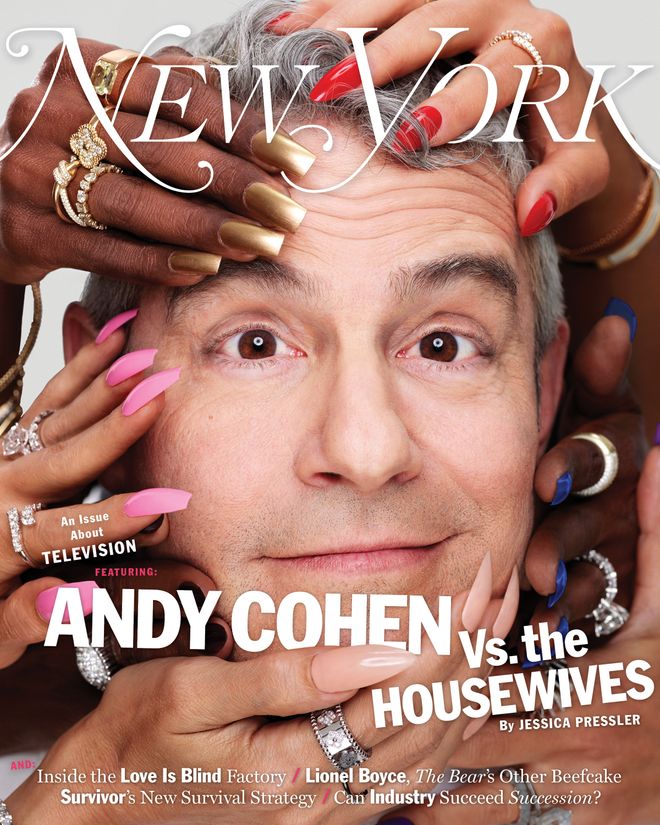

Illustration: James Merritt

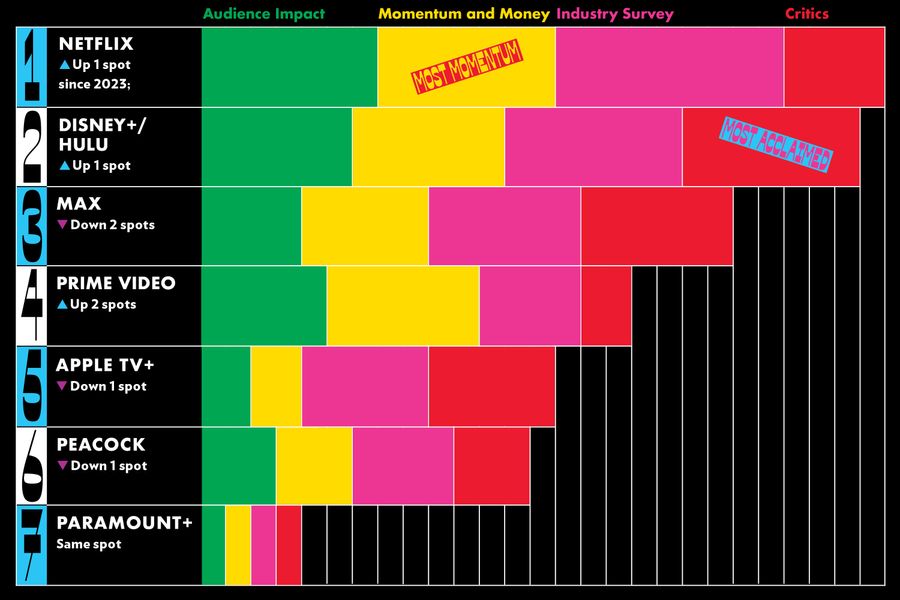

It’s been (another) brutal year for most of the players in the streaming space. Budgets are still being slashed and strategies trashed as the legacy companies behind Disney+/Hulu, Max, Peacock, and Paramount+ continue managing the aftershocks of last year’s talent strikes as well as the larger industry correction that began in 2022. Things that not so long ago felt unthinkable — like HBO agreeing to license Sex and the City reruns to archenemy Netflix — are now reluctantly accepted as necessary in order to help the corporate bottom line. But the focus on short-term gains comes at price. For the fourth year in a row, we set out to determine the hottest streaming platform right now, using metrics such as the state of content slates, audience size, and what industry insiders say about the streamers under the cloak of anonymity. And the result this year is a stunner: After easily topping our list the past two years, Max (née HBO Max) took a major tumble in the rankings. Read on to see who claimed the streaming crown this year and where all the other major platforms landed.

