Traders may want to adhere with set earnings investments — probably even incorporating to them — even with the Federal Reserve’s intention to slice desire prices this yr.

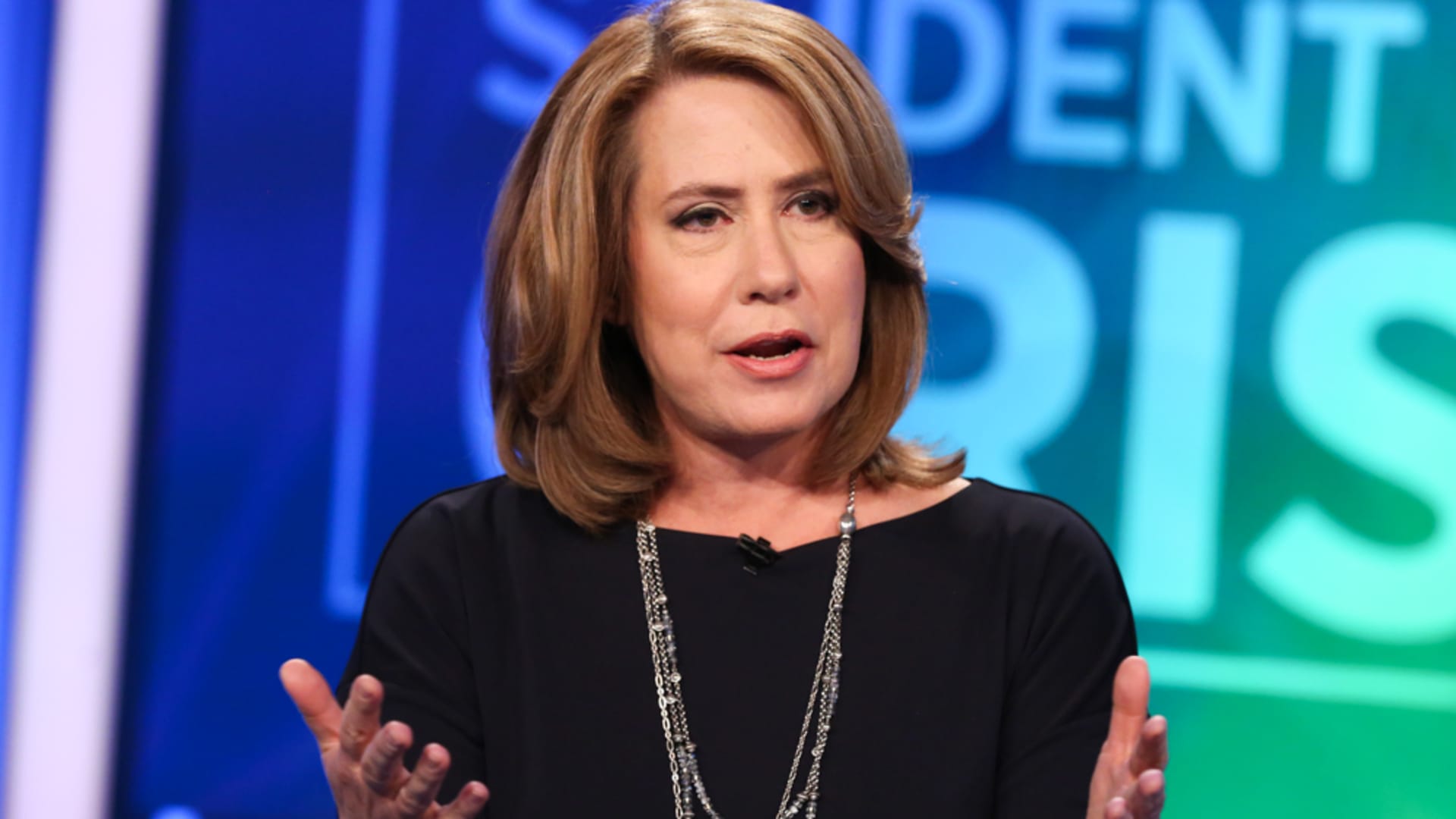

“Your biggest slip-up could be speeding again into equities in advance of you’re thinking about all these chances in mounted cash flow,” BondBloxx co-founder and COO Joanna Gallegos told CNBC’s “ETF Edge” this 7 days.

However off its peak of much more than 5% in late 2023, the benchmark 10-yr U.S. Treasury note generate has reaccelerated over the earlier thirty day period. As of Thursday’s current market shut, the yield was hovering in close proximity to 4.31%. It touched 4.429% on Wednesday, a high for this 12 months.

To control curiosity amount volatility properly, Gallegos implies traders seem to trade-traded funds targeted on intermediate phrase bonds.

“If you go into the intermediate area, whether or not it truly is in credit or in Treasurys, you’re taking on some hazard and you might be likely to benefit from a full return tail wind when costs go down,” she stated.

Morgan Stanley Financial commitment Management’s Tony Rochte endorses a comparable medium-expression system with automobiles like the Eaton Vance Full Return Bond ETF (EVTR) under his firm’s management.

“It is ideal now a 6-calendar year length, about a 6.6% generate,” the firm’s world-wide head of ETFs said in the identical interview. “It is really a best ideas portfolio.”

Rochte also pointed to municipal bond funds, like the Eaton Vance Small Period Municipal Cash flow ETF (EVSM), for profits-building alternatives.

“We also converted a municipal bond mutual fund final Monday below at the NYSE to an ETF, image EVSM, and that’s a municipal. Yet again, 3 1/2% yield, nearly a 6% taxable equal produce. So these are pretty attractive fees in the present environment.”