Eli Lilly ‘s elevated steerage stole the exhibit Tuesday, offsetting blended first-quarter results and propelling shares increased by almost 6%. The quantities leave tiny question that the long-expression Eli Lilly accomplishment tale remains intact, as demand from customers for its new diabetes and obesity medications, Mounjaro and Zepbound, outstrips offer. Income in the a few months ended March 31 rose 26% 12 months around year to $8.77 billion, shy of the $8.92 billion anticipated by analysts, in accordance to estimates compiled by LSEG. Altered earnings for every share in the initial quarter arrived in at $2.58, topping the consensus estimate of $2.46, LSEG information confirmed. Eli Lilly Why we possess it: Eli Lilly’s finest-in-class medicine should help progress above the marketplace ordinary for quite a few years to appear. The portfolio is anchored by its GLP-1 franchise, which at this time is composed of Mounjaro for form-2 diabetes and Zepbound for being overweight. The rapid-increasing class of medicines has the possible to handle other conditions, these types of as snooze apnea and minimize the possibility of stroke. Lilly’s experimental Alzheimer’s solutions include to the stock’s long-term charm. Competition: Novo Nordisk , Biogen , Eisai, Merck and Pfizer Excess weight in portfolio: 2.7% Most current invest in: Feb. 7, 2023 Initiated: Oct. 8, 2021 Base line Eli Lilly checked all the containers that make a difference to very long-phrase investors, like the Club, which is why it is really no surprise to see the inventory owning one particular of its very best times of the calendar year. At their highs of the early morning, shares of Eli Lilly traded higher than their all-time closing higher of $792.28 established on March 4. Desire for Mounjaro and Zepbound — which share an energetic component recognized as tirzepatide — is off the charts. But, equally as significant, administration is deftly dealing with the complex, highly-priced procedure of boosting production capacity for the injectable medications to relieve source constraints. That needs to happen for Lilly to meet Wall Street’s lofty expansion anticipations. “It is the best-good quality challenge,” Jim Cramer reported Tuesday, referring to Mounjaro and Zepbound demand from customers considerably outpacing availability. LLY .SPX 5Y mountain Eli Lilly’s stock general performance about the past five many years in comparison with the S & P 500. Eli Lilly expects meaningful will increase in cargo volumes for Mounjaro and Zepbound in the 2nd 50 percent of 2024. Which is enabled administration to increase its entire-yr revenue and profit assistance fewer than a few months soon after it was initially supplied — quieting sound all over initial-quarter benefits. “I like almost everything I read” from Eli Lilly on Tuesday, added Jim, who has prolonged stated tirzepatide could come to be the ideal-advertising drug of all time. Without a doubt, almost nothing contained in Tuesday’s report dims the likelihood of that going on in the many years to come. We are retaining our 2 score and $850-for every-share cost target on the inventory. Quarterly commentary In its initially total quarter on the U.S. market place, Zepbound sales trounced Wall Avenue anticipations, totaling $517.4 million in the 3 months finished in March, as opposed with estimates of $373.3 million, according to FactSet. Insurance plan protection for Zepbound, a critical piece to its lengthy-expression monetary achievements, is “fast” strengthening, CFO Anat Ashkenazi mentioned on the write-up-earnings meeting connect with. As of April 1, Zepbound has roughly 67% entry in the business insurance plan sector, up from about 33% on Feb. 1, according to the firm. Zepbound was accredited by U.S. regulators in early November and hit pharmacy shelves a handful of months later. In the fourth quarter, Zepbound revenue was about $176 million. Very first-quarter sales of Mounjaro much more than tripled to $1.81 billion but skipped Wall Road estimates. That is not precisely a shock provided the source constraints. Lilly’s other GLP-1 for kind-2 diabetic issues on the market, Trulicity, saw income fall 26% to $1.46 billion. It also skipped earnings