Mark Zuckerberg, CEO, Meta Platforms, in July 2021.

Kevin Dietsch | Getty Visuals News | Getty Pictures

Meta will report initially-quarter success soon after the bell Wednesday.

Here’s what analysts are expecting.

- Earnings per share: $4.32, in accordance to LSEG.

- Profits: $36.16 billion, according to LSEG.

- Everyday energetic buyers (DAUs): 2.12 billion, in accordance to StreetAccount

- Month-to-month energetic people (MAUs): 3.09 billion, according to StreetAccount

- Common revenue per consumer (ARPU): $11.75 according to StreetAccount

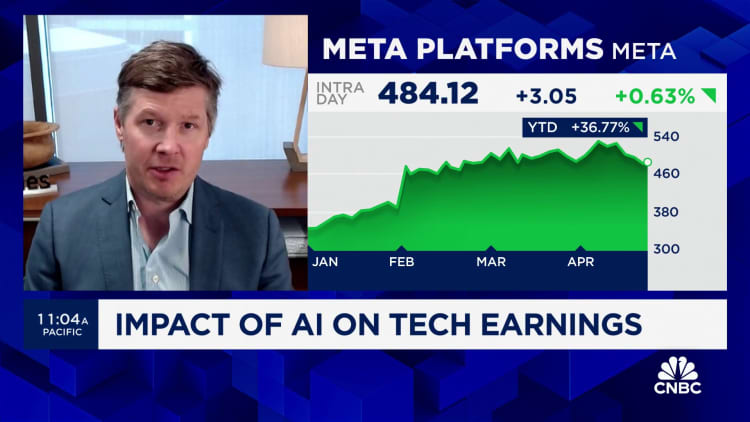

Meta has been a favored on Wall Road since early 2023, when CEO Mark Zuckerberg told investors it would be the “12 months of efficiency.” The stock virtually tripled past yr, trailing only Nvidia amid members of the S&P 500, and is up a further 40% in 2024.

The Fb dad or mum has been clawing back again digital ad current market share following a dismal 2022. At that time, the enterprise was reeling from Apple’s iOS privateness update and macroeconomic worries that led several models to rein in paying.

Zuckerberg spearheaded an initiative to rebuild the advert enterprise with a target on synthetic intelligence. On the company’s final earnings get in touch with in February, finance chief Susan Li stated Meta has been investing in AI versions that can precisely forecast suitable advertisements for people, as effectively as instruments that automate the adverts-development system.

Analysts expect Meta to report a 26% maximize in income from $28.65 billion a year previously. That would mark the fastest rate of growth given that the 3rd quarter of 2021, which was ahead of Apple’s privateness transform started off to exhibit up on other companies’ stability sheets.

Meta is benefiting from a stabilizing economic climate and surge in paying from Chinese discounted stores like Temu and Shein, which have been pumping revenue into Fb and enterprise-owned Instagram in an work to access a broader swath of buyers. Analysts at Baird stated in a Monday take note that slower paying out from China-dependent advertisers could be a source of worry in the very first-quarter results.

Nonetheless, the Baird analysts see continuing momentum for Meta, and claimed they have “fairly superior” anticipations for the enterprise because of its bettering advertiser resources and good results in short-type online video monetization.

Buyers will keep on being centered on Meta’s prices, which have been central to the stock rally. Early past calendar year, Zuckerberg mentioned the company would be far better at eradicating unnecessary tasks and cracking down on bloat, which would support Meta become a “more powerful and a lot more nimble organization.”

The enterprise cut about 21,000 work opportunities in the 1st 50 percent of 2023, and Zuckerberg explained in February of this year that selecting will be “somewhat minimal as opposed to what we would have done traditionally.”

As of Dec. 31, Meta experienced a worldwide workforce of 67,317, down from a peak of additional than 87,000 employees in 2022, according to Securities and Exchange Fee filings.

Jefferies analysts wrote in a report past 7 days that it can be “difficult to argue with excellence.” The analysts hope Meta to beat on its first-quarter results and present superior-than-expected steerage for the second quarter. As of now, the regular analyst estimate phone calls for earnings progress of 20% in the next quarter to $38.29 billion, in accordance to LSEG.

“We go on to be encouraged by META’s capability to maintain double-digit rev advancement, offered the mix of larger engagement from AI investments, and raising advertiser ROI & effectiveness,” the Jefferies analysts wrote.

Meta’s Fact Labs device, which homes the company’s hardware and software for advancement of the nascent metaverse, proceeds to bleed money. Analysts expect the division to exhibit an functioning loss of $4.31 billion for the quarter, on best of the $42 billion it is really dropped considering the fact that the close of 2020. Income in the device is projected to reach $512.5 million, a 51% improve from $339 million a 12 months previously.

Executives will talk about the firm’s final results on a simply call with analysts at 5 p.m. ET.