Mary Trump, the outspoken critic and niece of Donald Trump, mocked the inventory cost of the previous president’s media organization, which owns his social media platform Real truth Social, on Thursday.

Very last 7 days, Shareholders of Electronic Globe Acquisition Corp. (DWAC), an existing shell company, accomplished a merger with Trump Media & Technological know-how Group (TMTG), a company founded by the former president. The inventory value of TMTG rose 16 % the working day following the merger at about $58 a share and climbed even higher, up to $69.70 last Thursday.

Due to the fact then, the firm’s inventory has plummeted by far more than $23 and as of Thursday afternoon TMTG’s stock price tag was at $45.87. When it is typical for stock costs to fluctuate, this is a really substantial fall in a shorter quantity of time.

Mary Trump posted a screenshot of the stock selling price plummeting on X, formerly Twitter, and took at shot at the former president, crafting: “Everyone getting a great day?” with a smile deal with wearing sunglasses emoji.

Newsweek achieved out to Trump’s spokesperson through electronic mail for comment.

Mary Trump has been a staunch critic of her uncle, who is the presumed GOP presidential nominee and on tempo for a rematch with President Joe Biden, on social media and in her Substack newsletter. She also wrote the memoir Far too Much and In no way Ample published in 2020, which was significant of Donald Trump.

Industry gurus have formerly referred to Real truth Social as the 1st ever “election stock” saying that it will be a proxy for the financial implications of the private brand of Trump. Other individuals have termed it a meme inventory that is “overvalued.”

With 79 million shares, Trump’s the greater part stake in TMTG was really worth about $5.5 billion last Thursday, and even with the stock value fall, his stake is continue to worth a lot more than $3.6 billion.

The merger came as Trump’s lawful woes have established a monetary stress on the former president. Trump experienced to article a practically $92 million bond in March to attraction the jury’s verdict in a situation following a jury purchased him to fork out author E. Jean Carroll $83.3 million in a defamation lawsuit she submitted in opposition to him.

In the meantime, on Monday the previous president experienced to publish a $175 million bond in the civil fraud scenario that New York Attorney Standard Letitia James brought against him right after a choose purchased him to spend $355 million, in addition fascination, in damages. Trump has also appealed this case.

Trump has taken care of that he has performed almost nothing in these instances against him and claims that that they and other felony issues are politically enthusiastic.

When Trump does have a the vast majority stake in the new company worth billions of dollars, most mergers prohibit big shareholders from offering, lending, donating or encumbering shares within the initial 6 months of a deal to assure buyers that these shareholders will not instantly income out at the exact same time and tank the stock’s price tag.

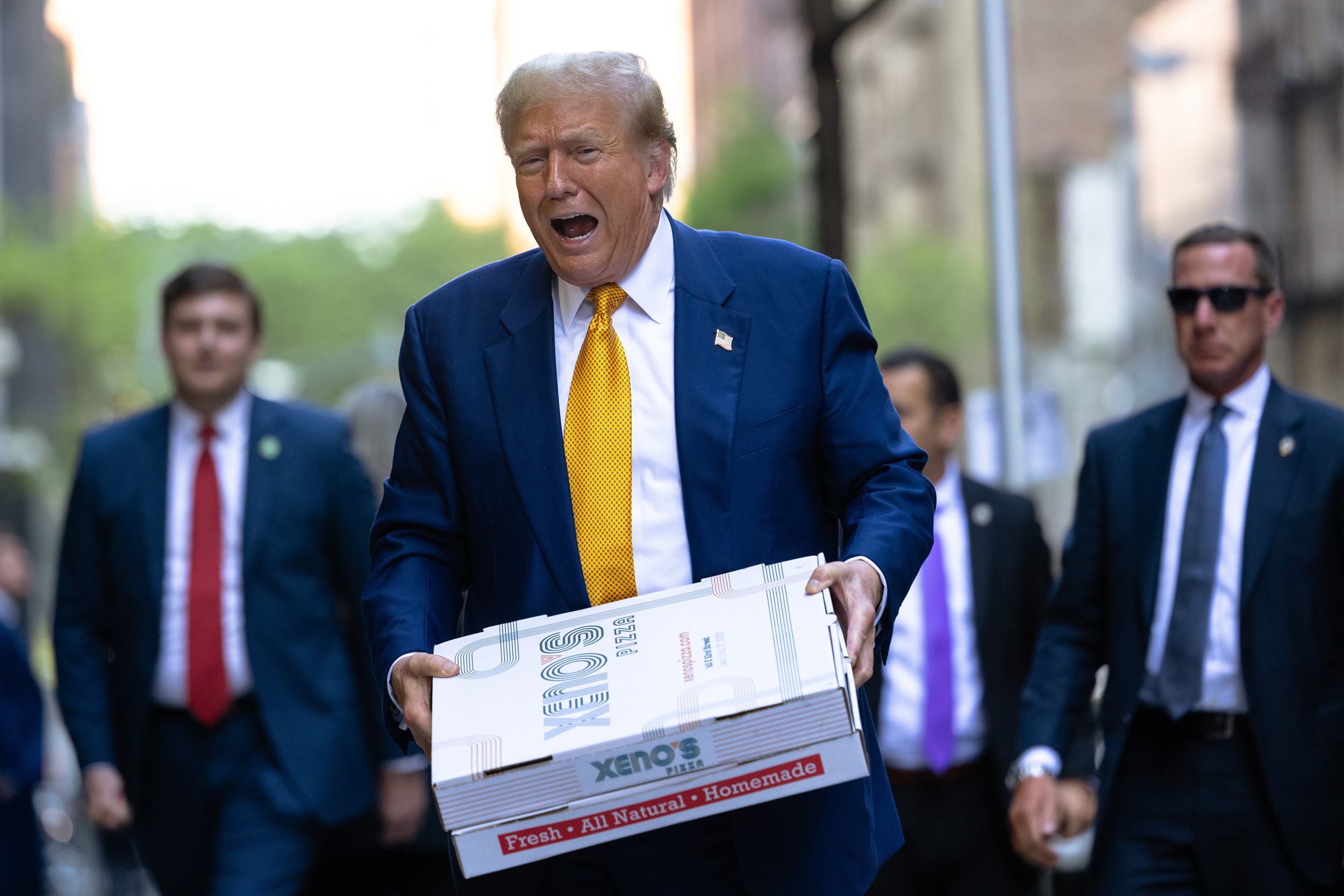

Anna Barclay/Getty Photos

Unusual Awareness

Newsweek is fully commited to challenging regular wisdom and discovering connections in the search for frequent ground.

Newsweek is dedicated to challenging traditional knowledge and discovering connections in the search for widespread floor.