Previous President Donald Trump is poised to get an supplemental 36 million shares of Trump Media Tuesday — an “earnout” reward worth additional than $1.25 billion, at Monday’s price.

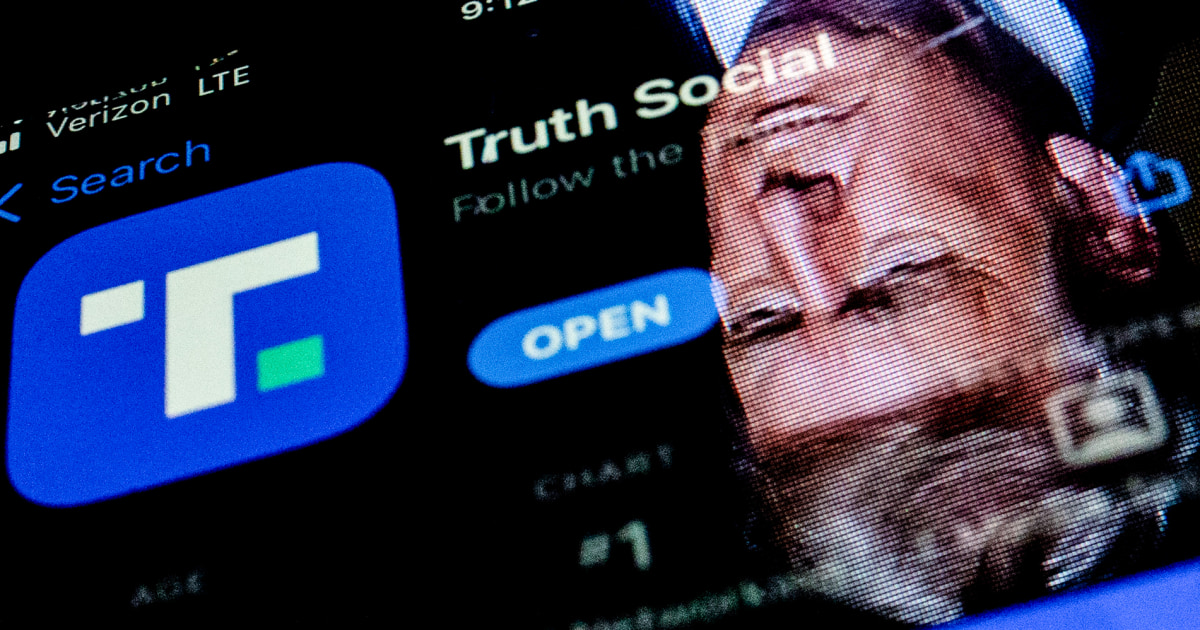

Trump Media, which owns the Reality Social app, was trading at close to $35 for each share mid-day Monday.

But that price tag is 2 times the $17.50 benchmark minimum amount share selling price, which the DJT ticker has to strike by the close of buying and selling Tuesday, for Trump to become suitable for the added so-called earnout shares.

That earnout is contingent on the benchmark staying strike for 20 buying and selling days inside a 30-investing working day period, beginning March 25. Tuesday is the 20th day and it is incredibly unlikely that DJT will drop below the benchmark price tag by the conclude of that day.

Trump Media’s share price was down about 1.8% as of 12:17 p.m. ET

The 36 million supplemental for Trump would be extra to the 78.75 million shares he previously owns, as the company’s bulk shareholder.

When the earnout shares are added to his existing stock, Trump’s overall stake in Trump Media would be well worth much more than $4 billion on paper, at $35 a share.

Trump Media has the electricity to concern a full of 40 million earnout shares, as part of the merger deal that mixed it with a publicly traded shell enterprise, Digital Planet Acquisition Corp.

“Assuming the comprehensive issuance of the Earnout Shares, President Donald J. Trump will obtain 36,000,000 Earnout Shares,” the business said in a securities submitting. The submitting indicates that some, if not all, of the remaining shares will be issued to Trump Media’s executive officers as portion of an incentive prepare.

Trump was in a New York Town courtroom Monday, listening to opening statements in his criminal hush revenue trial. Court docket resumes on Tuesday for the presumptive Republican presidential nominee.

The merged corporation, whose total title is Trump Media & Technological know-how Group Corp., commenced general public investing beneath the DJT ticker on March 26, at an opening price of $70.90 for every share.

That rate rose to a large of nearly $80 that day, briefly supplying the enterprise a industry capitalization of much more than $9 billion. This was irrespective of getting described a 2023 web decline of $58 million, and just $4.1 million in earnings.

But considering the fact that then, Trump Media’s share cost has plunged. By the shut of buying and selling on April 15, the share cost experienced fallen nearly 68% from its opening cost.

The stock price rose sharply final week. But as of Monday, Trump Media shares have been however trading around 50% decrease than the cost they debuted at last month, erasing billions of dollars in market place capitalization for the organization.

Even with a significantly reduce inventory selling price, Trump is almost certain to obtain all of his earnout shares.

Which is since the threshold share rate at which Trump will obtain all 36 million of his earnout shares was established at $17.50. The very last time the inventory traded at that price tag was in January, right before the Securities and Exchange Fee greenlighted DWAC and Trump Media’s ideas to merge.

It continues to be to be observed if the issuance of the earnout shares to Trump will affect the share cost of Trump Media.

Any shares that Trump owns are subject matter to a lock-up provision that prevents him from marketing them in the 6 months pursuing the merger’s closing day.

While Trump Media’s board could amend that provision, to day, it has not taken any steps to do so.

CNBC asked a firm spokeswoman about the expected triggering of Trump’s earnout shares.

She replied, “With much more than $200 million in the bank and zero personal debt, Trump Media is fulfilling all its obligations related to the merger and promptly relocating forward with its small business plan.”