A new ETF is creating a significant wager on true estate and other tough belongings.

CBRE’s Investment decision Administration introduced the IQ CBRE Actual Assets ETF in Might with the notion that it will deliver inflation safety in a rising interest fee atmosphere.

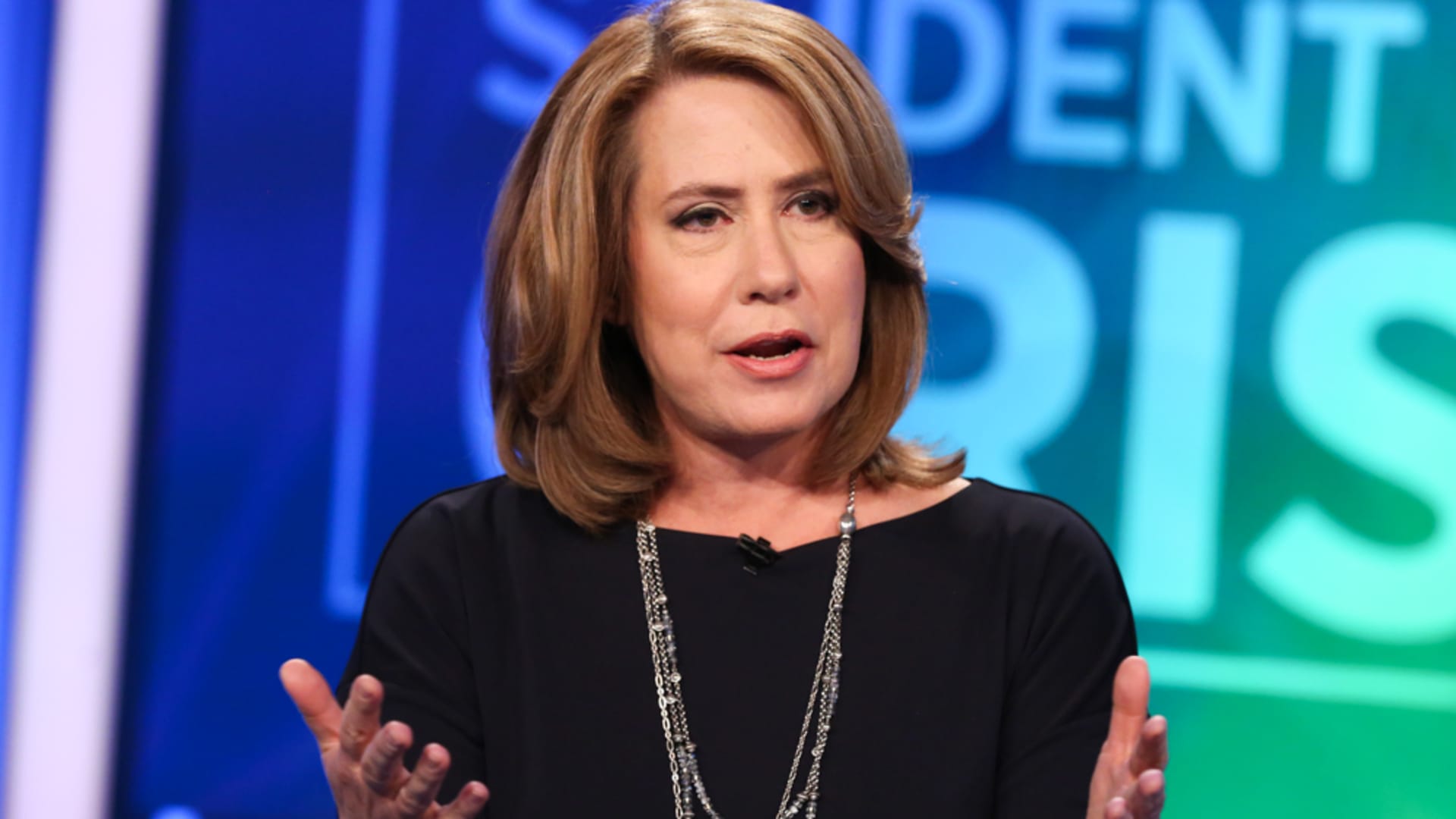

“The ETF current market is lacking selections in this house,” the ETF’s portfolio manager, Dan Foley, explained to CNBC’s “ETF Edge” on Thursday. “You can find a great deal of chance here with secular improvements in points like electronic transformation, decarbonization, and then, just frankly, mispricing in the industry.”

Foley pointed out that worldwide money institutions are now in the space and said he thinks retail investors should be, also.

“This has been one particular of the most attractively positioned segments of the authentic asset universe,” Foley mentioned. “Valuations are quite compelling. … [The] things are in area for a fairly sturdy full return going ahead.”

CBRE’s new ETF is hitting the market as excitement about synthetic intelligence providers and technologies dominate Wall Avenue.

Foley contended that really hard property, in normal, are an critical diversifier away from technologies — particularly hot AI shares. As well as, he famous that difficult assets are crucial in enabling a electronic overall economy in the first area.

“Knowledge facilities, mobile towers, enabling decarbonization — you need to have these foremost infrastructure firms to make that investment decision. It is really driving growth that we consider will generate a differentiated final result,” he said.

In accordance to issuer New York Lifetime Investments, the fund’s best holdings are in actual estate and utilities. They include things like Public Storage, Crown Castle, Nextera Electrical power and Equinix (EQIX), which is regarded as a leader in information centers.

Equinix shares are up 7% about the earlier month.

“Equinix is a great instance of a entire world-leading entity,” claimed Foley. “That is the form of asset you want. These are important to the new financial state.”

Because the IQ CBRE Serious Property ETF introduced Might 10, it is really down almost 6%.