After stalling out for a bit, Netflix’s growth engine has come roaring back to life: The steamer added a whopping 37 million customers over the past year, giving it a global subscriber base of nearly 270 million. That’s up 15 percent vs. June 2023 and puts it a cool 100 million subscribers ahead of the combined tally for Disney+ and Hulu. Not surprisingly, Netflix dominates actual viewing time in America with its shows accounting for seven of Nielsen’s ten most-watched originals in 2023. “Far more than was the case just a year ago, it’s Netflix and everyone else,” says one veteran PR exec. The combined power of Disney+ and Hulu allowed the Mouse House’s streaming bundle to place second here with Amazon’s scale lifting Prime to third.

Relative underdogs like Peacock and Apple TV+ have traditionally won this category, but halfway into 2024, it’s hard to argue any streamer has more wind at its back right now than Netflix. In addition to adding new customers and providing a steady serving of hits (Baby Reindeer, Avatar: The Last Airbender, and old episodes of Suits), it’s also making real money — over $2 billion in the most recent fiscal quarter — while competitors desperately try to stop hemorrhaging red ink. The other big winners this year on momentum are Prime, whose dad-friendly titles (from Reacher to Roadhouse) and blockbusters (such as Fallout) are breaking through in a big way, and Disney, which finally pulled off its long-awaited integration of Hulu programming into the Disney+ app.

After two years of judging Max the most essential streamer, our insider panel of writers, execs, and PR types pivoted hard to Netflix. All but four panelists ranked the streaming behemoth No. 1, the closest we’ve ever come to a consensus choice. “When you have close to the population of America as your global subscriber number, you can’t be beat,” says one studio executive. “It will be hard for anyone to come close to the power Netflix has.” Of course, respect for Netflix doesn’t always translate into love. “Netflix ranks ‘best’ in the same sense that the Death Star was the best planet-destroying space station in the galaxy,” says one veteran TV writer. “Just because everyone knows you and fears you doesn’t mean you’re not a plague.” Coming in a distant second with our panel was Disney+/Hulu with Max a close third.

Like with our industry panelists, Vulture critics’ new darling is Disney+/Hulu: All but one of them rated it No. 1, and it wasn’t because of all those superhero shows. “The FX factor is tremendous,” as Nicholas Quah puts it. The cable darling hasn’t missed a beat in its move to digital, classing up the Mouse House with a steady supply of buzzy hits such as The Bear, What We Do in the Shadows, and Shōgun. “There’s almost always something I feel like I need to watch coming out of that network.” Jen Chaney agrees, saying FX and Hulu “are among the few streamers/networks with serious creative integrity.” Thanks to its association with HBO, Max still got enough love to rank a close second with the critics, while Apple TV+ was third — and Netflix’s gourmet cheeseburgers settled for fourth.

Kelsey Grammer in the rebooted Frasier.

