For decades, NRG (quick for the proficiently named Countrywide Investigation Group) has been a go-to supply for people in the film organization thanks to its monitoring stories measuring viewers desire in future theatrical releases. (Wanna know how difficult the next DC motion picture is heading to bomb? They’re the early-warning procedure.) But extra not long ago, the enterprise — which right up until 2015 was owned by Nielsen — has been trying to keep tabs on the streaming planet, looking at how hundreds of to start with-run streaming displays and flicks accomplish throughout various platforms and distilling that facts, culled from 1000’s of interviews with individuals, into something named the Originals IQ Tracker.

This NRG report is not typically published for normal-viewers intake, although the organization does publish lots of general public-struggling with details. But in honor of the tracker’s 200th week of evaluation, NRG has identified some critical trends from its four several years of info and supplied Vulture an exclusive look. Among its results:

➽ Streaming is how audiences currently want to view motion pictures. NRG suggests 65 percent of People would instead watch a motion picture at house than see it in a theater. As a short while ago as 2018, theatrical usage was the default, with 57 percent of Us citizens picking cinemas first. No shock, the sea improve occurred in 2020, when at-property viewing took the lead.

➽ Marketing and advertising operates, as does a excellent person interface. NRG says the regular shopper demands to listen to about or see information about a new title, on ordinary, at the very least 4 times ahead of they truly choose to enjoy it.

➽ Churn is actual. For every NRG, a person in 5 subscribers to the best streaming platforms have possibly just begun or stopped their latest subscription.

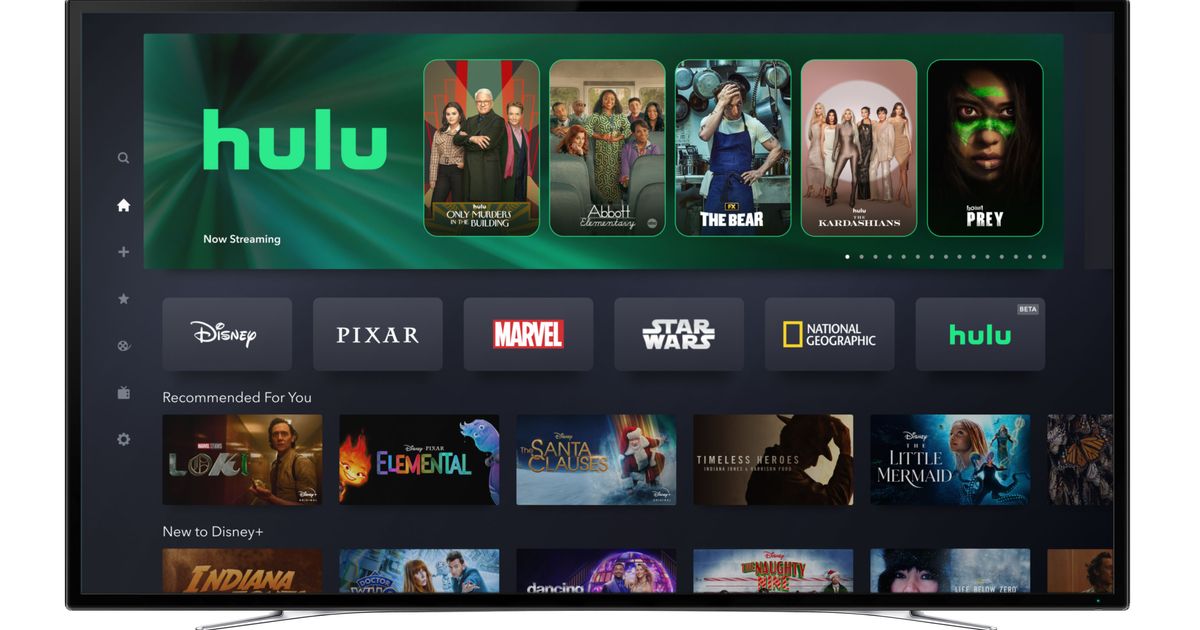

➽ Streamers have personalities. NRG questioned customers about the strengths and weaknesses of numerous services and took be aware of how they most generally describe them. It says Netflix customers rate the provider highly for “the high-quality and array of their initial programming”, though both of those Disney+ and Max are specified significant marks of their “rich movie libraries.” Peacock, in the meantime, stands out for obtaining stay material (a.k.a. sports).

➽ To know them is to adore them. NRG as opposed individual platforms’ subscriber numbers to weekly concentrations of brand name awareness and concluded that overall viewing or common “brand love” ended up basically not the most critical elements in goosing in general membership gains. Instead, the organization argues platforms will need to be either “the leading location individuals go to browse for titles when they sit down in entrance of their TV” or basically top rated of-thoughts with out being prompted. “These two far more implicit behaviors are improved predictors of how successful a streamer will be in growing and retaining its audience about time,” NRG argues.

There is a single factor this NRG research didn’t deal with, even so: How loudly customers yell when they get wind of however a different streaming selling price hike. Probably next time.