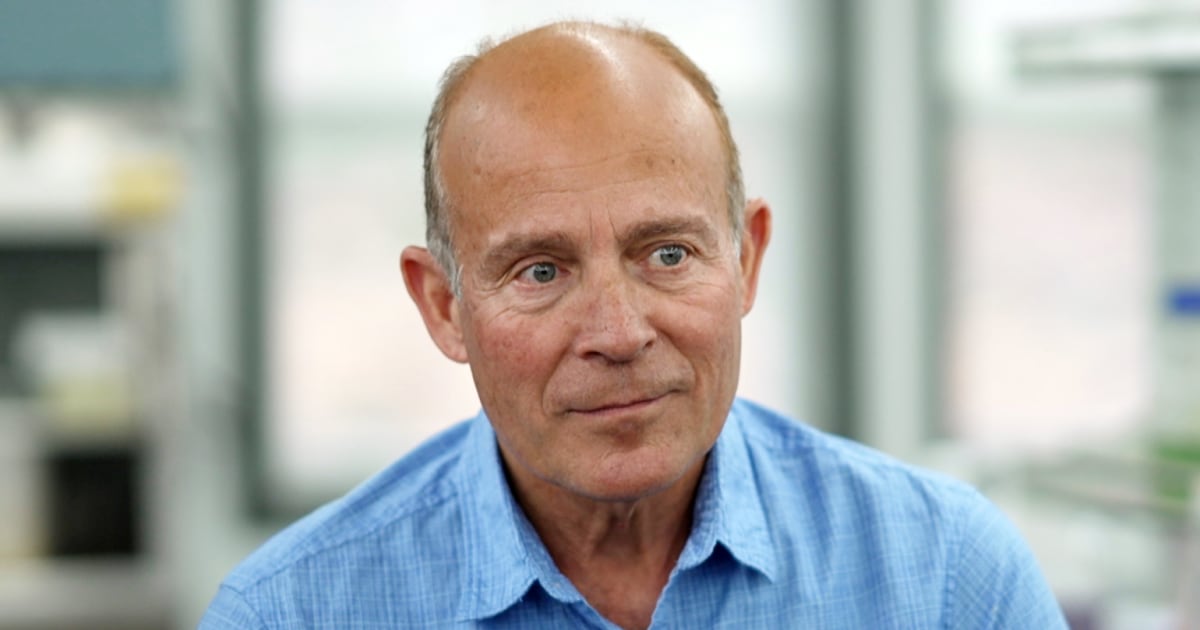

When the pandemic upended day-to-day lifestyle in his modest Missouri city, compact-business enterprise proprietor Scott Volner went into overdrive to retain his staff members on the payroll, even with a fall in earnings.

Then he began to get bombarded by telemarketers who had been declaring to be “tax service specialists,” telling him he skilled for a specific IRS pandemic relief credit. Between hundreds of calls and e-mails, he signed up with a business and agreed to shell out a 10% price. He ended up with a look at for $330,000 — income he plowed back into his enterprise.

“They are promoting it, and they have the company to put the full package collectively for you so you never have to fill out the varieties,” claimed Volner, who operates a fertilizer company in Rolla, Missouri.

But it turned out Volner wasn’t qualified for what is identified as the Personnel Retention Tax Credit, or ERC, which has very specific and narrow standards. For just one, the credit history is offered only to business owners primarily based in states where there had been mandatory shutdowns.

Now Volner has to figure out how to fork out back again funds he has presently expended.

“It’s likely to be a very long, difficult street to tow to get this all compensated back again,” said Volner, who experienced utilised a corporation referred to as ERC Specialists, which did not respond to requests for remark.

Volner is among the tens of thousands of persons caught up in the hottest pandemic reduction debacle — 1 the IRS acknowledges is costing taxpayers hundreds of billions more than it should have.

Congress explained the Staff Retention Tax Credit score would value all around $55 billion, but new estimates put the charge at $250 billion, and promises are continue to pouring in.

IRS officers say the application has been a magnet for unscrupulous promoters who took as substantially as a 3rd of each individual payout when filing what the IRS commissioner calls “a tsunami of terrible claims” on behalf of enterprises who under no circumstances experienced. They say there also has also been a sizeable amount of money of outright fraud by persons who lied on their apps.

“The difficulty is we have promoters out there who are making an attempt to place just one about on small organizations, convincing them they’re eligible for some thing that they’re not suitable for,” IRS Commissioner Danny Werfel explained in an interview. “We have important issue that promoters and entrepreneurs are making an attempt to in essence trick smaller firms.”

It’s not just promoters and marketers who have sought to deceive the federal government. A convicted murderer in a California jail is accused of orchestrating a plan utilizing ERC statements to steal more than a million dollars, some of which he used to toss a social gathering at a $9,000-a-night time Las Vegas penthouse and then fly his relatives house on a personal jet, according to courtroom documents.

Werfel explained the IRS has uncovered tens of thousands of claims for businesses that both never ever existed or didn’t have workforce through the pandemic.

“There are methods in which you can, sad to say, trick the IRS,” he acknowledged.

The ERC joins a listing of pandemic aid packages that have been plundered by fraudsters, with losses achieving as considerably as $280 billion, or plenty of to fund the FBI’s once-a-year finances for 25 years. And there are not ample FBI and other prison investigators to catch even 1% of the fraudsters, industry experts say.

The Justice Department past 7 days declared it experienced billed about 3,500 persons and seized $1.4 billion in stolen Covid-19 reduction funds — a very small portion of the approximated fraud.

