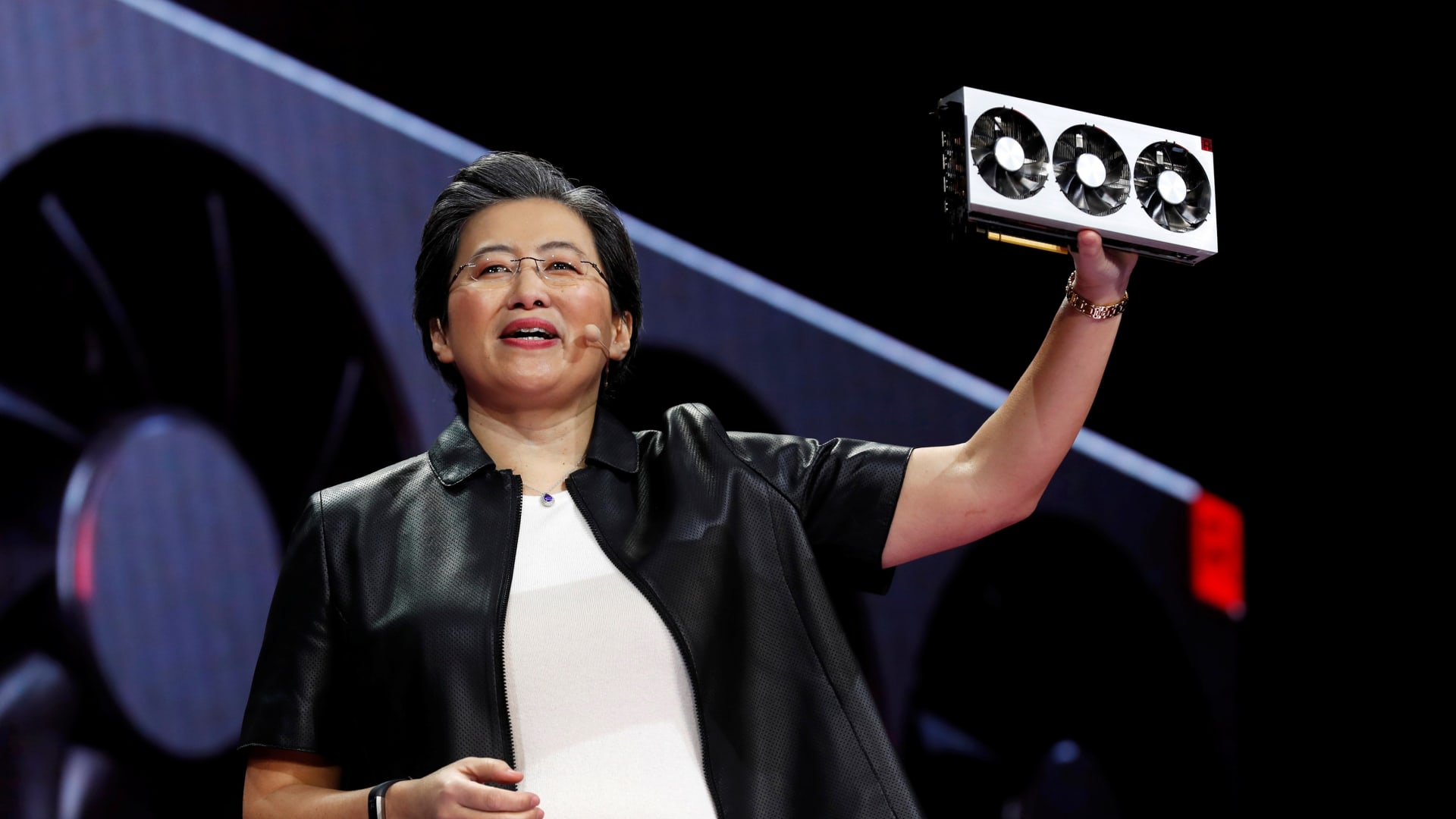

Lisa Su, president and CEO of AMD, talks about the AMD EPYC processor for the duration of a keynote deal with at the 2019 CES in Las Vegas, Nevada, U.S., January 9, 2019.

Steve Marcus | Reuters

AMD described very first-quarter earnings and revenue on Tuesday that were somewhat forward of Wall Avenue expectations, and delivered an in-line forecast for the current quarter.

AMD shares dropped 3% in extended trading.

This is how it did vs . LSEG consensus anticipations for the quarter ending in March:

- Earnings for every share: 62 cents adjusted vs . 61 cents envisioned

- Income: $5.47 billion vs. $5.46 billion predicted.

AMD stated it expects about $5.7 billion in gross sales in the latest quarter, in line with Wall Street estimates of the same approximate complete. That would represent about 6% once-a-year development.

The company documented net earnings of $123 million, or 7 cents for each share, as opposed to a web loss of $139 million, or 9 cents for each share, in the course of the 12 months-previously period of time. Revenue was up about 2% from a 12 months previously.

AMD claimed its closely-viewed Details Middle phase grew 80% on a yr-around-year basis to $2.3 billion thanks to gross sales of its MI300 AI chip, which competes with Nvidia’s AI graphics processors. AMD stated it experienced marketed around $1 billion of the AI chips considering that it released in the fourth quarter of 2023.

AMD also will make central processors which are often paired with sophisticated AI chips in servers. AMD CEO Lisa Su informed analysts on a get in touch with that the enterprise considered it had taken industry share in the server CPU phase — likely from Intel. Su said that AMD sees “indicators of improving upon need” for its CPUs thanks to the AI server increase.

AMD’s weakest division was its gaming phase, which was down 48% on an annual foundation to $922 million, which the business stated was due to decrease chip gross sales for game consoles and PCs. AMD can make chips for Sony’s Playstation 5, for illustration. AMD’s gaming gross sales trailed a StreetAccount estimate of $969 million.

AMD’s original company, processors for chips and PCs, is described as consumer phase revenue. AMD reported $1.4 billion in initially-quarter income, a 85% annual boost, suggesting that last year’s Computer system slump is more than. AMD is also highlighting its chips remaining able to operate artificial intelligence programs regionally, which would enable it to ability so-referred to as “AI PCs” that a lot of market members are banking on to generate new laptop computer and desktop revenue.

The company’s embedded phase, designed up of solutions acquired as aspect of the Xilinx acquisition in 2022, reported slipping income, dropping 46% on an once-a-year basis to $846 million, lagging Wall Road anticipations of $942 million.