David Ellison’s Skydance Media is near to clearing a big hurdle in its pursuit of Paramount World.

The media giant’s committee of impartial board associates has signaled its approval for Ellison’s takeover of the storied corporation, in accordance to 3 individuals common with the predicament who have been not licensed to remark.

Formal acceptance by Paramount’s special committee could come as early as Monday, 1 of the knowledgeable men and women said.

Having said that, the Skydance deal is not entirely stitched up. The arrangement still lacks the consent of Paramount’s managing shareholder, Shari Redstone, resources mentioned. Her help is essential for any offer to move ahead.

Reps for Paramount had been not instantly obtainable to comment.

Redstone’s spouse and children owns 77% of the controlling shares of Paramount World-wide via their holding enterprise National Amusements Inc., giving the heirs of Sumner Redstone massive sway more than the future of the having difficulties proprietor of Paramount Pictures, MTV and Nickelodeon.

Complicating issues, as the Skydance sale method has dragged on, Redstone has fielded fascination from at the very least two other intrigued prospective buyers for National Amusements.

Late previous 7 days, Redstone was explained to be mulling people presents, together with 1 which was increased than the almost $2 billion for Countrywide Amusements and its voting shares in Paramount that Skydance and its associates offered the loved ones.

Redstone has extensive most well-liked the Skydance proposal due to the fact it would maintain intact the media enterprise that her father used many years making into a behemoth with broadcast big CBS, the famous Melrose Avenue film studio and cable Tv channels, which include MTV, Wager, Nickelodeon and Comedy Central.

To gain the approval of the exclusive committee, Skydance, joined in its bid by RedBird Money Companions and personal fairness company KKR, very last week proposed location aside funds to acquire out certain non-voting B-class stockholders at $15 a share throughout a next stage of the transaction. The functions labored in excess of the weekend to hammer out these kinds of provisions.

Paramount shares rose 7% to $12.71 in midday buying and selling.

Even more boosting the bid for Paramount, Oracle’s billionaire chairman Larry Ellison has agreed to aid his son get the offer in excess of the finish line, just one of the sources claimed.

Paramount’s shareholders have extended protested the next phase of the offer, when Ellison intends to fold his enterprise, Skydance, into Paramount. Shareholders of Paramount have said that absorbing Skydance would dilute their shares. Non-voting shareholders have also complained that the Skydance deal would offer a quality to Redstone and her relatives for their voting shares.

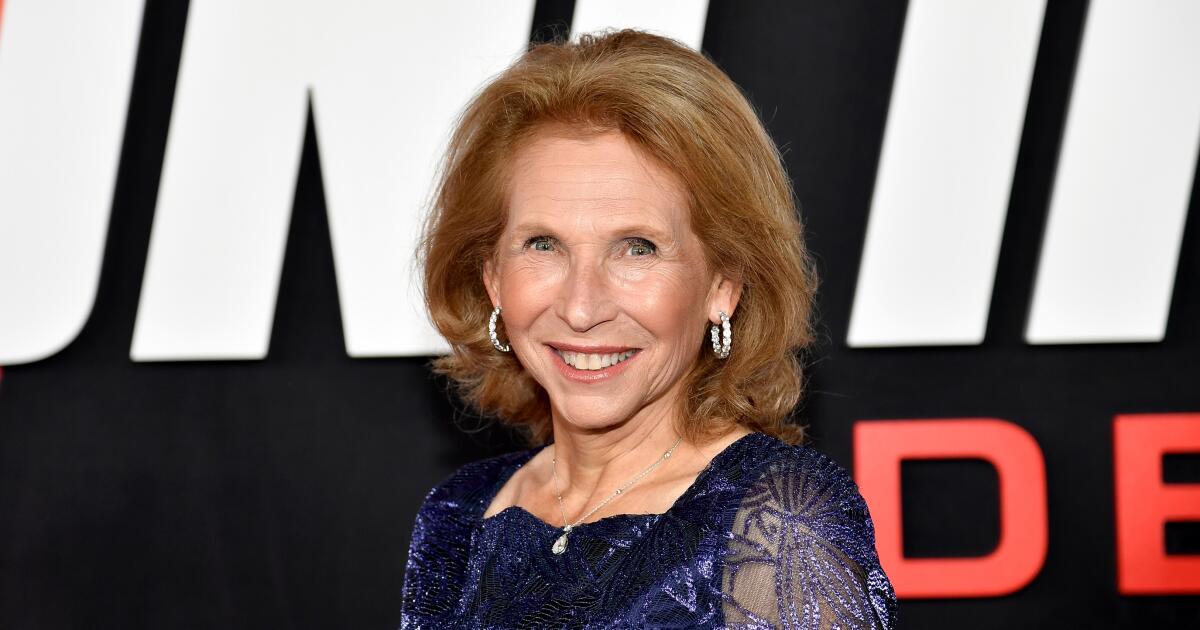

Movie govt Shari Redstone comes for the globe premiere of “Top Gun: Maverick” in 2022 aboard the USS Midway in San Diego.

(Robyn Beck / AFP through Getty Photographs)

The movement in the offer talks comes significantly less than a thirty day period right after Skydance’s exclusive negotiating window expired.

Since then, Paramount board members agreed to take into account a rival $26-billion bid from Sony Photos Amusement and Apollo World-wide Management, but those people talks lost momentum in latest weeks, professional folks claimed.

Sony, which has lengthy been regarded as a cautious purchaser, began to get rid of interest in the Apollo bid, believing it was way too high-priced, notably presented the struggles of Paramount’s cable channels that nevertheless provide the bulk of the company’s functioning money.

Sony’s Tokyo-based mostly father or mother corporation hasn’t forgotten how it overpaid for the Sony/Columbia-Tri Star offer a long time in the past, so the enterprise was leery about a repeat situation with Paramount, 1 of the resources stated.

The Wall Street Journal initial reported that Redstone was looking at other features for National Amusements. On Monday, CNBC documented the Skydance deal was close to winning acceptance.