Werfel, who was not the IRS commissioner when Congress developed the method, described a dynamic that was current in all pandemic reduction applications — a drive to get the dollars out quickly, main to reduced scrutiny of statements.

“When you have an acute circumstance like a pandemic and crisis, you’re often balancing ‘let’s get money to people that need to have it quickly’ as opposed to asking for a bunch of added paperwork and a bunch of additional evidence,” he explained. “There are unquestionably issues we want to master and do improved in the foreseeable future for the up coming crisis or the up coming emergency.”

The IRS is scrambling to stop the bleeding and to claw again what it can.

The agency suspended the processing of ERC statements and claims it has launched hundreds of audits and at minimum 400 felony investigations to go soon after ineligibility and fraud. It’s also focusing on promoters, 6 of which have been billed criminally, in accordance to the IRS.

So far, the greater promoters who blanketed TikTok with ads haven’t faced costs. Some of those people firms lifted awareness of the tax credit by that includes superstars, together with Kevin O’Leary of “Shark Tank” and Ty Burrell, who performed father Phil Dunphy on ABC’s “Modern Relatives.”

Neither could be achieved for remark.

“I’m upset — it’s discouraging and it’s aggravating on many amounts, because the marketing and advertising firms experienced also a great deal power to be included in this,” claimed Michelle Hance, who runs a compact audio/visible organization in Missouri.

She signed up to get the tax credit with Innovation Refunds, and she says she acquired $13,000 from the federal authorities, which she not too long ago had to pay again. She reported she paid the promoter 25% of the income the IRS paid her, and she now feels misled for the reason that it is now clear to her that she under no circumstances skilled.

“The promoters obtained loaded,” Werfel explained to NBC News. “And then you flip all-around, if you are the taxpayer, and you say, ‘Promoter, you explained no danger,’ and the promoter is long gone. They are abandoning you.”

About the past two months, Innovation Refunds has described two rounds of layoffs at its Des Moines, Iowa, offices, in accordance to condition labor documents.

A spokesperson for Innovation Refunds stated by textual content concept that it would issue clients refunds on the price the firm collected if it experienced informed company entrepreneurs they competent for the ERC and the house owners then found out from the IRS that they did not.

“Innovation Refunds is not a tax preparer,” the spokesperson wrote. “Independent tax specialists, to whom Innovation Refunds refers its clients, make ERC eligibility determinations for the enterprises they provide. If that impartial tax expert determines that funds must be returned to the IRS, then we absolutely aid that conclusion.”

The spokesperson stated businesses can contact Innovation Refunds “via email” to get income back again if they have found out they are ineligible.

IRS scrutiny of ERC promoters will keep on, Werfel claimed.

“We’re doing work with tax specialists that are assisting warn us to the forms of promoters out there that are driving these forms of fake claim pursuits,” he stated. “We have criminal investigations underway linked to about $3 billion in untrue promises.”

He reported the IRS has recovered $500 million in bad claims and is urging Congress to pass legislation to increase the audit interval. With out that, the IRS wouldn’t be capable to scrutinize statements from 2020.

Congress is also considering laws to repeal the ERC completely, but it has stalled amid a lobbying campaign to continue to keep it likely. Innovations Refunds invested $720,000 lobbying Congress past yr, according to Open Techniques, a website that publishes lobbying disclosure documents.

That organization explained to CNBC it had processed $7 billion in promises.

Larry Gray, a CPA in Rolla, Missouri, was amid the early voices warning that ERC fraud could turn out to be a key problem. He took to YouTube from his office in 2020, sounding the alarm. He also helped Volner and Hance discover they didn’t qualify for the credit score.

Gray states the accountability for the mess spans the federal government.

“IRS bears a lot of accountability,” he mentioned. “Congress bears accountability. Treasury really should have bought much more steerage out.”

Early on, Gray said, he realized that anyone could quickly defraud the program.

“You could set in a fraudulent federal ID quantity. You could set in fraudulent employees, mail it in. … Due to the fact everybody’s concentrated on receiving the revenue out, not viewing if they certified to get the revenue.”

Soon, third-party promoters sprung up, advertising the tax break.

One of the heaviest advertisers was Miami-centered Bottom Line Concepts, run by Josh Fox, who boasted on the net of hundreds of thousands in earnings for his consumers, telling businesses they had been missing out if they didn’t apply for the credit history. In a clip posted on TikTok, Fox advised an interviewer that he was surprised by how few enterprises and elected officers had been aware of the tax credit rating.

“It’s wonderful how quite a few politicians we discuss to who are unaware of the method and when we explain to them that their citizens, the people today that have corporations in their city, can commonly get hundreds of countless numbers and possibly hundreds of thousands of pounds back from the federal federal government,” he stated.

Fox did not reply to various messages still left at his workplace in Miami.

Quite a few did not qualify. In truth, Gray reported, the most prevalent way corporations imagined they did — if they were being noticeably impacted by government-mandated shutdowns — didn’t apply in many red states wherever mandatory shutdowns had been couple and significantly amongst.

“It appears they did not go as a result of the appropriate exam or check with the correct concerns,” Grey said.

But so far, when the IRS comes after a business that did not qualify, the promoters are not the kinds on the hook — the enterprises are.

Scott Volner employed the $330,000 he got from the credit to keep staff members on the payroll and increase his business, which recycles spent alkaline batteries into fertilizer by chemically extracting the zinc and manganese within.

At the instant, he is attempting to persuade the IRS to put him on a gradual compensation approach.

Volner reported he has not spoken to ERC Experts considering that he figured out he did not qualify for the tax credit rating for the reason that he did not consider it would do any very good.

“I really feel betrayed, due to the fact I believe I was sucked into it,” he said.