Skydance Media is well prepared to stroll away from its offer for Paramount Global unless it receives a company dedication from controlling shareholder Shari Redstone, pursuing the most up-to-date present from Apollo World wide Administration and Sony Images, in accordance to a individual common with the matter.

The exclusivity window for discussions involving David Ellison’s Skydance, backed by non-public equity corporations RedBird Cash and KKR, and Paramount ends Friday and will not be prolonged, people familiar with the issue told CNBC’s David Faber. Paramount shares rose following the report.

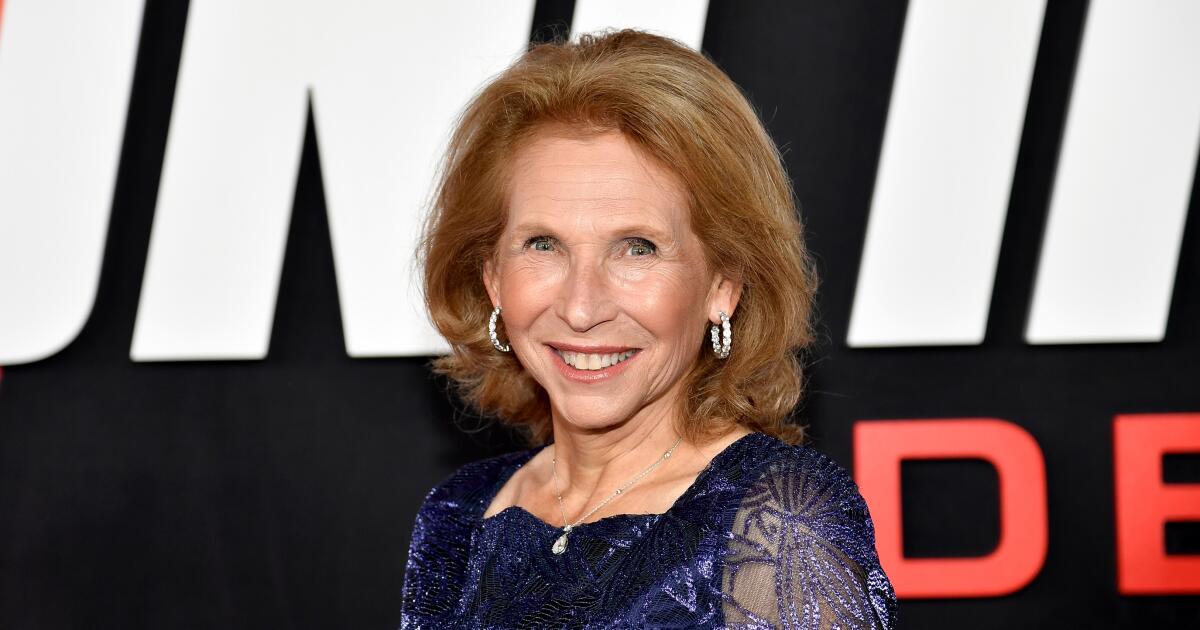

The consortium has been waiting for term from Paramount’s exclusive committee on no matter whether the panel will recommend its bid to acquire the company to Redstone. Now, with Apollo and Sony formally expressing fascination in obtaining the enterprise for about $26 billion, the Skydance group is hunting for Redstone to reaffirm her dedication to the deal.

The Skydance consortium is not eager to cling all around to be a stalking horse present for Apollo and Sony, one particular of the men and women stated. Even now, relying on what Redstone suggests, Ellison might be willing to work with her, a 2nd person mentioned.

Spokespeople for Skydance, Redstone’s Nationwide Amusements and Paramount’s special committee declined to comment on Friday.

Apollo and Sony made their hottest offer you Thursday, CNBC earlier documented. The exclusive committee is currently taking into consideration the bid, the persons said.

As element of Skydance’s most current offer on the table, Redstone may well take a lot less than $2 billion for her controlling stake in Paramount, which is reduced than Skydance’s first offer you. The consortium is contributing further money to pay prevalent, Course B shareholders at a almost 30% high quality to the undisturbed buying and selling price of about $11 for each share, CNBC has noted. In overall, Redstone and Skydance would lead $3 billion, with the broad vast majority heading to Class B shareholders, in accordance to people acquainted with the issue.

Skydance’s valuation as aspect of the deal continues to be all around $5 billion, the folks said. It’s unclear if the Apollo-Sony provide provides Redstone the similar high quality.

Beforehand, Redstone rejected an supply by Apollo in favor of special talks with Skydance. Redstone has most well-liked a offer that would hold Paramount collectively, as Skydance’s supply would, CNBC previously documented. A private equity firm is most likely to split up the organization.