Photo: Chris Haston/Paramount+

71 million subscribers

Audience Impact: 7th

Momentum: 7th

Vulture Critics: 7th

Industry Survey: 7th

Paramount+, which seemed to have some decent momentum going at the time of our 2023 survey, ranked dead last in all four of the metrics used for these rankings — and once again, dead last overall. Our industry-insiders panel and Vulture’s critics both put it at the bottom of their lists, while a lack of buzz for most of its originals (the Yellowstone pipeline dried up due to last summer’s labor issues) and the turmoil at its parent company killed its chances in the momentum and audience-impact categories. It’s a shame, because P+ actually still has some very strong components: It’s the home of next-day CBS content (including buzzy — or at least popular — fare like Ghosts, Elsbeth, and Tracker), it has great IP from Paramount Pictures and MTV Entertainment, and its reboot of Frasier was actually great. But P+ always seems to find a way to make the least of its strengths. Take the long-overdue integration of Showtime into the platform: It only happened after the pay-cable net saw its staff and programming slate slashed, then, rather than make it part of the core service (as HBO with Max), it’s been walled off behind a premium tier. This could be the last year there’s even a P+ to include in this ranker, and if so, it’ll be a shame. It coulda been a contender.

“The offscreen drama for Paramount is way better than anything they have onscreen. If they had a Real Housewives of Shari Redstone, they would be No. 1.” —Studio executive

“Obviously in turmoil and impossible to do business with for a while.” —Veteran showrunner

“Has always felt better than it gets credit for. Between great Star Trek shows, Evil, and CBS reruns, Paramount+ is probably the streamer that gets the most use in our home.” —TV-industry reporter No. 1

“A scrappy service that often punches above its weight but hobbled by its lack of breadth and resources.” —Media-industry analyst No. 1

“My dad’s favorite streaming service — and, oddly, the streaming home of RuPaul.” —Talent manager

“If you love CBS programming and a few cable catch-up brands, then this is the site for you. Otherwise, I can’t think of a reason to recommend it.” —Former network executive No. 1

“Merge with Peacock already.” —PR-industry veteran

Phaedra Parks in The Traitors.

Photo: Euan Cherry/Peacock

34 million subscribers

Audience Impact: 5th

Momentum: 5th

Vulture Critics: 5th

Industry Survey: 5th (tie)

After surging to fifth place in 2023, Peacock falls a spot this year, the victim of its inability to build on its past momentum. Yes, The Traitors was arguably even buzzier in season two, and audiences seemed to eat up Ted. But Apples Never Fall dropped from the Nielsen charts nearly as quickly as it appeared, and overall, most of what’s driving traffic to Peacock is next-day viewing of NBC programming and really expensive sports programming (like that NFL playoff game that annoyed so many football fans). Of course, NBCU execs would no doubt argue these are all good things, and maybe they are. There’s still plenty to like about Peacock, and if Paramount+ goes away (or its content gets folded into Peacock), things could look a lot different 12 months from now.

“Slowly and steadily, moving up the rankings by playing to sports-content and network-content offerings.” —Wall Street analyst

“Sure, they’ve got some buzz with Traitors and Poker Face — but does anyone outside the people who write about TV actually watch those shows?” —Unscripted producer

“The Olympics is really going to help. It’s a perfect streaming event — need to get it to watch the events you want when you want, or else you’re doomed to tape delay.” —Media-industry analyst No. 2

“If you love Bravo programming or live sports, Peacock might be a priority. But for me, it’s mostly just a grab bag of random titles.” —TV-industry reporter No. 2

“They should rename this Bravo. We watch it frequently because of that. Would love to see them do more original scripted programming and more documentaries, but Bravo and The Real Housewives are what keep this on our monthly streaming expenses.” —Hollywood writer No. 1

“Peacock seems like maybe they’re sincerely trying to break out of the pack (or maybe just survive?). They have some great originals, excellent library stuff, and they seem to understand that if they add sports, people might actually subscribe and stay subscribed.” —Veteran showrunner

“Merge with Paramount already.” —PR-industry veteran

Colin Farrell in Sugar.

