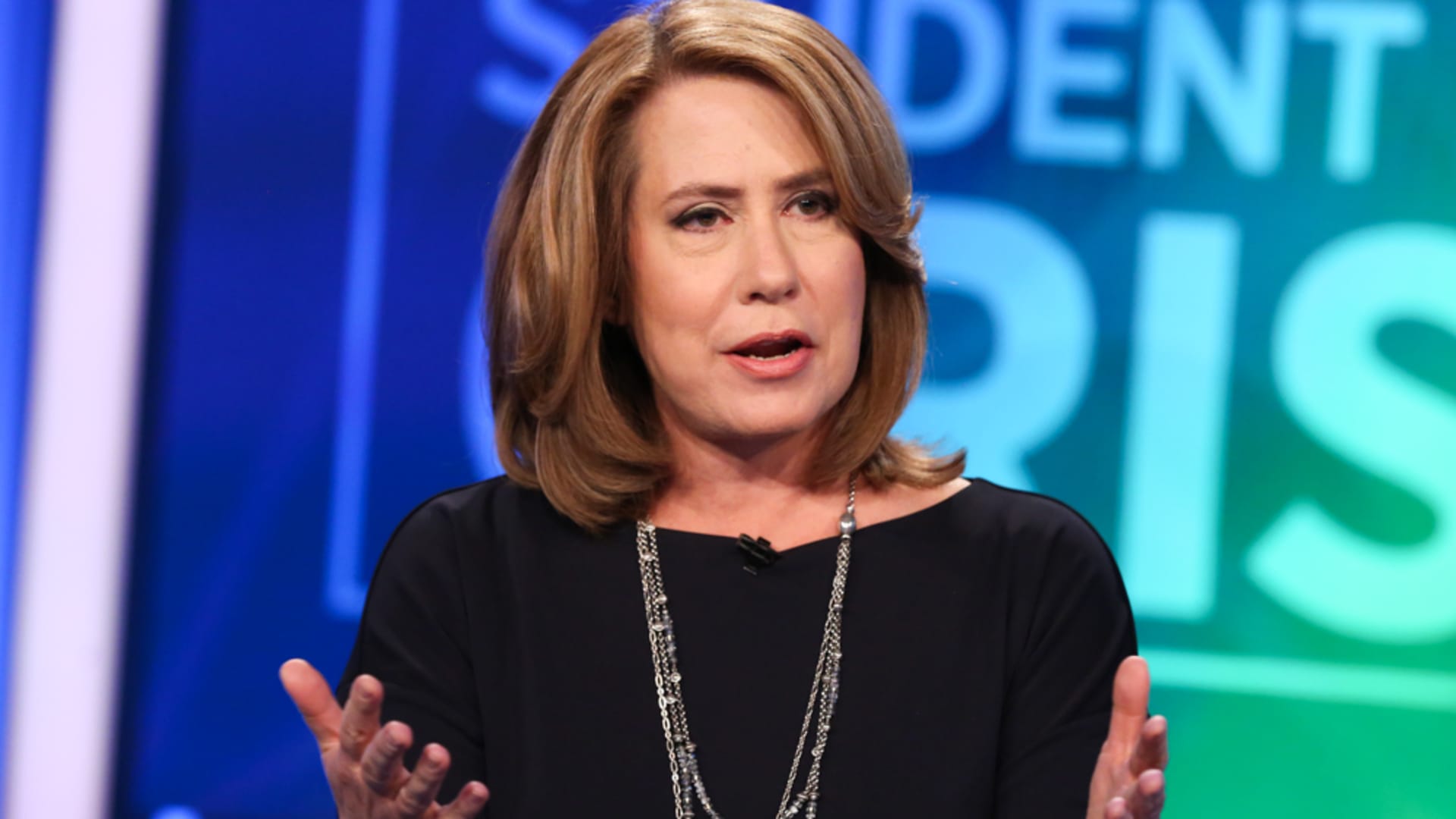

Regional bank earnings may well expose essential weaknesses, according to Sheila Bair, previous chair of the U.S. Federal Deposit Insurance coverage Corp.

Their quarterly figures get started hitting Wall Street this week.

“I’m nervous about a handful of them,” Bair told CNBC’s “Rapid Dollars” on Tuesday. “I believe some of them are however extremely reliant on field deposits, have a good deal of concentrated business real estate publicity, and then I consider the greater picture seriously is the opportunity instability of their uninsured deposits even for the nutritious types if we have a different financial institution failure.”

Bair, who ran the FDIC through the 2008 financial crisis, is anxious that regional bank challenges from 2023 usually are not thoroughly settled.

“Congress need to reinstate the FDIC’s transaction account warranty authority so that they can stabilize those people deposits,” she said. “This is even now a dilemma for the regional banking companies, and fingers crossed that there is certainly [not] a further failure. We are just not fairly confident what’s likely to take place.”

Regional banking institutions are owning a rough 12 months so considerably. The SPDR S&P Regional Bank ETF (KRE) is down pretty much 13%, and only four of its users are constructive for 2024.

The largest laggard in the KRE is New York Neighborhood Bancorp which has tumbled much more than 71% this calendar year. Metropolitan Bank Keeping Corp., Kearny Fiscal, Columbia Banking System and Valley Countrywide Bancorp are down far more than 30% in that time time period.

“The significant concern is no matter if there is yet another shock to uninsured deposits mainly because of a lender failure, and I imagine that is actually the most significant challenge confronting regional financial institutions proper now,” she reported.

Her most recent regional bank warning arrives as the benchmark 10-calendar year Treasury be aware produce topped 4.6% this week and strike its best stage since November 2023.

Bair is anxious increased yields could put extra anxiety on commercial serious estate debtors, and regional banks have a great deal of exposure.

“Component of the challenge in commercial actual estate is that a whole lot of it is refinancing this 12 months and upcoming,” said Bair. “So, the increased the premiums go for all those refinancings, the a lot more distress there will be with borrowers to be capable to keep on with their payments.”

On the other hand, regional banks’ concerns could convey additional company to more substantial establishments.

“Regional lender distress added benefits the large money-heart banking companies. You can find no question in my brain,” Bair reported.