estimates. Like Zepbound and Mounjaro, Trulicity is facing shortages. Traditionally, some patients also swap onto Mounjaro from Trulicity. According to a Food stuff and Drug Administration databases, most doses of Zepbound and Mounjaro are predicted to see confined availability by the close of the second quarter in June. It is really a related timeline for most doses of Trulicity, which was very first approved almost a 10 years in the past . All a few medicines are at the time-weekly injectables, and sufferers scale up the dosage quantity for the duration of the class of treatment method. “Unprecedented need” for Eli Lilly’s so-referred to as incretin medications — a team that consists of Zepbound, Mounjaro and Trulicity — is contributing to the shortages, Ashkenazi mentioned on the phone. “In the quick to mid-phrase, we expect product sales expansion to principally be a perform of the quantities we can develop and ship,” she reported. The quantities continue to be poised to raise. Eli Lilly’s output of incretin doses in the second fifty percent of 2024 is nonetheless on keep track of to be about 1.5 periods where it was in the very same period last yr, Ashkenazi mentioned. The organization has six production amenities beneath design or ramping up, Ashkenazi said. Previous week, it introduced a offer to purchase a seventh facility from Nexus Prescription drugs situated in Wisconsin. Eli Lilly estimates output there could begin at the stop of subsequent calendar year. Eli Lilly’s most important competitor in the GLP-1 market, Ozempic and Wegovy maker Novo Nordisk , also is investing intensely to prevail over shortages for its medicine. “Our best priority is building much more product,” Eli Lilly CEO Dave Ricks told CNBC previously Tuesday. “We are executing every thing we can to do that. This is 1 of the most technically sophisticated medicines we’ve ever designed.” Eli Lilly also claimed the Food and drug administration advisory panel that designs to review the security and efficacy of its experimental Alzheimer’s procedure donanemab has yet to plan the meeting. However, it is envisioned to get put in the middle of the calendar year, with management reiterating their self esteem in the drug’s means to gradual the development of the memory-robbing disorder. Eli Lilly experienced formerly planned for regulatory approval at the end of March. Direction Eli Lilly now expects whole-12 months income among $42.4 billion and $43.6 billion, up $2 billion at the two ends of the assortment. Its revised modified earnings for every share outlook is amongst $13.50 and $14.00, in contrast with $12.20 to $12.70 earlier that’s about 10% larger at the midpoint. Eli Lilly also boosted its altered functioning margin outlook to involving 33% and 35%, up from 31% to 33%. The improvements ended up driven by the powerful general performance of Mounjaro and Zepbound, alongside with “higher visibility” into Eli Lilly’s generation enlargement ideas, the business stated in a release. People are particularly the explanations you would want Lilly to hike guidance. In typical, the extra-bullish economic outlook can help make Eli Lilly’s substantial cost-to-earnings ratio coming into earnings much more tolerable for buyers. Eli Lilly’s comprehensive-year outlook for other money and its tax level have been unchanged. The corporation does not offer quarter-by-quarter steerage. (Jim Cramer’s Charitable Rely on is extensive LLY. See in this article for a comprehensive list of the shares.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will get a trade warn right before Jim would make a trade. Jim waits 45 minutes immediately after sending a trade warn prior to obtaining or advertising a inventory in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC Television, he waits 72 hrs right after issuing the trade warn ahead of executing the trade. THE Earlier mentioned INVESTING CLUB Information IS Subject TO OUR Conditions AND Circumstances AND Privacy Plan , Alongside one another WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR Duty EXISTS, OR IS Developed, BY Virtue OF YOUR RECEIPT OF ANY Data Presented IN Relationship WITH THE INVESTING CLUB. NO Unique Result OR Revenue IS Assured.