Photo: Apple TV+

Doesn’t report subscriber numbers

Audience Impact: 6th

Momentum: 6th

Vulture Critics: 3rd

Industry Survey: 4th

Apple TV+ made more shows than ever this past year, and many of them were actually very good: Our critics ranked it No. 3, ahead of Netflix, and there’s a decent chance the platform will have several breakthroughs when the next round of Emmy nominations comes out next month. Apple also did okay with our industry insiders, who ranked it a respectable fourth. But those two things weren’t enough to overcome the feeling that as many good shows as Apple TV+ boasts, and as many shows as it cranks out, period, it too often feels like the forgotten streamer. Marketing for the platform has been nonexistent to poor — which probably explains last month’s exit of marketing chief Ricky Strauss — and lately the cadence of releases has picked up so much it’s been hard for even those who get paid to cover the business to keep up with everything new coming from the service. Apple’s decision to forgo spending billions to buy a library of another company’s old TV shows and movies allowed it to instead spend billions making lots of its own shows and movies. But as the streamer prepares to mark its fifth anniversary this fall, it needs to figure out how to make sure all that programming has an impact.

“Who are they making shows for? I know the Apple brand is super-upscale, but their shows seem to just be fishing for critic love instead of an actual audience.” —Former network executive No. 2

“Proof that just because you have the most money doesn’t make you the most popular — or necessary.” —Reality-TV producer

“Clearly star/prestige fuckers. They want to be the new HBO. Someone should tell them who actually succeeds at this goal for a fraction of the price—FX. (Start buying ideas and make stars, instead of trying to buy them.)” —Hollywood writer No. 1

“I think Apple has done a good job of trying to be the HBO of streaming. Not every show is great, but I love the batting average. I realize that nobody’s watching (relatively speaking), but I’m glad that Apple’s ecosystem play is helping fund a bunch of actually good content.” —Media-industry analyst No. 2

“You can find good stuff; you just have to do it on your own or hear from friends because they don’t help you discover it. The glossy marketing all looks the same. Nothing stands out for its own personality or attitude. —Former network executive No. 1

“Consistently high-quality programming that most people have never heard of.” —Hollywood writer No. 2

“The writers’ strike really hurt them. Severance was a hit and the second season got delayed so Apple TV+ couldn’t capitalize on it at all. They’ve been wallowing all year.” —Media-industry analyst No. 2

“I’ve discovered a couple shows I really like here, but there seems to be more shit on this network that no one has actually heard of than any other streaming network. Who is watching these shows? And why are they all about space? Is this a pyramid scheme?” —Hollywood writer No. 3

Alan Ritchson in Reacher.

Photo: Keri Anderson/Prime Video

Doesn’t report subscriber numbers

Audience Impact: 3rd

Momentum: 2nd

Vulture Critics: 6th

Industry Survey: 5th (tie)

Prime Video may not be beloved — it’s part of a corporate behemoth, after all — but the Amazon streamer quietly had a really good year on multiple fronts. Fallout has become a ratings monster, spending three weeks atop Nielsen’s streaming charts and notching a full month of billion-plus minutes streamed, easily a record for a Prime series. Meanwhile, Reacher racked up big numbers for its second season last winter, many critics were fond of Mr. and Mrs. Smith, and audiences have warmed up to the platform’s presentation of Thursday Night Football. And while (some of) those same audiences have been vocal on social media expressing their anger over the decision to include advertising as a default on Prime Video, the play instantly turned the streamer into a TV ad contender, potentially providing billions in revenue that can be used to pay for more Dad TV. Overall, while critics and our industry panel were sort of meh on Prime — particularly its perennially awful user interface — the streamer’s undeniable momentum over the past year plus its huge reach with broad-based hits allowed it to move up two spots in our ranking, the biggest upward leap of any service.

