Why is it so tough to purchase a house? Charges have much outpaced middle-course incomes. Home finance loan rates are above 7% for the 1st time considering the fact that 2002. And 3 out of 10 properties are offered earlier mentioned listing value.

But none of people elements totally captures the wide range of problems prospective buyers nationwide confront in the current market place. The ailments on the ground can vary broadly across point out and even county lines.

To better seize how housing marketplace conditions shift at the local level — as comprehensively and in as close to genuine time as feasible — we’re introducing a new regular gauge: the NBC Information Home Purchaser Index.

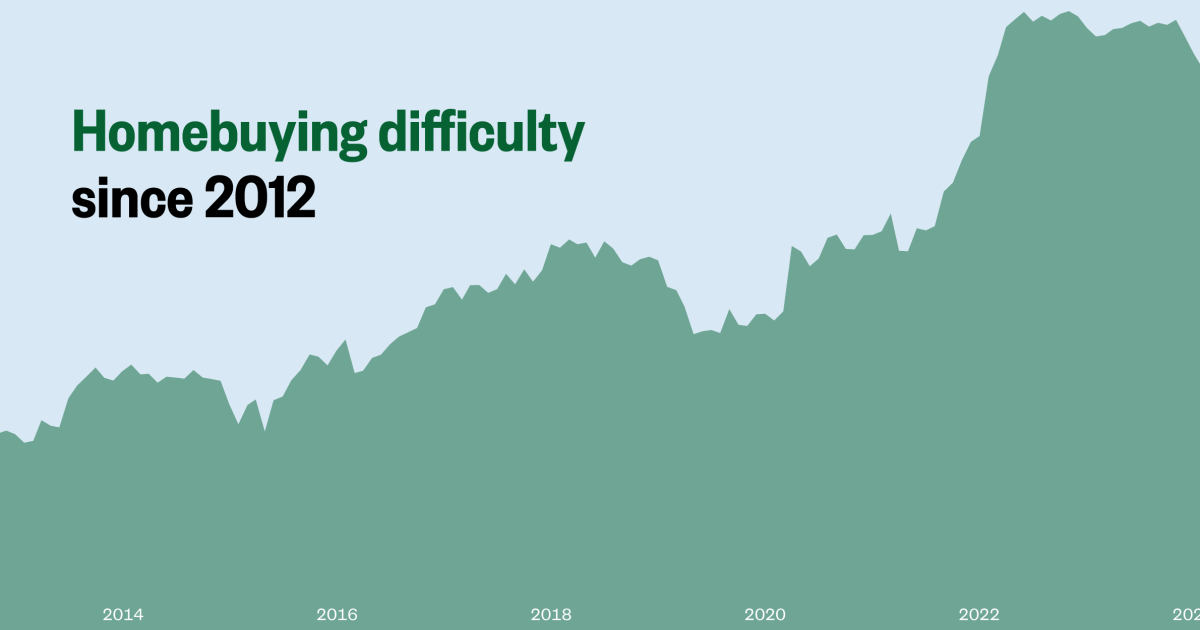

The Household Buyer Index, which NBC News produced with the direction of a genuine estate business analyst, a bank economist from the Federal Reserve Lender of Atlanta and other professionals, is a number on a scale of to 100 representing the problems a prospective purchaser faces making an attempt to obtain a dwelling. The increased the index value, the greater the issue.

A lower index benefit, of 10 for example, indicates superior purchasing situations for a buyer — lower curiosity prices, ample homes for sale. Chambers County, Texas, close to Houston, is just one of the 50 least tough spots to get in in the region, with minimal scores on scarcity, value and competitiveness.

A high benefit nearer to 90 indicates really difficult situations, which can end result from intensive bidding, significant insurance policy expenditures or steep jumps in residence price ranges relative to profits. Costs are soaring in Coconino County, Arizona, creating it 1 of the 25 most tricky counties to purchase a property in. 5 a long time ago it was rated 300, but the median sale price has greater 81%, just about 2 times the nationwide figure.

The index measures trouble nationwide, as effectively as on the county level, in the counties where there’s adequate homebuying details to make knowledgeable assessments.

The nationwide index, presented beneath, captures the massive-photo marketplace and economic problems that impact homebuying across the U.S.

This index consists of four things:

- Cost: How much a home fees relative to incomes and inflation — as effectively as how related expenditures, such as insurance plan prices, are changing.

- Opposition: How lots of people today are vying for a home — and how intense the need is. This is measured as a result of observations together with the percentage of households marketed over listing price and the quantity that went below contract inside two weeks of becoming stated.

- Scarcity: The amount of properties that are on the market place — and how several more are anticipated to enter the sector in the coming month.

- Financial instability: Market volatility, unemployment and desire prices — reflecting the broader climate in which dwelling customers are weighing their selections.

For April, the overall Dwelling Buyer Index nationally was 82.4, up somewhat from March and about 5 details reduce than it was this time 1 yr ago.

Enhancements in industry competitiveness and the broader financial system have eased situations to some degree in just the previous calendar year. Nonetheless, substantial expenditures and ongoing housing shortages have retained general homebuying problem higher.

The index updates month-to-month on the Thursday after the 3rd Saturday of the month. The future update is June 20.