The Micron Technology headquarters in Boise, Idaho, on March 28, 2021.

Jeremy Erickson | Bloomberg | Getty Pictures

Shares of Micron popped a lot more than 14% in extended trading on Wednesday immediately after the organization introduced 2nd-quarter fiscal 2024 success that beat analysts and available rosy advice. The enterprise, which would make memory and storage for pcs, claimed it has benefitted from the artificial intelligence boom.

Here is how the business did:

- Earnings per share: 42 cents modified vs. 25 cent reduction anticipated by LSEG, formerly regarded as Refinitiv.

- Revenue: $5.82 billion vs. 5.35 billion envisioned by LSEG.

Micron mentioned income rose to $5.82 billion from $3.69 billion in the yr back quarter. The corporation reported a internet money of $793 million, up from a net decline of $2.3 billion in the same interval past calendar year.

For its fiscal third quarter, Micron expects to report profits of $6.6 billion, over the $6.02 billion expected by analysts.

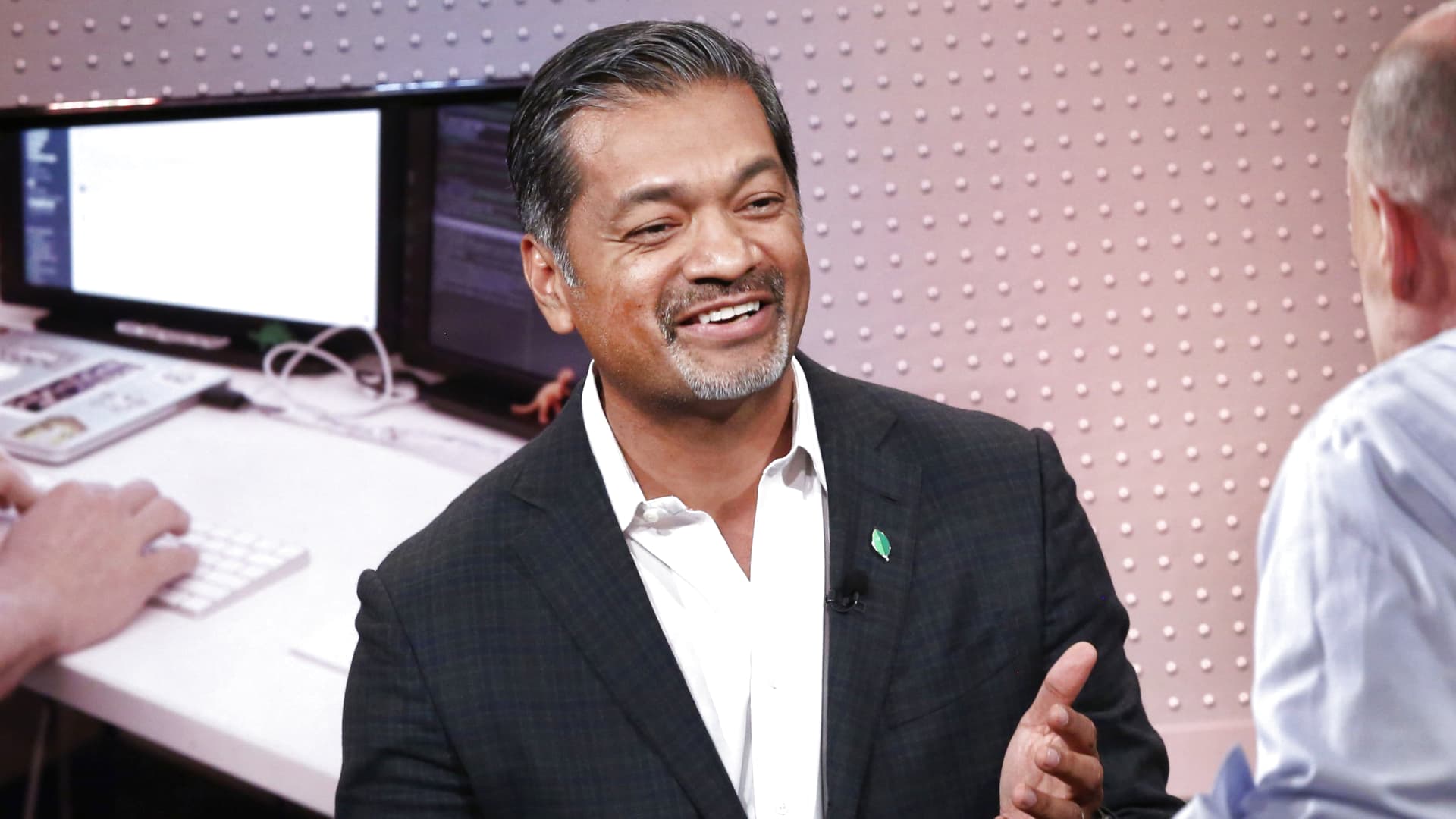

“We feel Micron is one of the largest beneficiaries in the semiconductor sector of the multi-calendar year prospect enabled by AI,” Micron CEO Sanjay Mehrotra reported in a launch.

Micron has prolonged offered memory and flash storage for pcs, facts centers and phones. Big information facilities are utilised to electrical power the inflow of new AI software program. When Nvidia has grabbed much of the spotlight for its graphics processing units that operate AI, businesses like Micron benefit by furnishing the memory and storage for those people techniques.