U.S. electric truck manufacturer Lordstown Motors filed for personal bankruptcy safety on Tuesday and put by itself up for sale soon after failing to resolve a dispute above a promised financial investment from Taiwan’s Foxconn.

Shares of Lordstown tumbled 35% in trading on the Nasdaq. The company’s individual bankruptcy is not the initially among the the crop of EV startups that went public all through the pandemic-era SPAC growth. But Lordstown was a high-profile member of that course mainly because it was tough the main of the legacy Detroit automakers’ business of substantial-margin pickup vehicles, and for the reason that of its site.

“The bankruptcy of Lordstown indicators that the times of successful EV startups is in the rear-perspective mirror,” mentioned Thomas Hayes, chairman at hedge fund Good Hill Capital. “Moving forward it will be Tesla and the standard incumbents … that will duke it out for marketplace share.”

The automaker, named just after the Ohio city exactly where it is dependent, filed for Chapter 11 security in a Delaware personal bankruptcy courtroom. In the criticism, Lordstown accused Foxconn of fraudulent conduct and a collection of damaged claims in failing to abide by an settlement to devote up to $170 million in the electrical-motor vehicle producer.

Foxconn previously invested about $52.7 million in Lordstown as component of the agreement, and presently holds an 8.4% stake in the EV maker. Lordstown contends Foxconn is balking at buying additional shares of its stock as promised and misled the EV maker about collaborating on automobile enhancement plans.

Foxconn, formally identified as Hon Hai Precision Industry and greatest recognised for assembling Apple’s iPhones, has reported Lordstown breached the investment arrangement when the automaker’s inventory fell below $1 for every share.

The Taiwanese organization claimed on Tuesday that it experienced preserved “a good perspective in conducting constructive negotiations with Lordstown” but said the U.S. company experienced been reluctant to carry out the financial commitment settlement in accordance with its conditions.

It stated the organization was suspending negotiations with Lordstown and reserved the correct to pursue lawful action.

The twin filings by Lordstown set up an intercontinental organization clash that could intensify scrutiny of Foxconn’s EV ambitions and partnerships, not only with Lordstown but also other automakers.

The lawsuit portrays Foxconn as consistently shifting intention posts in its collaboration with Lordstown on the automaker’s long term automobiles, which provided failing to fulfill funding commitments and refusing to interact with the business on initiatives Foxconn allegedly directed and purported to assist.

Lordstown, a startup released in 2018, stated in a regulatory submitting earlier this thirty day period that it had planned to sue Foxconn just after acquiring a letter from the firm that led Lordstown to believe Foxconn was unlikely to make its added predicted financial investment.

Lordstown accused Foxconn in that regulatory submitting of participating in a “pattern of poor faith” that brought about “material and irreparable harm” to the company.

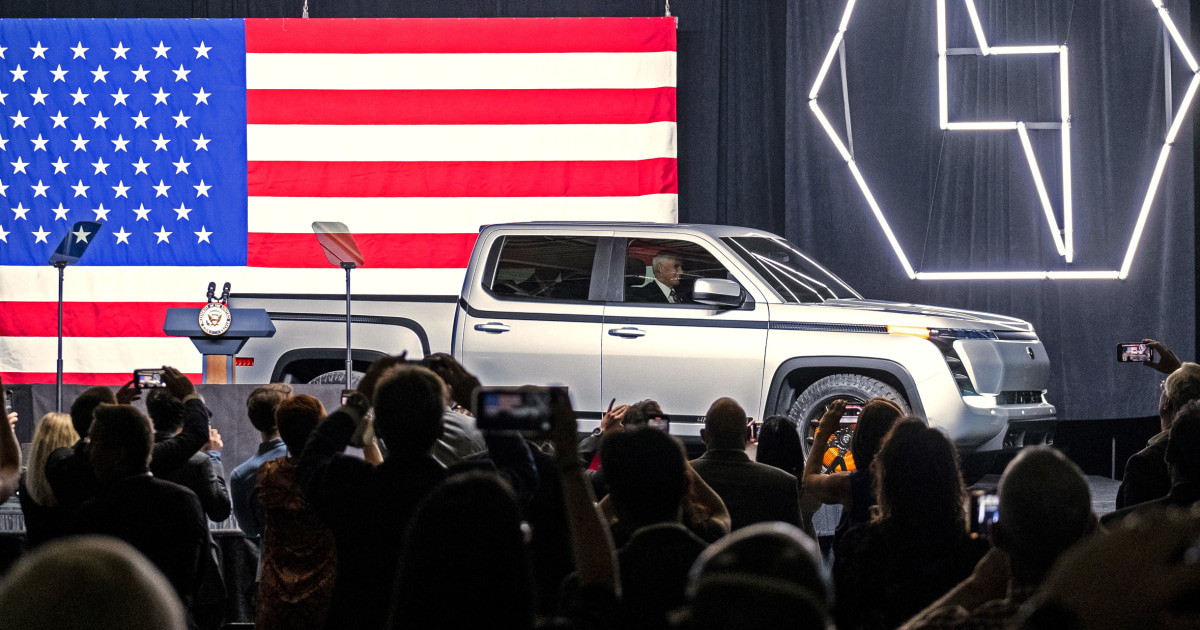

The automaker’s key solution is the Stamina electrical pickup truck, which is crafted at a former General Motors tiny-car factory in Lordstown for commercial buyers this kind of as community governments. Lordstown offered the plant to Foxconn in 2022.

Lordstown paused output of the Endurance previously this calendar year and given that April has resumed developing the vehicles at a reduced charge soon after resolving good quality troubles with suppliers.

Really should Lordstown fail to find a rescuer prepared to re-start off total output of the Stamina, the Ohio manufacturing unit could be a draw for abroad automakers seeking for a quick way to build autos in the United States.

Lordstown submitted for bankruptcy with strategies to seek a customer. It does not have an preliminary provide in hand, recognised in personal bankruptcy parlance as a stalking-horse bidder, which sets a least price other suitors can leading in an auction.

Lordstown CEO Edward Hightower instructed Reuters the Endurance small business could demonstrate attractive to yet another automaker seeking for a quickly entry into the EV market at a time the Biden administration’s insurance policies are attempting to go absent from gasoline-powered autos.

The Lordstown manufacturing unit in Northeast Ohio was formerly a GM (GM.N) small-motor vehicle factory that GM made the decision to shut in 2018. Then-U.S. President Donald Trump and other Ohio political leaders place stress on GM CEO Mary Barra to reverse the selection, or locate a purchaser. GM agreed to promote the plant to a freshly-formed entity termed Lordstown Motors launched by the previous major executive at an electrical truck maker termed Workhorse Team.

Like numerous others, such as truck maker Nikola, Lordstown, which went community in 2020, has struggled to are living up to the large anticipations of early investors. In 2021, its main govt and founder, Stephen Burns, resigned following the automaker acknowledged it had overstated pre-orders for its electrical vans.

Lordstown’s finance chief at the time also resigned. Burns has since bought his whole stake in Lordstown, according to a June regulatory filing.

As Lordstown wrestled during 2021 and 2022 with investigations by regulators and the U.S. Justice Office, Ford Motor was launching its electrical F-150 Lightning pickup truck, aiming at industrial clients.

EV startup Rivian launched its luxurious electric powered pickup in 2022. GM and Stellantis have introduced designs for electrical pickups. Elon Musk’s Tesla has promised it will start generating its Cybertruck late this yr.