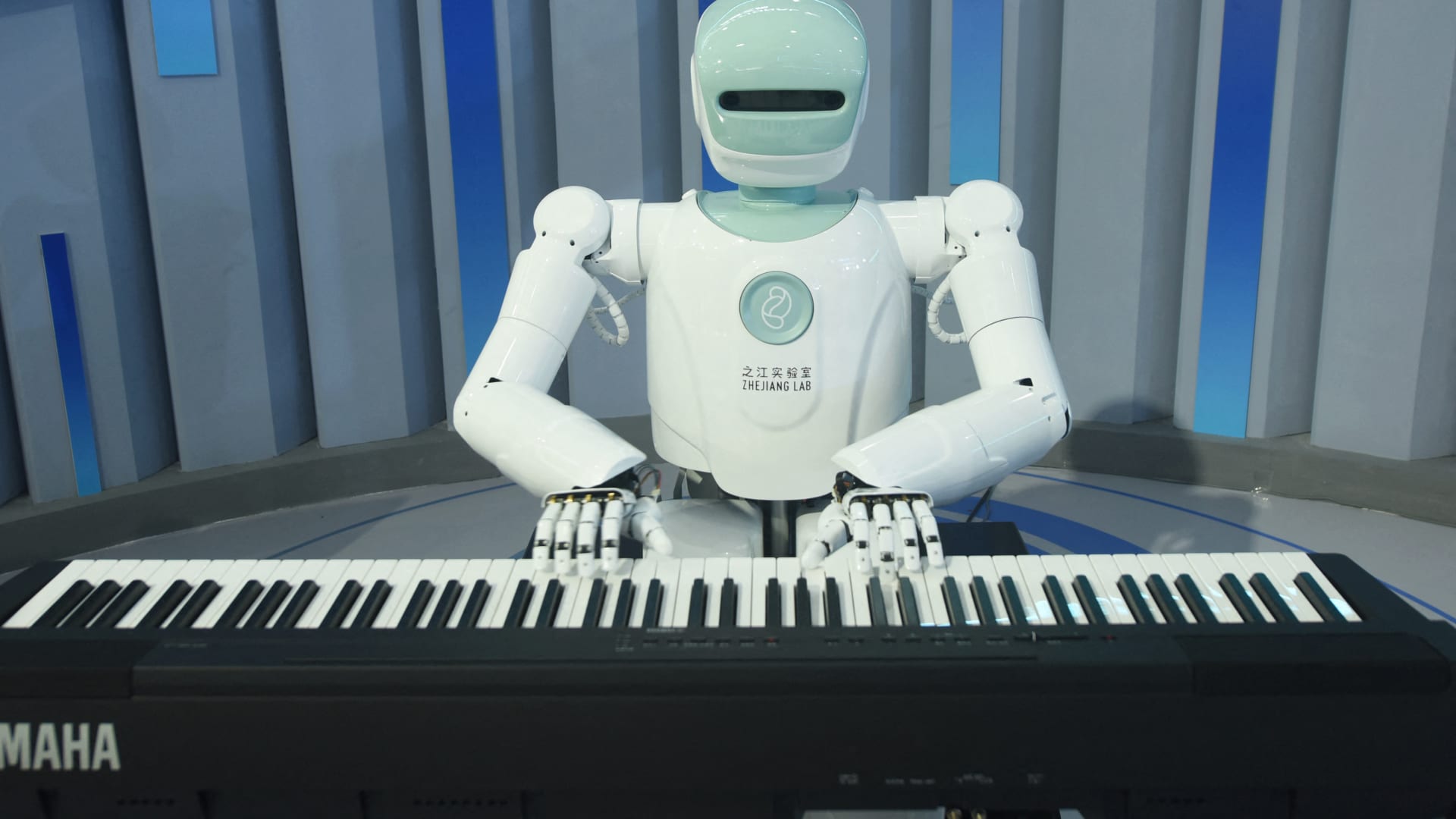

A robotic performs the piano at the Apsara Conference, a cloud computing and artificial intelligence conference, in China, on Oct. 19, 2021. Although China revamps its rulebook for tech, the European Union is thrashing out its personal regulatory framework to rein in AI but has but to move the finish line.

Str | Afp | Getty Illustrations or photos

The artificial intelligence trend has eaten Wall Avenue in 2023.

The madness located its roots in November of very last 12 months, when OpenAI released the now infamous big-language model (LLM) ChatGPT. The software touts some spectacular abilities, and spurred an AI race with rival Google asserting it is very own chat box – Bard AI – only a several months later.

But the enthusiasm went even additional. Investors commenced flocking to stocks that could offer sufficient AI publicity, with names like C3.AI, chipmaker Nvidia, and even Tesla, submitting amazing gains inspite of an total tense macroeconomic ecosystem.

Just like “blockchain” and “dotcom” right before it, A.I. has come to be the buzzword providers want to seize a piece of.

Now some with tiny to no historical ties to synthetic intelligence have touted the technologies on conference phone calls to analysts and traders.

Grocery store chain Kroger touted itself as acquiring a “loaded history as a technology leader,” and main government officer Rodney McMullen cited this as a reason for the business is poised to take advantage of the rise of synthetic intelligence. McMullen exclusively pointed to how AI could support streamline shopper surveys and assistance Kroger consider the information and implement it into stores at a far more fast clip.

Shares of the supermarket large have ticked up just earlier mentioned 4% from the start out of the year.

“We also consider robust, precise and assorted very first-bash data is essential to maximizing the influence of innovation and info science and AI,” McMullen explained to traders on the company’s June 15 earnings contact. “As a result, Kroger is effectively-positioned to correctly adopt these innovations and produce a improved client and associate encounter.”

In the same way, Tyson Foods, the second-premier world wide producer of rooster, beef and pork, thinks the firm can profit from the explosion of expenditure and excitement around synthetic intelligence. Nevertheless, chief executive Donnie King failed to specify how AI would participate in into the firm’s long run, or what specific purposes the technology would be utilized to in the Tyson business.

Tyson Foodstuff inventory has declined far more than 20% from January.

“…And we continue to build our digital capabilities, operating at scale with digitally-enabled standard operating procedures and utilizing data, automation, and AI tech for decision-generating,” King informed buyers on the firm’s May possibly 8 earnings get in touch with.

For heating, air flow, and air conditioning (HVAC) products producer Johnson Controls, synthetic intelligence can aid the business experience a choppy macroeconomic setting, it proposes. Chief executive officer George Oliver did not elaborate past thirty day period on how AI would enjoy a role in the company’s future over and above mentioning AI as a most likely handy tool when asked about a decrease in orders.

Shares have acquired 2.2% from January.

“…AI is going to proceed to make it possible for us to be equipped to increase companies no make a difference what the [economic] cycle is that we in the end working experience,” Oliver informed investors on the firm’s May 5 earnings connect with.

The promise of artificial intelligence has held shares larger, as Wall Street heads into the second 50 % of the calendar year. The tech-significant Nasdaq Composite, for comparison, has included about 16% from January.

But although the likely of AI upends a myriad of industries and threatens to automate hundreds of tens of millions of employment, investors will in the end choose about time who are the authentic beneficiaries and who is just seeking to experience the buzz.