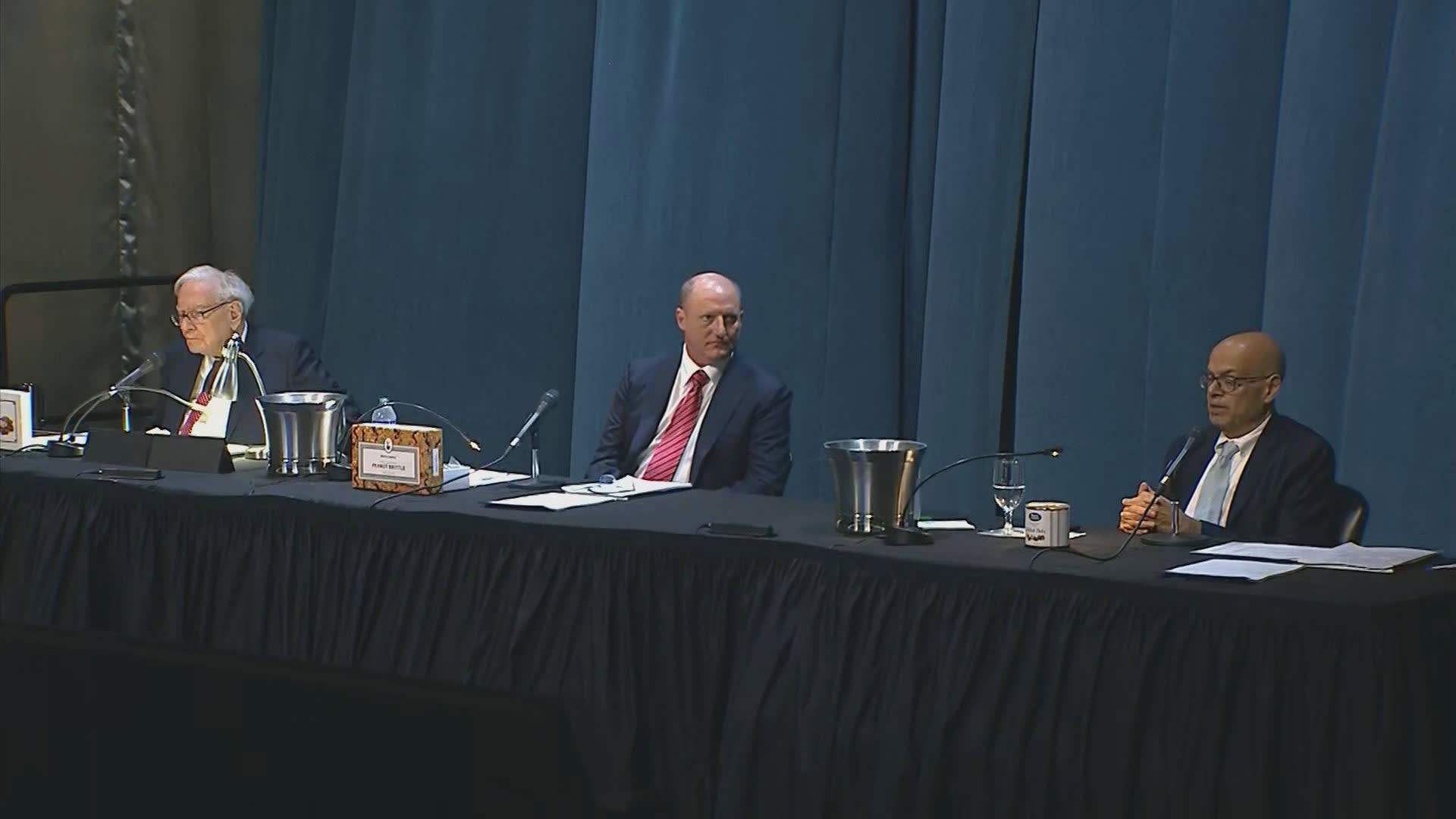

OMAHA, Nebraska — Warren Buffett mentioned Saturday his designated successor Greg Abel will have the closing say on Berkshire Hathaway’s investing choices when the Oracle of Omaha is no more time at the helm.

“I would depart the capital allocation to Greg and he understands enterprises really perfectly,” Buffett instructed an arena complete of shareholders at Berkshire’s once-a-year conference.

Abel, 61, turned acknowledged as Buffett’s heir obvious in 2021 after Charlie Munger inadvertently manufactured the revelation at the shareholder conference. Abel has been overseeing a main portion of Berkshire’s sprawling empire, which include vitality, railroad and retail.

Buffett available the clearest perception into his succession approach to day right after many years of speculation about the actual roles of Berkshire’s major executives just after the eventual changeover. The investing icon, who’s turning 94 years previous in August, claimed his choice is motivated by how significant Berkshire’s belongings have grown.

“I employed to imagine in different ways about how that would be handled, but I imagine that accountability need to be that of the CEO and whatever that CEO decides may well be beneficial,” Buffett claimed. “The sums have developed so substantial at Berkshire and we do not want to consider and have two people today all around that are managing a billion every single. It just doesn’t get the job done.”

Berkshire’s hard cash pile ballooned to just about $189 billion at the end of March, when its gigantic equity portfolio has stocks value a whopping $860 billion primarily based on today’s sector rates.

“I believe what you’re handling the sums that we will have, you have acquired to assume quite strategically about how to do quite significant issues,” Buffett extra.

Although Buffett has designed clear that Abel would be taking about the CEO job, there were being nonetheless issues about who would manage the Berkshire general public stock portfolio, where by Buffett has garnered a enormous next by racking up huge returns by investments in the likes of Coca-Cola and Apple.

Berkshire investing professionals, Todd Combs and Ted Weschler, equally former hedge fund professionals, have aided Buffett regulate a smaller portion of the stock portfolio (about 10%) for about the final ten years. There was speculation that they may perhaps get above that part of the Berkshire CEO purpose when he is no more time ready.

But it looks by Buffett’s latest responses that Abel will have closing decision on all cash allocation, like stock picks.

“I feel the main govt ought to be somebody that can weigh acquiring organizations, buying shares, performing all sorts of points that could come up at a time when no person else is eager to move,” Buffett said.

Abel is regarded for his robust abilities in the vitality business. Berkshire obtained MidAmerican Energy in 1999 and Abel grew to become CEO of the company in 2008, 6 many years before it was renamed Berkshire Hathaway Electrical power in 2014.