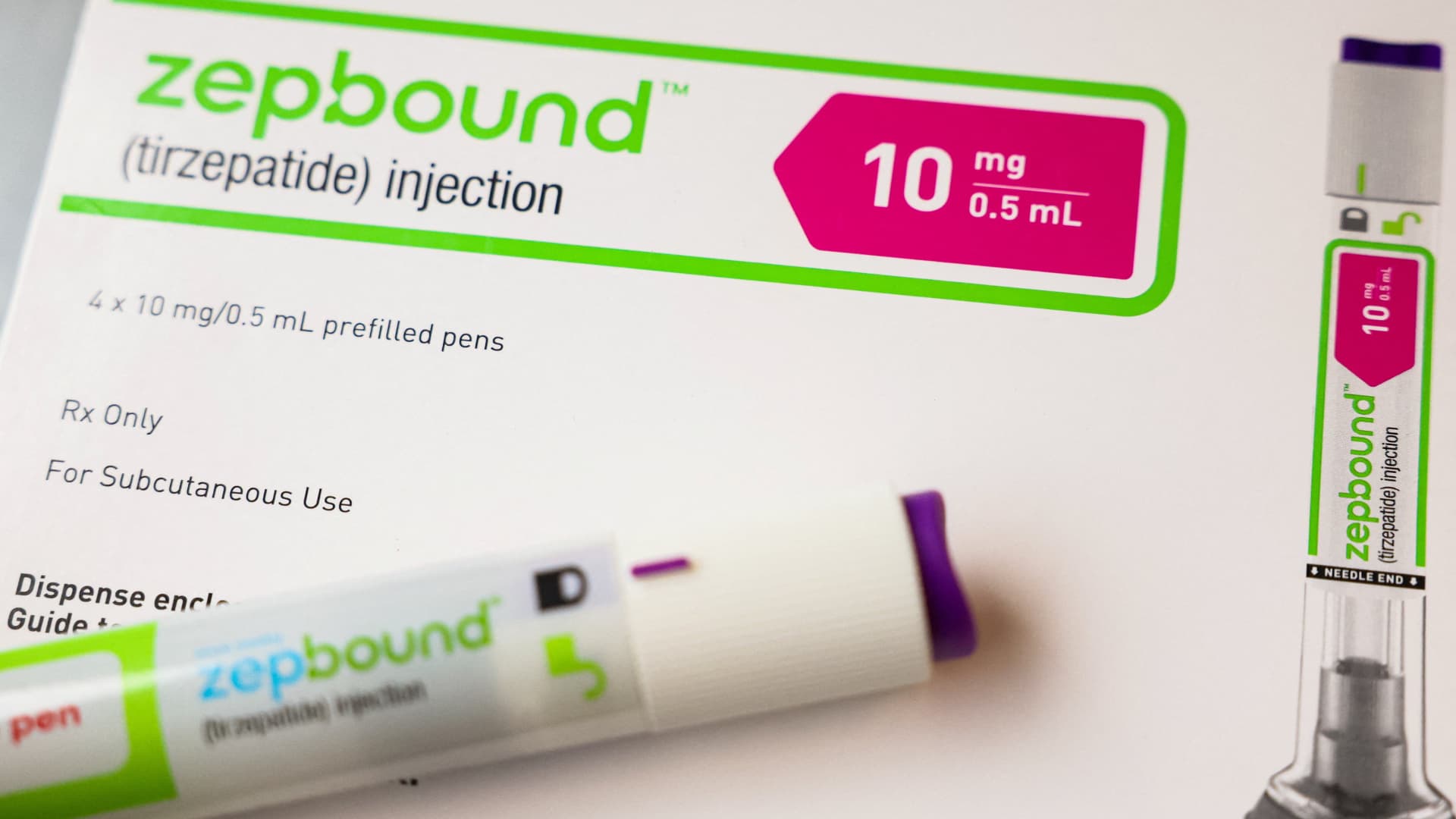

An injection pen of Zepbound, Eli Lilly’s body weight reduction drug, is displayed in New York City, U.S., December 11, 2023.

Brendan McDermid | Reuters

Eli Lilly‘s raised assistance stole the demonstrate Tuesday, offsetting combined to start with-quarter results and propelling shares increased by nearly 6%. The quantities leave minor question that the extensive-phrase Eli Lilly achievement tale remains intact, as demand for its new diabetes and weight problems prescription drugs, Mounjaro and Zepbound, outstrips source.