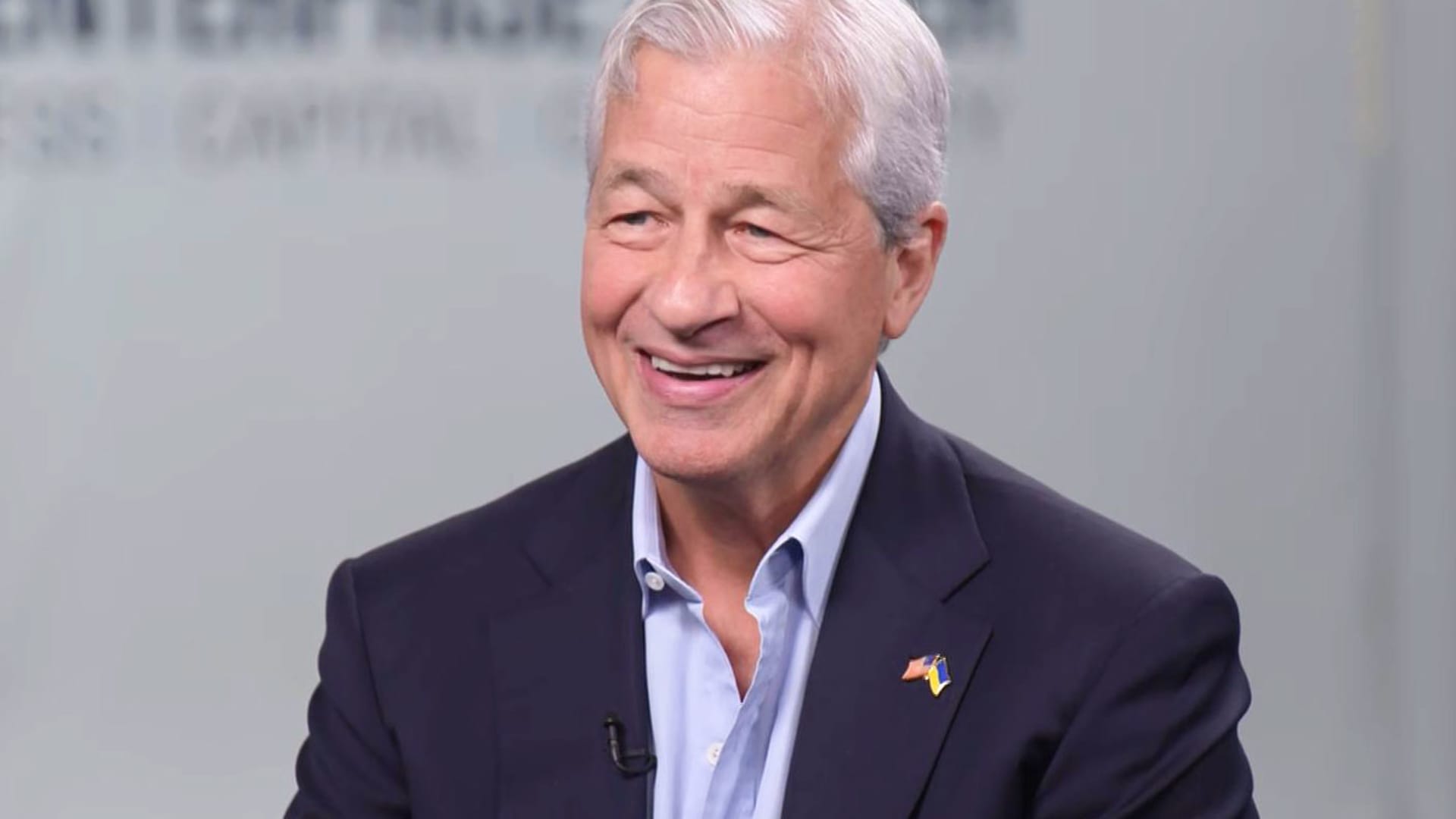

Jamie Dimon, CEO, JP Morgan Chase, through Jim Cramer job interview, Feb. 23, 2023.

CNBC

The largest U.S banking institutions which includes JPMorgan Chase, Wells Fargo and Morgan Stanley reported Friday they strategy to increase their quarterly dividends just after clearing the Federal Reserve’s yearly tension exam.

JPMorgan programs to strengthen its payout to $1.05 a share from $1 a share setting up in the 3rd quarter, the New York-based mostly financial institution explained in a statement.

“The Federal Reserve’s 2023 stress take a look at benefits show that banks are resilient – even while withstanding severe shocks – and continue on to serve as a pillar of toughness to the fiscal procedure and broader financial system,” JPMorgan CEO Jamie Dimon claimed in the release. “The Board’s intended dividend raise represents a sustainable and modestly larger amount of funds distribution to our shareholders.”

Wells Fargo mentioned it will enhance its dividend to 35 cents a share from 30 cents a share, and Morgan Stanley mentioned it would raise its payout to 85 cents a share from 77.5 cents a share.

On Wednesday, the Fed released results from its once-a-year exercising, declaring that all 23 of the banking companies that participated cleared the regulatory hurdle. The check dictates how much capital banking institutions can return to shareholders through buybacks and dividends. In this year’s test, the financial institutions underwent a “severe global recession” with unemployment surging to 10%, a 40% decrease in professional actual estate values and a 38% fall in housing rates.

Although bigger dividends are welcomed by investors, the banks held again on announcing particular ideas to raise share repurchases. JPMorgan and Morgan Stanley just about every said they could acquire back again shares many thanks to formerly-introduced repurchase programs Wells Fargo just stated it had the “capacity to repurchase frequent inventory” over the future year.

Analysts have mentioned that banking institutions would likely be extra conservative with their money-return strategies this 12 months. That is for the reason that the finalization of worldwide banking laws is envisioned to increase the stages of funds the major world-wide companies like JPMorgan would will need to manage.

There are other factors for banks to maintain on to funds: Regional financial institutions may perhaps also be held to increased requirements as part of regulators’ response to the SVB collapse in March, and a prospective recession could improve foreseeable future loan losses for the field.

This story is acquiring. Be sure to look at back for updates.