When student personal loan repayments started final Oct, Rachel Grace was faced with a unpleasant economical option: start out earning payments or fall her wellness insurance coverage coverage. She selected her financial loans and has considering the fact that been crossing her fingers that she stays healthful.

“We’re currently all pinching pennies. It was that major wellbeing insurance policies price tag each individual month that I thought was the just one put where, at minimum for now, fingers crossed, I can do with out so that I can deal with this mortgage payment,” stated Grace, who is 39 and functions in advertising and marketing communications in Nebraska. “Of system, that could improve in an quick, and which is terrifying.”

But this week, Grace bought the information she’d been in fiscal limbo more than for months — her federal financial loans had been staying forgiven, wiping out a approximately $300 a thirty day period payment, underneath a Biden administration plan to crystal clear the personal loan balances for people who have been making payments for at minimum 20 years.

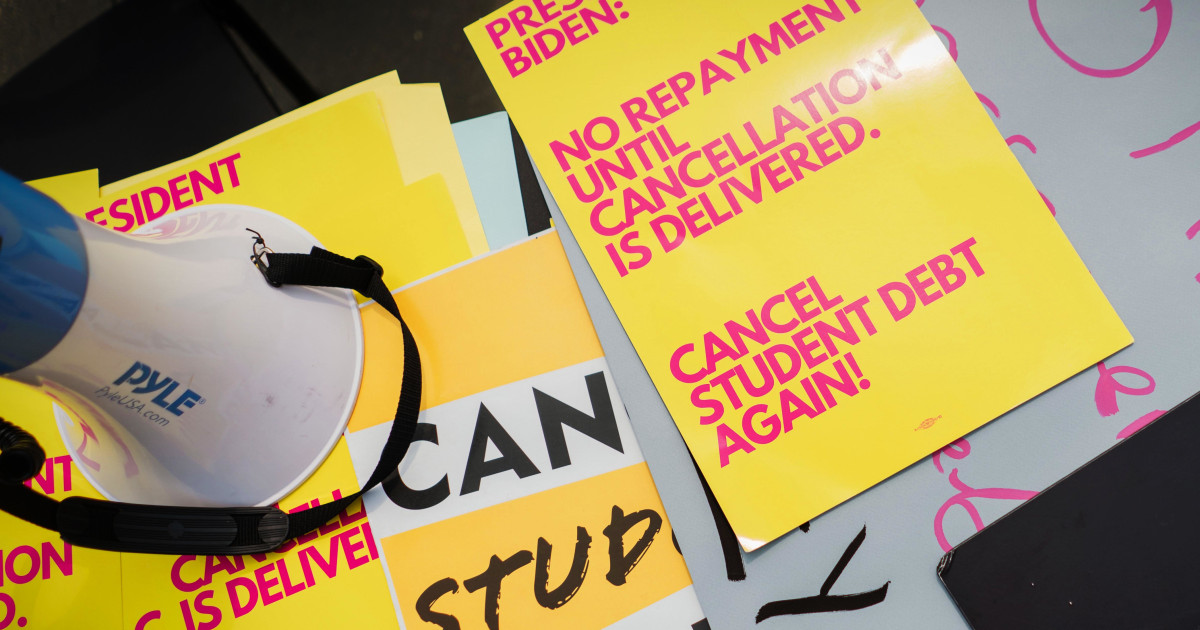

Just after the Supreme Court docket turned down President Joe Biden’s sweeping personal debt forgiveness proposal and a Covid-era pause on pupil financial loan payments expired, hundreds of thousands of debtors have been faced with rough money possibilities and a world-wide-web of new credit card debt relief strategies and administrative delays that have remaining many in limbo in excess of if and when their personal debt will be forgiven, reported university student credit card debt counselors and borrowers.

“The road to hell is paved with very good intentions,” reported Betsy Mayotte, the head of the Institute of Pupil Financial loan Advisors, a nonprofit that gives cost-free pupil bank loan guidance. “I have viewed a substantial number of borrowers who have had aid, but on the flip aspect, because almost everything has had to transpire definitely quickly, it’s also brought about some confusion for debtors and it is brought about some bumps in the road.”

But the results of that reduction are commencing to be felt by much more borrowers like Grace, something the Biden campaign is working to capitalize on in the months foremost up to the election.

Biden’s efforts to deliver relief to scholar personal loan debtors has been a leading policy precedence all through his time in business. The Biden administration claims it has supplied university student personal debt relief to 4.6 million Us citizens as a result of more than two dozen diverse systems, including fixes to a pre-existing personal loan forgiveness plan for general public provider employees, erasing financial debt for borrowers defrauded or misled by their university and increasing credit card debt forgiveness for people with disabilities.

Final thirty day period, Biden proposed supplemental designs he explained would cut down or erase the scholar mortgage money owed for thousands and thousands far more as early as this slide, an Instruction Department formal stated.

But quite a few borrowers have struggled to make sense of what all those initiatives mean for them or see the whole gains as some courses proceed to be applied, explained Robert Farrington, who counsels scholar loan debtors and is editor-in-chief of the web site The School Trader.