“As always, Prime Video is a black hole of mystery as to their ways, their goals, their methods, and their interface. They have show business’s most impenetrable executive hierarchy (which is saying something), and their decision-making is as chaotic and inscrutable as any I’ve experienced.” —Veteran showrunner

“Think that they don’t get enough credit for being intentional about some of their bigger successes (Reacher), but it’s a little chaotic over there, so maybe it’s their own fault.” —Agent No. 1

“Overall, the UI still has ’80s cigarette-vending-machine vibes. There are no must-watch shows on Prime Video for me, though I do enjoy a couple.” — Streaming-industry consultant

“This service has a surprisingly large library that it somehow still does not leverage particularly well. Its efforts to create less highbrow original shows has worked particularly well with action fare like Bosch and Reacher, and its forays into sports have also worked. Its interface still needs work.” —Media-industry analyst No. 1

“I don’t fully get what the brand is, but there is a lot of variety, and like Apple, they have money to burn. Bezos wants to be able to go to the Oscars.” —PR-industry veteran

“The interface is messy, and a lot of their stuff is just bland. Even I, a middle-aged dad, can’t muster any enthusiasm for the next Dad TV installment Jack Reacher or Jack Ryan or Bosch.” —Media-industry analyst No. 2

“Feeling like the Costco of streaming. Good programming but like a scavenger hunt to find a desired program.” —Former network executive No. 3

Larry David in Curb Your Enthusiasm.

Photo: John Johnson/HBO

99.6 million subscribers (including Discovery+)

Audience Impact: 4th

Momentum: 4th

Vulture Critics: 2nd

Industry Survey: 3rd

Max finds itself slipping to third mainly because our industry panel bailed hard (dropping it from first to third) and because HBO has been in one of its occasional “slow” periods of late where there’s more focus on what’s leaving (Succession, Curb Your Enthusiasm, Barry, A Black Lady Sketch Show, Winning Time, Our Flag Means Death) than on what’s new. And while True Detective did very well, and Hacks is hotter than ever, this was also the year of The Idol and The Girls on the Bus. Fact is, even if you think, as I do, that there’s been some overly dramatic, sky-is-falling commentary over David Zazlav’s many management errors at Warner Bros. Discovery, it’s also hard to deny the real damage the past few years have done to the platform’s brand. The name change, a user interface that’s gotten worse instead of better, and creative types regularly bashing the (big) boss — they all add up, and you see the result in this year’s ranking. That said, both Max and HBO proper still possess all the elements of an essential streaming platform (there’s a reason it ranked second with our critics), and season two of House of the Dragon followed by the fall launch of The Penguin and a new season of The Sex Lives of College Girls will very likely get people talking about Max positively again, as will 2025’s returns of White Lotus and The Last of Us.

“David Zaslav would make a great CEO of G.E. in 1985; he is a terrible boss of an entertainment company in 2024. He has no feel for the creative at all. You can feel it when you look at the Max slate, which is … well, what is it, actually? It still seems like just the place where you wade through a bunch of crap to watch HBO shows.” —Veteran showrunner

“A great streaming service hobbled by terrible management and destructive penny-pinching.” —Media-industry analyst No. 1

“They still have a good interface, they feel like they actually still have a brand, and they have enough new material to keep me coming back and checking in without feeling totally overwhelmed. —Reality-TV producer

“So many strong scripted shows that I can name easily and had the audience talking. Not as many shows as Netflix, but you aren’t overwhelmed with too much content that you don’t care about.” —Television-publicity executive

“It’s not Max, it’s HBO. It will always just be HBO. And they still reign in premium. Is this the last year they rank so high? If I was a bettor, I wouldn’t put.” —Studio executive

“HBO Max was a blessing; Max is a blight.” —Hollywood writer No. 2

Cosmo Jarvis and Anna Sawai in Shōgun.

Photo: FX

168 million combined subscribers

Audience Impact: 2nd

Momentum: 3rd

Vulture Critics: 1st

Industry Survey: 2nd

We combined Disney+ and Hulu in this ranking last year, anticipating the day that the two services would be available on one platform. And that’s exactly what happened late last year, when D+ finally allowed consumers who subscribed to both offerings to watch episodes of The Bear in the same place they stream i and Winnie-the-Pooh. The combo underscored the power of Disney’s streaming bundle for both our industry insiders and Vulture’s critics, who ranked them second and first overall, respectively. The critics were mostly wowed by FX’s programming over the last year (think Shōgun and, of course, that darn Bear); industry insiders were taken with the way the two streamers balance each other out and make it a more formidable rival for Netflix. It’s impressive that Disney+/Hulu did so well in a year when its Marvel and Star Wars offerings were relatively weak — and a sign of how much room to grow there is should Disney’s big franchises return to full strength.

