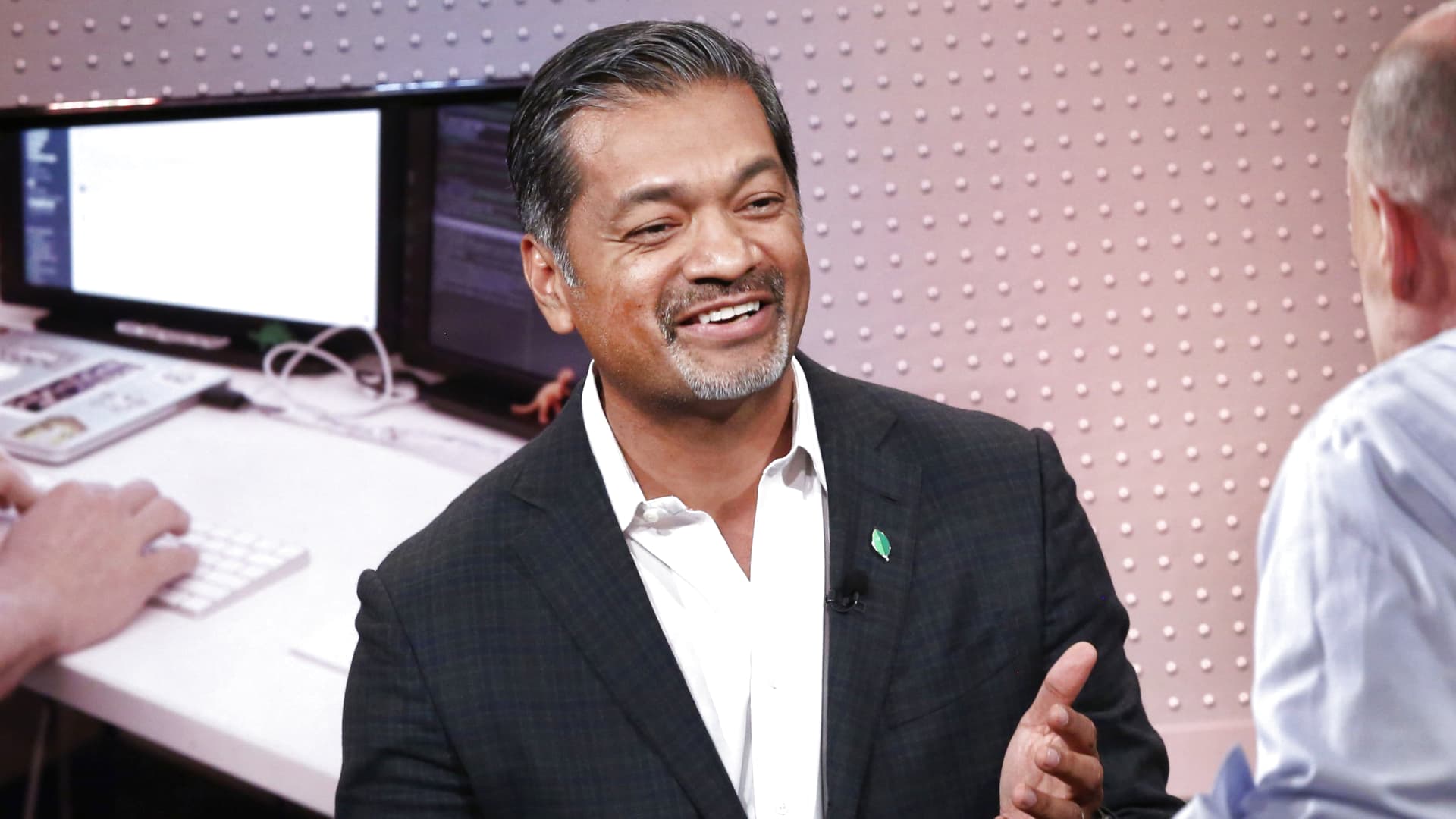

Amazon CEO Andy Jassy speaks at the Bloomberg Technological innovation Summit in San Francisco on June 8, 2022.

David Paul Morris | Bloomberg | Getty Photos

Amazon will report first-quarter earnings following the bell on Tuesday.

Here’s what analysts are anticipating in accordance to LSEG:

- Earnings for every share: 83 cents

- Profits: $142.5 billion

Wall Road is also watching numerous other numbers in the report:

- Amazon World-wide-web Providers: $24.5 billion in revenue, according to StreetAccount

- Advertising: $11.7 billion in earnings, according to StreetAccount

Analysts are expecting Amazon to report revenue progress of 12%, which would mark a fourth straight quarter of enlargement in the low double digits and a slight acceleration from a calendar year earlier.

Earnings are escalating substantially speedier, thanks to widespread cost-slicing, tweaks to Amazon’s fulfillment functions and the stabilizing of cloud shelling out. Operating money of $11.2 billion is predicted, in accordance to StreetAccount, up in excess of 130% from a 12 months before.

Under CEO Andy Jassy, Amazon has become a lot more disciplined in its paying, even though expanding financially rewarding solutions like promotion, cloud computing, Prime memberships and its third-celebration market.

The firm has laid off extra than 27,000 staff considering the fact that late 2022, with the cuts bleeding into 2024. In the course of the 1st quarter, Amazon let go hundreds of staffers in its well being and AWS organizations.

Following a rough 2021 and 2022, Amazon shares soared 75% past yr, and have obtained 19% calendar year to day, outperforming the Nasdaq Composite, which is up about 6.5%.

Analysts assume Amazon to report a 12% improve in AWS profits. Which is a slight deceleration from the previous quarter, when earnings grew 13%, but a noteworthy uptick from the very first quarter of 2023, when sales expanded just 9%.

Executives said in February they be expecting increasing demand from customers for generative synthetic intelligence technological know-how to give AWS a increase. Jassy echoed that sentiment in his annual letter to shareholders launched previously this thirty day period.

Promotion, a further superior-margin organization, will also be a essential place to view, with revenue projected to grow extra than 23% year over yr to $11.7 billion. Digital advert friends Meta, Google and Snap all noted earnings past 7 days that surpassed analysts expectations.

Wedbush analysts expect to see sturdy expansion in Amazon’s advert company in the initially quarter, and “healthy shelling out intent for the remainder of 2024,” they wrote in a be aware to purchasers very last week.

“We think the chance for Amazon is however early and hope multiyear growth previously mentioned the broader electronic advert marketplace, supported by continued enlargement of off-system advertising and marketing options, ongoing monetization of Prime Video adverts, emerging demand from customers from non-endemic advertisers, and main on-platform sponsored item growth supported by the secular transition to e-commerce,” Wedbush analysts wrote. They have an outperform rating on Amazon’s shares.

Wall Road will also be looking at to see if Amazon usually takes a webpage from its tech peers in saying its first-ever dividend. Google father or mother Alphabet very last week issued its very first dividend along with its quarterly benefits, while Meta licensed its 1st-at any time dividend in February.

Amazon finished 2023 with $73.4 billion in cash and equivalents.

The enterprise will discuss the success on a meeting connect with with traders at 5:30 p.m. ET.