Time is operating out for Paramount World-wide and Skydance Media to attain a deal combining their amusement empires inside of the 30-working day exceptional negotiating window that closes Friday, and it appears probable that the week will move devoid of an settlement on a transaction.

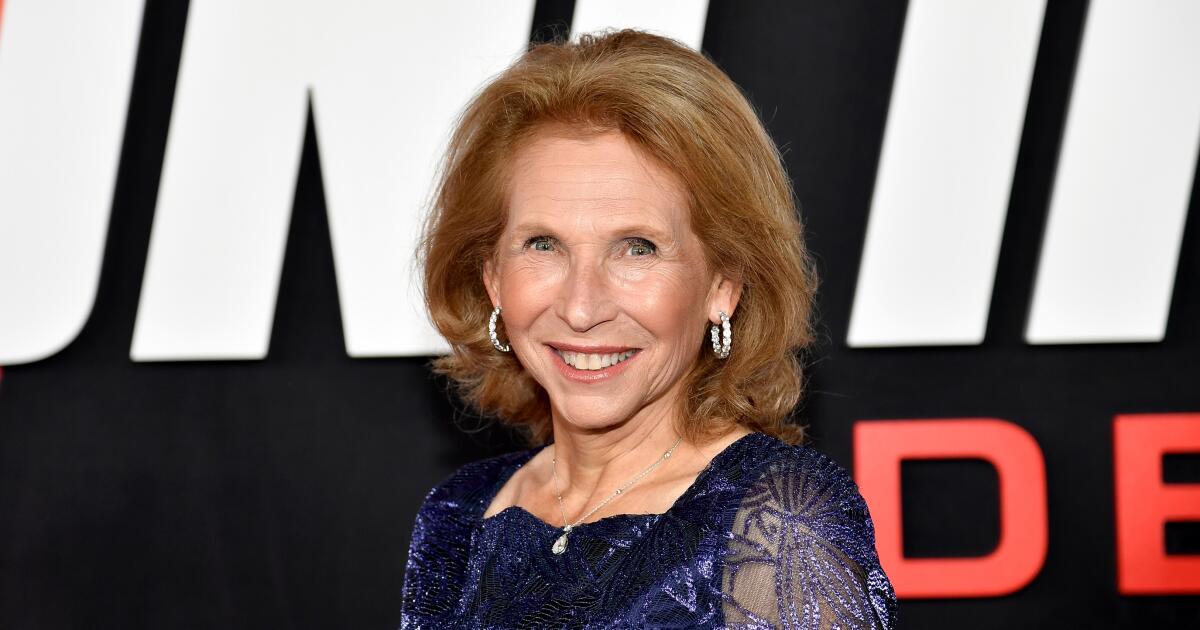

Paramount, controlled by Shari Redstone , and Skydance, helmed by film producer David Ellison, have been making an attempt to hammer out a intricate deal that would depart Ellison in regulate of the storied media big. And so considerably, no arrangement has been struck.

What has extensive looked like Paramount Global’s most practical buyout solution has been the topic of months of palace intrigue, plagued by an trader riot and company shakeups. Paramount’s inventory fell around 6% on Friday amid a report that the organization was finding chilly ft about Skydance’s offer.

New York-dependent investigate business LightShed Companions stated Friday that it expects the bargaining deadline to get there sans agreement, with one more bid from Sony Photographs Enjoyment and Apollo World Administration on deck.

The Instances has contacted Paramount World-wide for comment. A spokesperson for Paramount’s mergers and acquisitions committee declined to comment.

The Skydance circumstance

Considering that reviews surfaced in January that Ellison’s Skydance was discovering an all-hard cash deal to obtain Nationwide Amusements Inc. — the enterprise that retains 77% of Paramount Global’s voting stock — issues have gotten messy.

About the previous month, Paramount has been negotiating with Skydance, which has joined up with investment decision corporations RedBird Money and KKR to take above National Amusements, which would give it management of Paramount, proprietor of the Paramount Pics film studio on Melrose Avenue, broadcast community CBS and cable channels MTV and Nickelodeon.

The talks spurred a revolt led by Paramount International traders who expressed fears that the offer on the table would mostly reward Paramount’s nonexecutive chairwoman, Redstone, at the expense of standard shareholders.

The investor rebellion caused Paramount shares to plummet and prompted several of the company’s directors to phase down. In an effort to quell the backlash, Skydance a short while ago upped its offer you with a cash infusion for Paramount and by environment aside resources especially for Paramount’s nonvoting shareholders, which would most likely decrease Redstone’s acquire.

All of this company turmoil culminated Monday in the termination of Paramount International Chief Executive Bob Bakish, whose opposition to the Skydance deal did not sit well with Redstone.

Bakish most well-liked yet another Paramount World wide suitor, private fairness organization Apollo International Administration, which joined forces this week with Sony Photographs Leisure to submit a $26-billion all-hard cash bid for the amusement empire.

Sony-Apollo hover close to the hoop

While this Paramount-Skydance saga has been unfolding, Apollo and Sony have formally entered the ring as a team.

Culver Town-based Sony has supplied to come to be a the vast majority shareholder in the enjoyment firm, with Apollo as a minority owner.

Because Sony Corp. is dependent in Tokyo, Apollo would probably have to presume management of Paramount’s CBS community in get to abide by Federal Communications Fee rules that limit foreign ownership of broadcast Television set stations — a technicality that could make the supply fewer beautiful to a corporation reluctant to divvy up its property, according to analysts at LightShed.

These a offer, even though cleaner from a economic perspective, would induce upheaval in Hollywood. It would possibly final result in mass layoffs, minimizing the amount of key movie studios from 5 to four.

What if none of the higher than?

Soon after Bakish was ousted, Paramount International appointed three of its top rated leisure executives — Paramount Photographs CEO Brian Robbins, CBS CEO George Cheeks and Showtime/MTV Leisure Studios head Chris McCarthy — to direct the enterprise in an “office of the CEO” potential.

If a Paramount-Skydance merger fails to pass, analysts at LightShed Associates forecast Paramount will move ahead with its management trifecta, aim on restructuring its business enterprise and ultimately revisit mergers and acquisitions discourse later this 12 months or in 2025. The regulatory landscape is anticipated to become clearer just after the 2024 presidential election.

The LightShed analysts doubt that Paramount will right away pivot to a Sony-Apollo deal in the event that talks with Skydance tumble aside.

“We’re only 4 times in so there’s not a whole lot I can say,” Cheeks wrote in a memo to Paramount Global employees. “But … Brian, Chris and I are in the method of finalizing our strategic system that we’re likely to roll out as before long as achievable.”

Periods staff writers Samantha Masunaga and Meg James contributed to this report.