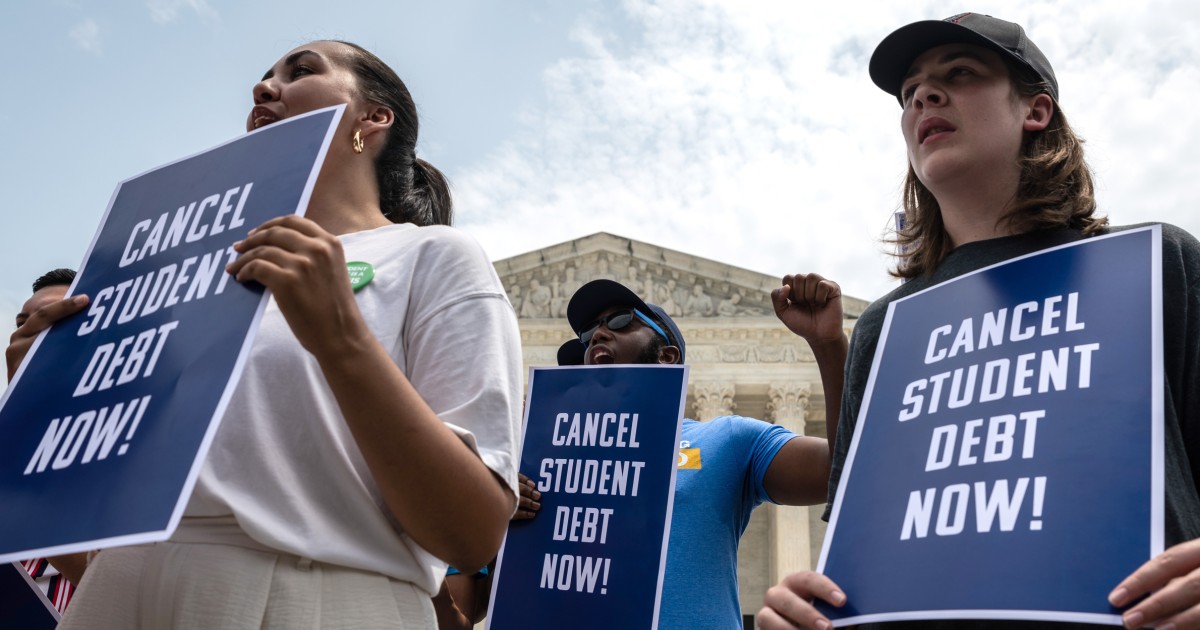

WASHINGTON — President Joe Biden on Friday introduced new actions aimed at aiding debtors repay pupil loans following the Supreme Court invalidated his personal debt aid approach.

Biden outlined new compensation options that would be accessible to tens of millions of borrowers, as perfectly as his administration’s approach to give broader reduction.

The president said that when college student bank loan repayments get started on Oct. 1 — just after a three-calendar year pause that commenced all through the Covid pandemic — borrowers will have the opportunity to enroll in a short term 12-thirty day period “onramp compensation plan” that will eliminate the menace of default.

“Throughout this time period, if you can pay out your month-to-month charges, you should,” Biden reported in quick remarks from the White Property. “But if you are not able to, if you miss payments, this onramp will briefly remove the threat of default or obtaining your credit harmed, which can harm borrowers for many years to come.”

The Department of Education will not refer debtors who have skipped payments to credit rating organizations in the course of this period of time, Biden explained.

“We know that figuring out how to pay these extra bills can consider time for borrowers, and they could possibly miss out on payments on the entrance stop as they get back again into compensation,” he extra. “Commonly, this can lead borrowers to drop into delinquency and default.”

This program would be diverse from the student personal loan pause initiated in 2020 by then-President Donald Trump and prolonged several moments by Biden. Under that application, which carries on for the upcoming couple of months, desire has not accrued since regular payments have not been required.

Biden also introduced adjustments to caps on the percentage of discretionary revenue compensated toward university student personal debt. Heading forward, no borrower will need to spend far more than 5% of their discretionary cash flow on undergraduate loans, down from the earlier cap of 10% just about every month.

A lot more broadly, Biden explained, his administration would function to provide student personal debt aid to “as numerous borrowers as feasible, as quickly doable” by the 1965 Bigger Schooling Act. He mentioned that doing so would allow for Education and learning Secretary Miguel Cardona to “compromise, waive or release loans below certain situation.”

The Supreme Court docket on Friday rejected the Biden administration’s arguments that his pupil personal loan system was lawful below a 2003 regulation called the Bigger Training Relief Possibilities for College students Act, or HEROES Act. The law states that the governing administration can give aid to recipients of pupil loans when there is a “national crisis,” permitting it to act to be certain persons are not in “a worse situation financially” as a outcome of the crisis.

In the course of his remarks, Biden known as the Supreme Court’s scholar bank loan conclusion a “miscalculation” and “incorrect.” He also criticized Republicans, indicating they could not “bear the believed” of furnishing aid for working and middle-course Individuals.

When questioned by a reporter if he experienced specified debtors “wrong hope” on bank loan forgiveness, Biden pointed the finger at Republicans.

“I failed to give debtors fake hope, but the Republicans snatched absent the hope that it was,” Biden explained.