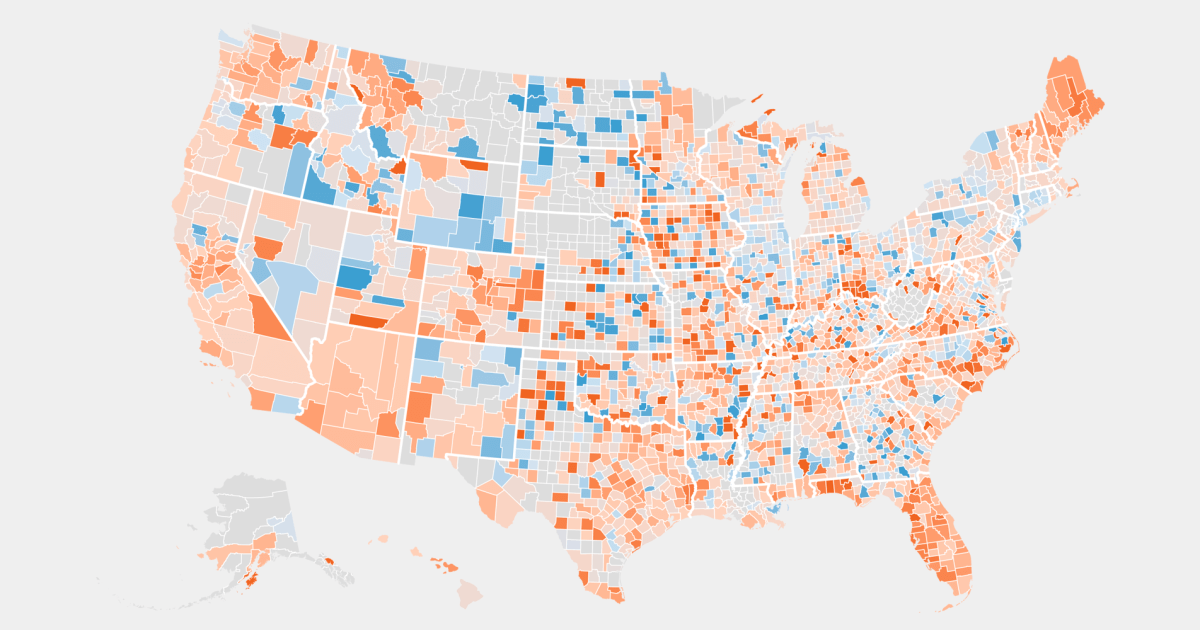

Today’s housing sector has two competing realities: a value crunch that shows no signals of halting, and a extend of mounting inventories and slowing competition that could offer relief — for these who can afford it.

Homebuying problem fell by a fifty percent-level to 82.2 in Might, in accordance to info printed Friday from the NBC News Property Customer Index. That easing owes to things which include improved supply and slowing consumer action.

But affordability stays a block for likely buyers. The Dwelling Customer Expense Index — a subcategory that incorporates house price ranges, mortgage and insurance fees — improved for the fourth month in a row and continues to be around its all-time superior.

“High rates merged with large home finance loan charges usually means housing is unbelievably unaffordable for these who have to finance their dwelling purchase,” stated Daryl Fairweather, main economist at Redfin.

:quality(85):upscale()/2023/01/04/939/n/1922153/4e89cbd063b5f08931a245.03921110_.jpg)