Homebuyers hoping to capture a reduce mortgage amount on the back of the Federal Reserve cutting fascination fees in 2024 may perhaps have to wait around a very little lengthier.

The housing market place, however rebounding from COVID-induced inflationary pressures and the Fed’s charge hikes aimed at stabilization, was eyeing relief from a few projected coverage changes later this calendar year. Even so, the prospect of those people decreased prices dimmed Thursday following Minneapolis Federal Reserve Financial institution President Neel Kashkari claimed that the inflation data the Fed is seeing does not correspond with its expected styles.

Read additional: How the Federal Reserve Impacts Home loan Rates

Kashkari, in an interview with Pensions & Investments, opened up about the Fed’s predicament.

Joshua Roberts/Getty Images

“There’s a great deal of uncertainty about what is actually taking place in the overall economy right now,” he explained, noting that the reopening of the economic system submit-COVID has challenged the Fed’s forecasting abilities, foremost to a reliance on inflation facts more than common versions which, in accordance to him, “are not describing the inflationary dynamics that we are viewing correct now.”

“The disinflation we noticed in the 2nd fifty percent of previous yr principally arrived from the provide side of the economic climate strengthening,” Kashkari noted. On the other hand, he expressed issue about modern inflation facts, stating, “The last couple months of inflation information has been a minor bit concerning, a lot more going sideways than continuing to tumble.”

That observation casts doubt on the envisioned trajectory in the direction of the Fed’s 2 per cent inflation concentrate on, complicating upcoming plan decisions that would have a constructive impact on property finance loan prices.

Kashkari’s uncertainty was echoed in his stance on curiosity fee cuts. “In March, I experienced jotted down two amount cuts this 12 months if inflation carries on to slide back again to our 2 per cent concentrate on,” he uncovered. Yet, the persistently higher inflation has made him rethink, “But if we continue to see inflation relocating sideways, then that would make me query irrespective of whether we necessary to do individuals charge cuts at all.”

Specialists say that for the housing market place, that implies higher house loan prices for more time.

“We do not count on rates will decrease meaningfully in the in the vicinity of phrase,” Sam Khater, Freddie Mac’s chief economist reported Thursday although noting a current stagnation in property finance loan prices.

Study extra: What Is a House loan? Kinds & How They Function

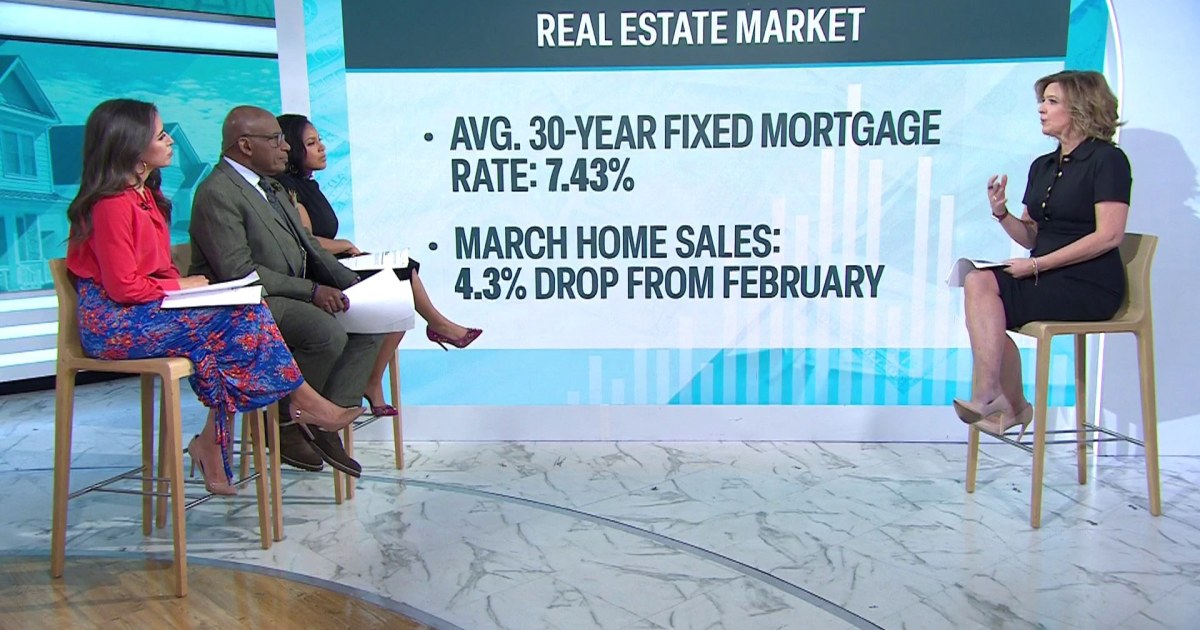

His commentary echoes a broader sentiment of uncertainty within just the housing market place, largely motivated by a tightrope stroll of economic indicators. The recent property finance loan price, which Freddie Mac pegged at an typical of 6.82 p.c, is a marked enhance from the preceding yr. The figure, whilst not breaching the 7 per cent threshold witnessed in earlier fluctuations, represents a barrier to entry for quite a few likely homeowners.

Regardless of a recent uptick in customer rate inflation to 3.2 per cent yearly that is avoiding the Fed from cutting premiums, Khater reported the housing sector is altering in a distinctive way.

“On the as well as aspect, stock is improving upon fairly, which should really enable mood residence cost development.”

A report issued Tuesday by knowledge analytics enterprise CoreLogic indicates a calendar year-above-12 months home value maximize of 5.5 per cent as of February, with predictions of ongoing, reasonable expansion.

The growth, in accordance to the report, indicates a industry responding to property finance loan fees, inventory amounts, and financial sentiment. “Dwelling rate advancement pivoted in February, as the impact of the January 2023 Home Value Index base ultimately pale,” stated CoreLogic chief economist Dr. Selma Hepp.

“As a result, the U.S. ought to begin to see slowing yearly residence price tag gains relocating ahead,” she said.

Purchasers, some of whom are watching the Fed’s future moves, may well locate them selves navigating a marketplace where by options are measured towards the backdrop of economic indicators and plan instructions.

Uncommon Expertise

Newsweek is committed to demanding typical knowledge and locating connections in the lookup for prevalent floor.

Newsweek is committed to demanding conventional knowledge and obtaining connections in the research for frequent ground.

:quality(85):upscale()/2024/04/09/048/n/1922729/df14ea856615d8e1b04f46.70810493_.jpg)