The selling price of Trump Media closed investing Friday down approximately 20% for the week.

DJT shares, which dropped by extra than 8% inside the first hour of buying and selling Friday, eked out a slight obtain by the end of the day.

Shares shut up 18 cents at $32.59, an maximize of all-around .5%.

That closing value was much more than $38 lower than what its shares very first sold for when the social media company started general public buying and selling on March 26.

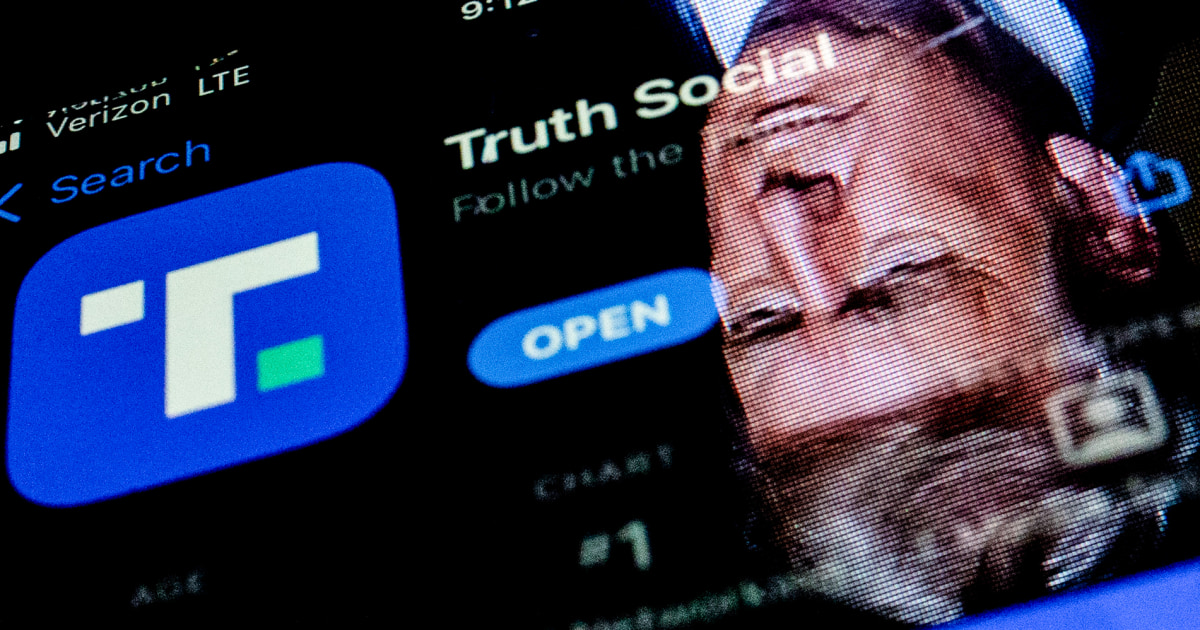

Shares of Trump Media, which owns the Real truth Social app, have dropped by 47.4% so far in April wiping out billions of dollars in the company’s sector capitalization.

Former President Donald Trump is the major shareholder in the corporation, proudly owning nearly 60% of its inventory. Trump on Monday is set to begin jury assortment for his felony demo in Manhattan Supreme Courtroom on charges of falsifying organization data associated to a 2016 hush income payment to porn star Stormy Daniels.

Trump Media on March 26 opened its 1st day of buying and selling with a price of $70.90 for each share, hitting a high of just about $80 afterwards that exact working day. In the course of trading that working day, the company’s market place capitalization topped $9.5 billion.

By Friday’s shut, Trump Media’s industry cap stood at $4.45 billion — a whopping $5 billion decreased than the substantial it strike additional than two months back.

Trump Media commenced general public buying and selling a day right after it merged with the shell firm Electronic Planet Acquisition Corp., which was developed to enable a private agency go general public.

Trump Media very last 12 months experienced income of just $4.1 million, and reported a web decline of $58 million.

That effectiveness and the comparatively significant value of the company’s inventory have drawn keen desire from small sellers, who make trades that are correctly bets that a company’s share price will drop.

As of this week, so-called limited desire in DJT was $208.7 million, with 5.44 million shares shorted, in accordance to Ihor Dusaniwsky, taking care of director of predictive analytics at S3 Partners, a top economic information market system.

There had been less than 100,000 shares of Trump Media out there to borrow to market shorter. Traders who want to offer inventory quick should borrow shares to offer, with the expectation that they will afterwards purchase back again the very same selection of shares at a reduce rate to return them to the loan company, pocketing the selling price distinction between the trades.

Trump Media has 136.7 million outstanding shares.

A week back, traders who preferred brief Trump Media shares experienced to shell out up to 900% in once-a-year financing expenditures, which means they would need to have a then-$30-per-share fall inside a thirty day period to break even on their trade, Dusaniwsky mentioned.

Given that then, nevertheless, financing fees for shorter trades in Trump Media had sharply fallen, to 200%.