“There is a firehose of bulletins and new plans and so several several nuances to all of these items. There’s distinctive reimbursement strategies, there’s unique forgiveness plans, distinct lawsuits,” mentioned Farrington. “It’s tricky for borrowers to even know what applies to them. It is so baffling.”

Training Division officers say debtors who think they are qualified for personal debt aid but haven’t obtained it nonetheless need to get in touch with their bank loan servicer or the office ombudsman’s workplace.

Amid the confusion, the Biden marketing campaign has been searching for to clearly show the real-earth effects on debtors who have acquired debt forgiveness in its pitch to voters for a 2nd time period, a campaign official claimed. Biden and other top administration officers have fanned out across the country to tout their endeavours.

In just one occasion, Biden frequented the house of a former faculty principal in North Carolina who had $90,000 in credit card debt erased under the community services personal loan forgiveness software, a many years-old software the Biden administration has manufactured alterations to in purchase for far more borrowers to qualify. A TikTok online video of the go to manufactured by the man’s son received hundreds of thousands of views.

Nonetheless, the the greater part of voters have claimed they disapproved of Biden’s handling of the college student mortgage challenge — with 44% approving, producing it Biden’s strongest place amongst registered voters, according to an NBC News poll last thirty day period. In a individual poll by the Harvard Institute of Politics, just 39% of voters below age 30 reported they permitted of the occupation Biden has carried out on scholar loans. But like in the NBC poll, it was a better approval score than on other essential concerns.

The campaign formal explained it will take much more time and intense messaging to get the awareness of voters, whom the marketing campaign thinks are not nonetheless shelling out near interest to the election. The marketing campaign is also looking for to distinction Biden’s procedures with individuals of former President Donald Trump, who has opposed scholar financial debt relief applications and actively sought to do away with funding for them though president.

Rep. James Clyburn, D-S.C., a close Biden ally, mentioned he expects tens of hundreds of added borrowers to see financial debt aid in advance of the election as Biden’s packages continue on to be carried out, offering the marketing campaign far more chances to emphasize the contrast with Trump’s opposition to these types of packages, he stated.

“Who do you want to place in charge of that application?” Clyburn said in an job interview with NBC Information. “The dude who refused to carry out it?”

Biden “has executed the method that [Trump] attempted to get rid of,” Clyburn continued.

But for the hundreds of thousands of borrowers not eligible to have their personal debt cleared, they have been essential to make payments considering that October, producing an extra economic pressure for several. About 40% of borrowers who have resumed payments claimed they are reducing back again on shelling out when 29% reported they were being reducing the amount they were preserving, according to a University of Michigan study released in January.

The study discovered that debtors who experienced decreased incomes, less schooling and weaker money prospective buyers were being additional likely to enhance their use of credit rating to preserve their expending amid the resumption of mortgage payments.

Other people have opted not to make their payments. All over 64% of debtors who experienced payments owing were latest on their college student mortgage payments as of the stop of December, according to the Section of Education and learning.

The Biden administration has mentioned it will hold off right up until this tumble on imposing the harshest penalties for nonpayment, like reporting delinquent debtors to credit history rating companies and employing pressured collections.

Mayotte mentioned a selection of debtors she will work with have been holding off on creating their payments simply because they can’t afford them or have opted to use the cash to pay back down increased-interest credit card debt or to devote in significant-generate discounts or investing accounts till the administration’s nonpayment penalties kick in.

Once that comes about, the broader implications of the restart in payments could be felt, but so significantly it has not appeared to have experienced a significant influence on the broader economic system, according to an assessment by Wells Fargo.

For Grace, who took out all around $40,000 in private and federal financial loans to attend a 4-calendar year community college in 2003, she said her regular mortgage payments have been a significant load on her finances considering that she very first commenced earning them far more than a 10 years back.

At the start off of her profession, her loan payments amounted to far more than 15% of her acquire-house fork out, blocking her from being in a position to create up an emergency fund for unpredicted prices, like a auto repair service, and producing her to rack up credit rating card personal debt. For years, she claimed, she experienced to do the job a second position on the weekends to address her expenditures.

But her money image substantially improved in the course of the pandemic when the Covid payment pause started. Without having that regular monthly bank loan payment, she explained she was in a position to get started making up her discounts and pay off credit card credit card debt. Finally, she was able to buy her initial property.

“Prior to that pause, things had been really dire,” Grace explained. “And so this gave me the possibility to seriously ultimately start off to catch up. It’s awesome what transpires when you really do not have hundreds of dollars thirty day period right after thirty day period likely to this.”

Grace reported she understood the payment would at some point restart and didn’t get on any additional month to month expenses. But with inflation driving up the price tag of all the things from groceries to utilities, the resumption of the payment was an even bigger strain on her spending plan than in advance of.

When it arrived time for the payments to restart in Oct on the $10,000 she even now owes, Grace was also generating a selection about signing up for her employer’s wellbeing coverage prepare for 2024. She opted to get the hazard of likely with no well being insurance coverage to go on earning development on having to pay down her credit card debt.

With her federal mortgage payment now forgiven, she is aware of what she will do with the excess upcoming thirty day period.

“I will not be going to Target with that funds, I won’t be heading on holiday,” she claimed. “I will be enrolling in well being insurance policy.”