Blame it on the property finance loan premiums. Blame it on the scarce supply.

There are much more than ample factors to blame for the dismal condition of the U.S. housing current market, which are now quantified and classified in NBC News’ Dwelling Buyer Index.

Here are some critical takeaways from the initial report:

Homebuying is tricky all over the place

The April Dwelling Purchaser Index report found nationwide issue to be at 87.3 out of a possible 100, a rating that signifies extremely tough ailments. And homebuyers throughout the nation are experience the squeeze: 26 states have at least a single county in the record of the 100 most complicated counties. Colorado is household to the three most tough counties in the region: Garfield, Routt and Mesa counties.

All three Colorado counties have significant price and levels of competition scores, indicating that houses are both expensive and going swiftly when they hit the marketplace. In Routt County’s Steamboat Springs, purchasers experience a housing growth so intensive that even superior earners simply cannot pay for properties.

But it’s not just in general value that is driving trouble. Forty-a few of the 100 most hard counties in which to purchase a residence have median list prices underneath the national typical.

“I feel it’s been a common situation which is not just the high-expense areas,” mentioned Daniel McCue, senior research affiliate at Harvard’s Joint Middle for Housing Scientific studies. “It’s incredibly a great deal throughout the nation.”

McCue pointed to Columbus, Ohio, as an illustration of a position exactly where a historically secure industry all of a sudden started to surge throughout the Covid pandemic, noting that Columbus had “somewhere around 40% development in prices between 2021 and 2023 — something that hadn’t been observed in many years.”

The Dwelling Buyer Index in Franklin County, Ohio, the place Columbus is principally situated, displays difficulty has increased steadily given that the commencing of 2020, growing from 39.5 in December 2020 to 74. in April.

Dwelling offer slipping small

Today’s homebuyer faces a smaller sized pool of alternatives than in previous years. And there is minimal aid in sight, as the pace properties are arriving on the industry continues to be outstripped by desire.

The NBC News Home Consumer Shortage Index — which accounts for current stock, new design and other components — displays that, with a value of 87.8 — far larger than prior to the pandemic, when values rarely exceeded 60.

“The spoken rule is that six months of source has typically indicated a balanced sector,” McCue claimed. “At this level, we’re at traditionally lower month to month provide.”

Supply has remained below that stage because Could 2020. An NBC Information assessment of Redfin knowledge shows that, nationally, the out there housing inventory can satisfy 2.6 months of need, given the latest fee at which homes are leaving the marketplace. At the exact same time, the variety of new listings’ hitting the current market continues to be small — suggesting that these waiting for additional alternatives may possibly want to wait around a minimal more time.

Need — and competition — is elevated

Among the the a few trouble sub-indexes specific to housing, competition is the major driver of problems in approximately 50 % of the counties calculated.

Nationally, the Household Buyer Opposition Index — which captures how swiftly residences transfer out of the current market — exhibits that opposition has soared in the final 5 decades, climbing from a small of 39 in April 2019 to 99 — just about the max — for all of 2021 and most of 2020. And although competition has moderated a bit in 2023 and 2024, it nonetheless remains much above pre-pandemic stages.

Central California’s Tulare County is just one of the most competitive marketplaces in our April report. About 55% of properties in Tulare County remaining the sector within just two weeks in April. And 36% bought over checklist price — 6 proportion details earlier mentioned the national figure.

Out of sight

Nationally, the typical household’s getting ability has eroded sharply. The value of a property the ordinary homebuyer could pay for has practically halved given that December 2020.

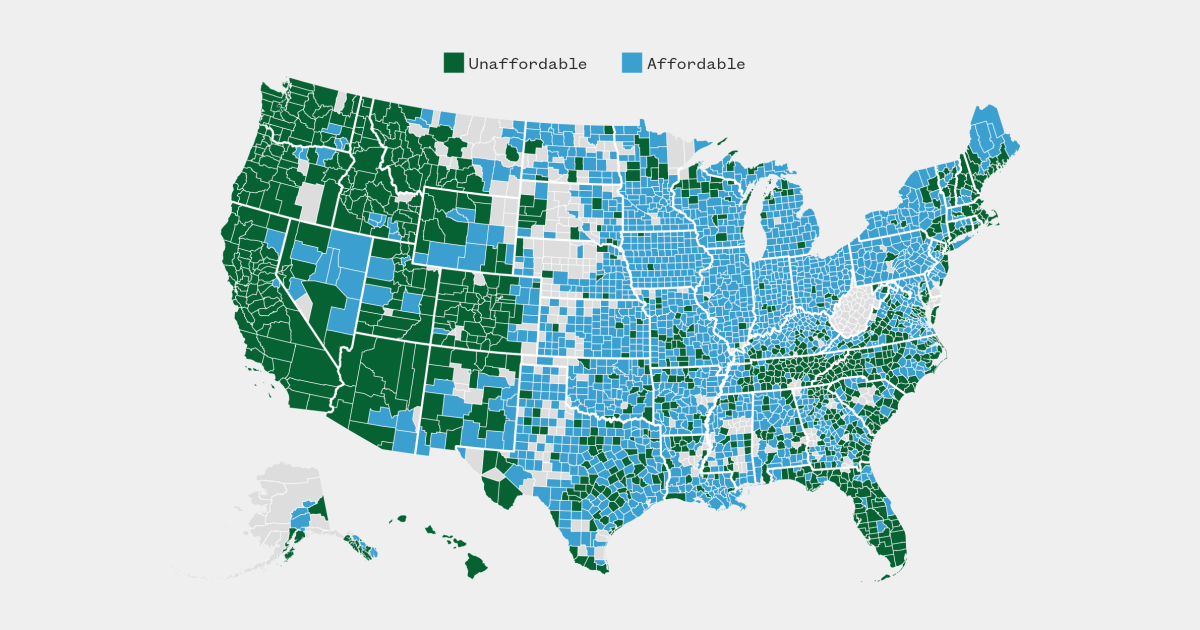

In 2019, a domestic earning the median revenue could afford to pay for to purchase the median-priced house in 94% of U.S. counties. Currently, a median-cash flow home would be capable to afford to pay for only a median-priced home in 63% of counties, as houses throughout Florida and a lot of the West have climbed out of access.

:quality(85):upscale()/2024/04/10/834/n/1922794/8b4b73b76616e22424bd03.45464031_.jpg)