“As stand-alone options, Disney+ and Hulu would fall further down on the list, but as a combination, it’s hard not to put them in second position, even in a house without young kids. You need a streamer in your life that will throw down for a Taylor Swift concert every once in a while, or rare Beatles footage, then serve up a glorious surprise and revelation like The Bear.” —Television-publicity executive

“Outside the Beatles doc, I keep Disney+ for the kid. Hulu, on the other hand, is all-around good. There’s always some great docuseries on here, plus the shows from the networks and FX that we watch here.” —Hollywood writer No. 1

“Very reliable. Consistent. Shōgun outstanding. Other offerings have an air of self-importance, maybe a little pretentious. Maybe I’m projecting.” —Former network executive No. 3

“They do need to stop spending money on Marvel and Lucas and make more SHOWS. For a company that is so big, they just don’t have a lot to watch.” —Agent No. 2

“Definitely a stronger product with Hulu attached. Otherwise, D+ alone feels like it has lost some mojo.” —Former network executive No. 2

“Hulu has some awesome shows, and I love the access to broadcast stuff, but they have a problem because everybody knows when a show is on Netflix, and no one knows when a show is on Hulu.” —Veteran showrunner

Richard Gadd in Baby Reindeer.

Photo: Ed Miller/Netflix

270 million subscribers

Audience Impact: 1st

Momentum: 1st

Vulture Critics: 4th

Industry Survey: 1st

Less than two years after Wall Street and many in the entertainment industry soured on Netflix, there’s been a vibe shift from both camps: The streaming giant is back on top, arguably stronger than ever. In recent weeks, its stock price has flirted with all-time highs, as investors applaud Netflix’s return to double-digit subscriber growth and quarterly profits measured in billions. Those gains have come in no small part by a series of moves consumers would probably say they hate: cracking down on password sharing, putting commercials on shows, and hiking the monthly fee. But those viewers seem pretty satisfied by Netflix’s content strategy, embracing both ambitious bets like 3 Body Problem and Ripley as well as crowd-pleasers such as The Night Agent and The Roast of Tom Brady. And it doesn’t hurt that rival conglomerates have once again taken to leasing their biggest library titles to the enemy, allowing Netflix to give its members access to linear TV faves such as Young Sheldon. Overall, this year’s rankings race wasn’t even close. Says one veteran TV-publicity executive, “Future installments of this survey may actually need to place Netflix in its own ‘above it all’ category with everyone else fighting each other down below while the king sits by and takes it all in, amused.”

“We’re in an era when your show almost MUST be on Netflix to be in the conversation.” —Veteran showrunner

“You listen to their self-regard and their feeling that their underpayment of talent is okay because of the value of the “Netflix Effect,” and you wish they’d fail miserably. Then your heart sinks as you realize that they won’t.” —Agent No. 1

“The best all-around service, from UI to content offering, usability, and value for the price. They’ve had two of the most-discussed shows with Beef and Baby Reindeer. Is two enough? Probably not. But Netflix still feels like the only must-have service.” —Streaming industry consultant

“More consumers are beginning to see Netflix as synonymous to TV; a one-stop shop where they can get everything except decent live sports. If they ever crack live sports, news, and topical programming, they will become the Google of TV.” —Media-industry analyst No. 1

“Netflix ranks ‘best’ in the same sense that the Death Star was the best planet-destroying space station in the galaxy. Just because everyone knows you and fears you does not mean you’re not a plague.” —Hollywood writer No. 2

“They’re a simply dominant service. I don’t even like the shows that much. But there’s just something new every week. Their movies are awful. —Agent No. 2

“The kings — even if I can barely remember anything I watch on there a week later.” —PR-industry veteran

Additional research by Anusha Praturu.