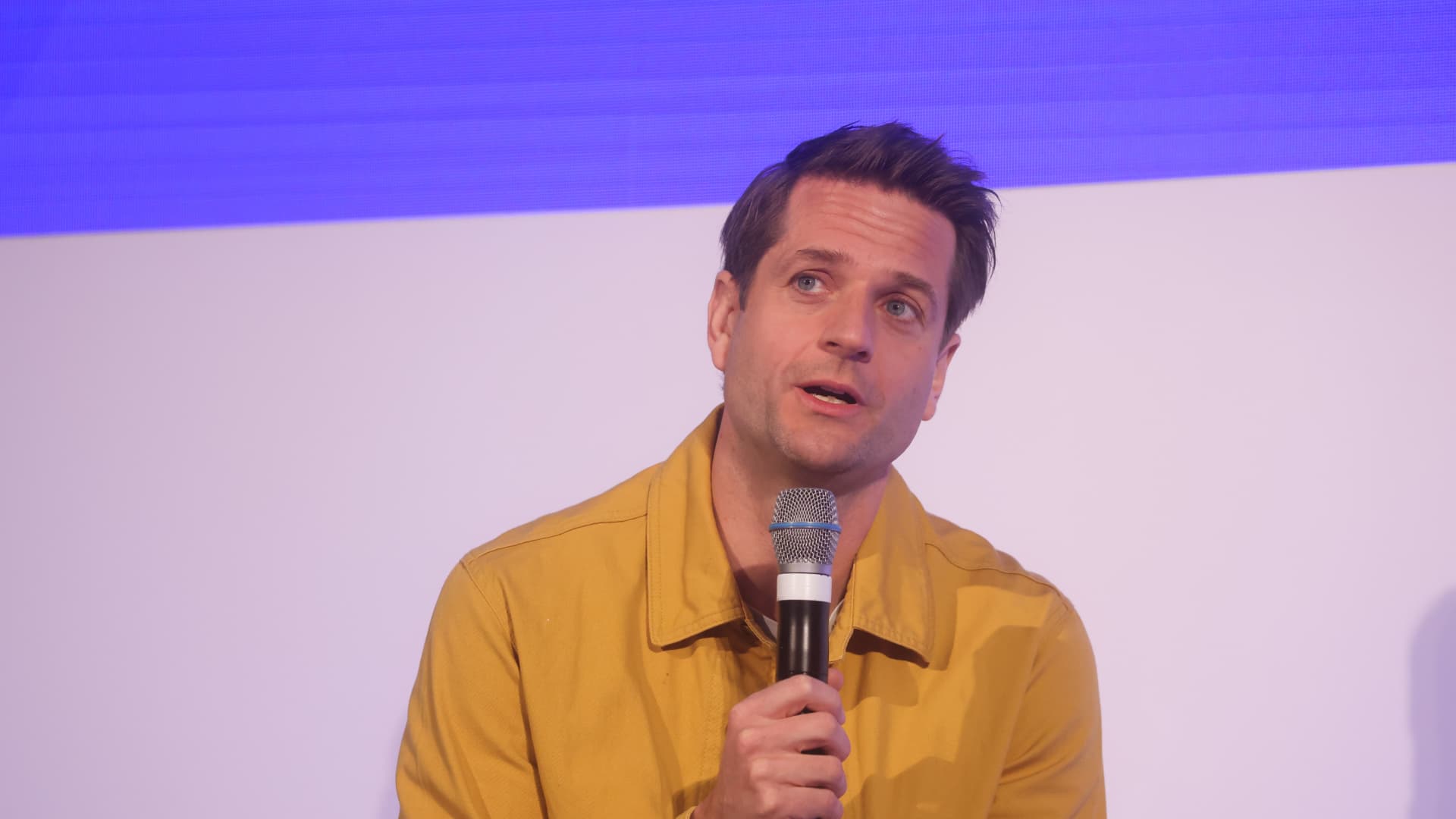

Sebastian Siemiatkowski, CEO of Klarna, talking at a fintech celebration in London on Monday, April 4, 2022.

Chris Ratcliffe | Bloomberg through Getty Pictures

Klarna, the Swedish buy now, pay back later fintech corporation, halved its web reduction in the very first quarter, recording a sizeable enhancement in its base line immediately after a significant charge-cutting drive.

The firm posted a net decline of 1.3 billion Swedish krona ($120.7 million), down 50% from the 2.6 billion krona decline in the identical time period a year ago.

Klarna documented total internet running earnings of 5 billion Swedish krona, up 22% year-more than-calendar year.

“This quarter we have impressively managed to expand GMV and earnings, at the identical time as we slice expenditures and credit losses, and also investing ambitiously in AI driven merchandise,” Klarna CEO Sebastian Siemiatkowski reported in a assertion.

“We are on monitor to accomplish profitability this yr all even though revolutionizing searching and payments by way of our AI-run technique.”

Siemiatkowski beforehand told CNBC the organization was preparing to achieve profitability in the 2nd fifty percent of 2023.

Klarna attributed the most current reduction in losses to a fall in customer defaults many thanks to an advancement in its underwriting, as effectively as to diversification into other sources of revenue, this kind of as internet marketing.

The benefits display how Klarna is making “considerable strides” towards profitability on a month-to-month basis, the agency said.

Klarna, which now has extra than 150 million prospects, was in April given a credit history rating of BBB/A-3 with a secure outlook by S&P World. The rankings company at the time explained this reflected Klarna’s “ability to protect its sturdy e-commerce position in its key marketplaces, rebuild profitability,” and “sustain a solid funds buffer.”

Early indications sign that Klarna’s deep price tag-slicing measures are starting to pay off. The enterprise went on a hiring spree all through 2020 and 2021 to capitalize on progress activated by the Covid-19 pandemic, and was forced to minimize headcount by around 10% in Might 2022 in reaction to trader force to slim down functions. Inspite of this measure, it nonetheless afterwards missing 85% of its industry benefit in a funding round past summer time.

Klarna is not on your own in its difficulties. Buy now, pay back afterwards companies, which allow purchasers to defer payments to a afterwards date or spend about installments, have been specifically impacted by souring investor sentiment on know-how, amid a worsening macroeconomic natural environment.

AI push

Additional not too long ago, Klarna has turned its concentration towards AI. The company revamped its app with a far more innovative AI suggestion algorithm to enable its retailers focus on shoppers extra correctly.

Klarna earlier released the means to integrate OpenAI’s ChatGPT into its provider with a plugin that allows customers inquire the well-known AI chatbot for searching inspiration. The business reported it was embedding AI in its organization to “strengthen inner efficiencies and deliver shoppers with an even improved provider and encounter,” for case in point by way of authentic-time translations in client chat.

The business has now also manufactured a foray into facilitating small-time period holiday getaway rentals. Before this thirty day period, Klarna announced a partnership with Airbnb to enable the online holiday vacation rental firm’s shoppers book vacations and pay back down the cost around installments.